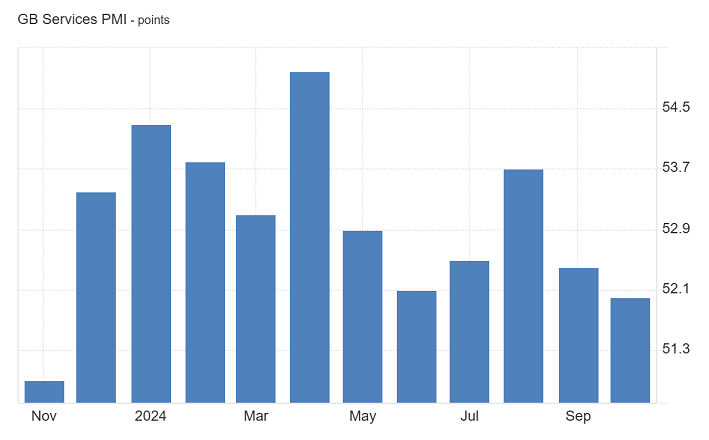

FxNews—In October 2024, the S&P Global UK Services PMI—which gauges the health of the UK’s service sector—was slightly revised upward to 52 from an initial estimate of 51.8. This is a small drop from September’s reading of 52.4.

The service sector is still expanding since any number above 50 means growth. However, the pace of this growth has slowed for the second month in a row, marking the slowest rate since November 2023.

UK Business Growth Slows as Clients Await Budget

Companies noted that better economic conditions within the UK helped boost business activity. Yet, many clients hesitated to spend due to uncertainty before the Autumn Budget announcement. This led to the slowest growth in new work since June. On a positive note, export sales—sales to customers abroad—grew fastest since March 2023.

Service Sector Employment Drops for the First Time This Year

Additionally, employment in the service sector fell for the first time this year, meaning companies hired fewer people or reduced staff. Regarding prices, higher wages for employees increase businesses’ costs. To cope, many companies raised their prices to customers. Lastly, businesses’ optimism about the future has decreased.

GBPJPY Technical Analysis – 5-November-2024

FxNews—The British pound trades bullish against the Japanese Yen above the 100-period simple moving average. The GBP/JPY pair broke from the symmetrical triangle in today’s trading session, trading at approximately 197.4.

Interestingly, the Awesome Oscillator histogram is green, approaching the signal line from below, meaning the bull market strengthens. Additionally, the RSI and Stochastic depict 50 and 59 in the description, respectively, signaling the market is not overbought and the uptrend should resume.

Overall, the technical indicators suggest the primary trend is bullish and should resume.

GBPJPY Forecast – 5-November-2024

The September 27 low at 195.75 immediately supports the bullish trend. From a technical standpoint, the current uptick in momentum should resume if buyers maintain a position above 195.75. In this scenario, the next bullish target will likely be revisiting the October all-time high at 200.

Please note the bullish outlook should be invalidated if EUR/JPY falls below the 195.75 support.

- Support: 195. 75 / 193.65

- Resistance: 198.4 / 200.0