The 10-year US Treasury yield stayed around 4.43% on Thursday, close to a recent high, as investors waited for the Federal Reserve’s policy update. The Fed is expected to cut interest rates by 0.25% today, and traders are watching closely for any hints of another possible cut in December.

On Wednesday, the yield jumped by 20 basis points after Republican Donald Trump won the US presidential election. Republicans also took control of the Senate, which could lead to big policy changes, though control of the House is still undecided.

Trump’s plans include reducing illegal immigration, raising tariffs, lowering taxes, and reducing regulations to boost economic growth and inflation. Expectations of more government spending and rising debt also pushed Treasury yields higher.

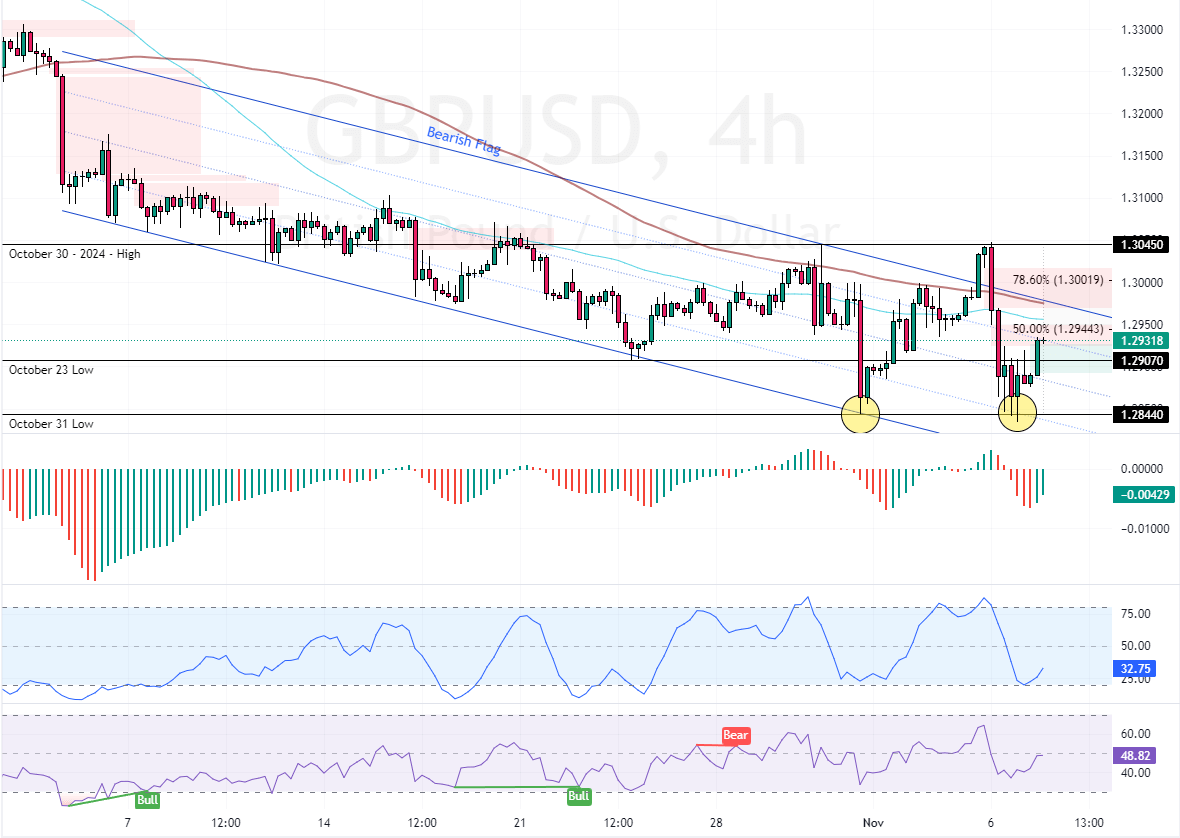

GBPUSD Technical Analysis – 7-November-2024

The British pound trades in a bear market against the Greenback, below the 100-period simple moving average and the bearish flag. The currency pair’s bearish momentum paused at the October 31 low, the 1.284 mark. Consequently, a double bottom pattern is formed, resulting in the GBP/USD price aiming for the bearish fair value gap near the 50-SMA.

Monitor GBPUSD for Bearish Signs Below 1.304

The outlook for the GBP/USD trend remains bearish as long as the price is below the 1.304 resistance, the October 30 High. Hence, traders should monitor the price action near the 50—and 100-period SMAs and $1.304 closely for bearish signals, such as a bearish engulfing pattern or long wick candlestick patterns. These resistance areas provide a decent bid to join the bear market.

- Next read: USDCAD Hits 1.395 Next Stop Might be 1.41

That said, the GBP/USD bearish trend would strengthen if sellers push the price below the immediate support of 1.284. In this scenario, the next bearish target could be 1.267 support.

Please note that the bearish outlook should be invalidated if GBP/USD exceeds the 1.304 resistance.

- Support: 1.290 / 1.284 / 1.267

- Resistance: 1.294 / 1.300 / 1.304