The offshore yuan recently strengthened to about 7.22 per dollar, bouncing back from its lowest point in over three months, which it hit in the previous session. This rise ended a three-day losing streak.

The main factor behind this recovery was that Chinese authorities set a stronger-than-expected midpoint rate for the yuan. This move indicates their increasing concern over the currency’s rapid decline in value.

Yuan’s Unexpected Strength Surprises Markets

The People’s Bank of China established the yuan’s midpoint rate at 7.1991 per dollar—the weakest level since September 2023. However, this rate was still 314 pips stronger than the market had anticipated, marking the largest gap since August.

Meanwhile, on Monday, Chinese banks reported issuing only 500 billion yuan in new loans for October. This amount sharply decreases from September’s total and falls short of the forecasted 700 billion yuan.

Additionally, data released over the weekend showed that China’s consumer inflation for October dropped to a four-month low, missing market expectations. Producer prices declined for the 25th consecutive month, recording the steepest drop since November 2023.

USDCNH Forecast – 13-November-2024

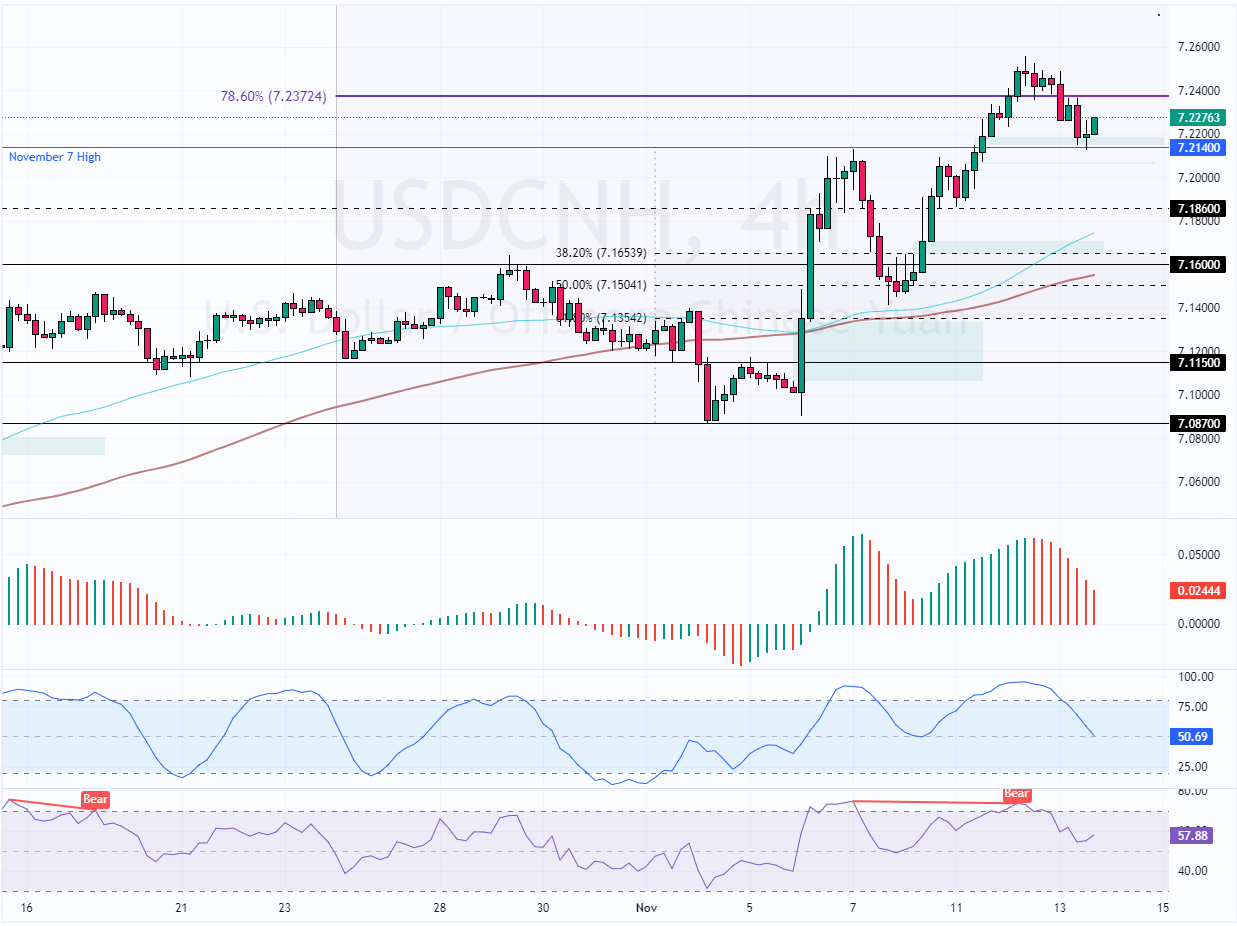

The Greenback trades in a bull market against the Chinese Yuan. But, the price failed to stabilize above the 7.23 resistance (78.6% Fibonacci retracement level). As of this writing, the USD/CNH bears are testing the November 7 high at 7.214.

As for the technical indicators, the Awesome Oscillator histogram is red, declining toward zero from above. Additionally, the Stochastic and RSI 14 records show 50 and 57, meaning the bull market weakens.

Overall, the technical indicators suggest the primary trend is bullish, but the USD/CNH price could dip toward the lower support levels.

USD/CNH Downtick May Extend if Bears Push Below 7.21

The USD/CNH immediate support is at 7.21. From a technical perspective, today’s downtick momentum would extend to 7.18, followed by 7.16, if the bears close and stabilize USD/CNH below the immediate support.

USDCNH Aims for 7.27 on Breaking 78.6% Fibonacci

On the other hand, if the American dollar exceeds the 78.6% Fibonacci retracement level at 7.23, the primary bullish trend will likely resume. If this scenario unfolds, the USD/CNH’s path to 7.27 will likely be paved.

- Support: 7.21 / 7.186 / 7.16

- Resistance: 7.24 / 7.27 / 7.31