FxNews—On Tuesday, gold prices stayed above critical support at $2,725 but didn’t show much movement. This lack of activity was due to markets focusing on that day’s U.S. presidential election.

Rising Gold Prices Signal Investor Worries on Inflation

Recently, uncertainty about the election outcome has caused gold prices to rise. Many believe that if Trump becomes president, his plans to increase trade tariffs significantly could lead to higher inflation. As a result, investors are buying gold to protect themselves against the possibility of long-term inflation.

However, these expectations have been tempered since the election race is close. Also important this week is the Federal Reserve’s announcement on monetary policy, which is scheduled for Thursday.

Lower Rates Likely to Drive Gold’s Appeal Higher

Markets widely expect the Fed to cut interest rates by 0.25%. This potential rate cut is good for gold because lower interest rates reduce the cost of holding gold, which doesn’t pay interest. Furthermore, if other major central banks lower their interest rates, gold could appeal more to investors.

Gold Technical Analysis – 5-November-2024

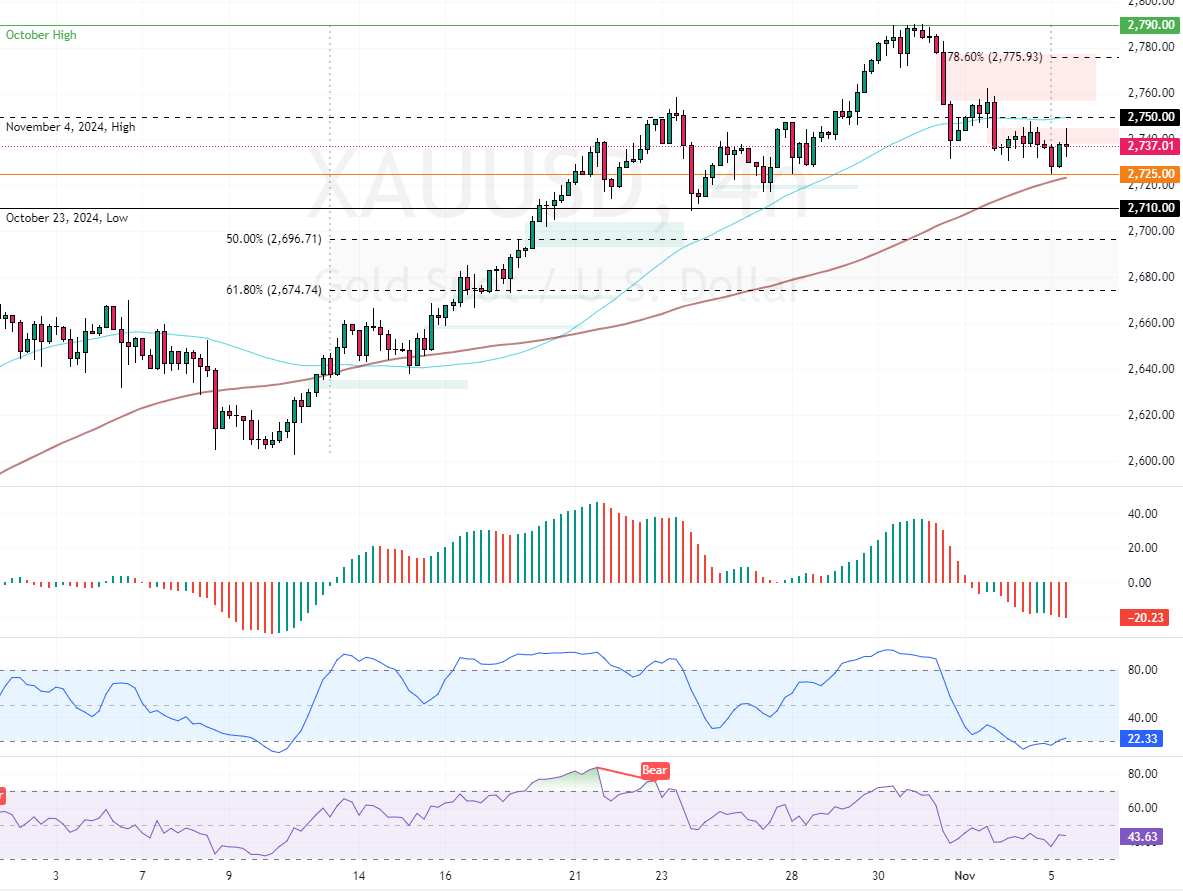

The XAU/USD’s primary trend should be considered bullish because it trades above the 100-period simple moving average. Additionally, the Stochastic Oscillator stepped outside the oversold territory, meaning the bullish market is gaining more momentum.

Can Gold Break $2,750 for a New Bullish Rally?

The November 4 high at $2,750 is the immediate resistance. From a technical standpoint, a new bullish wave would form if the gold price closed above this resistance. In this scenario, the market will likely aim to fill the bearish Fair Value Gap at approximately $2,775.

Conversely, the bullish outlook should be invalidated if XAU/USD drops below $2,725. If this scenario unfolds, the downtrend begun in late October could extend to $2,710, followed by the %50 Fibonacci retracement level at $2,696.

Gold Support and Resistance Levels – 5-November-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 2,725 / 2,710 / 2,674

- Resistance: 2,750 / 2,775 / 2,790