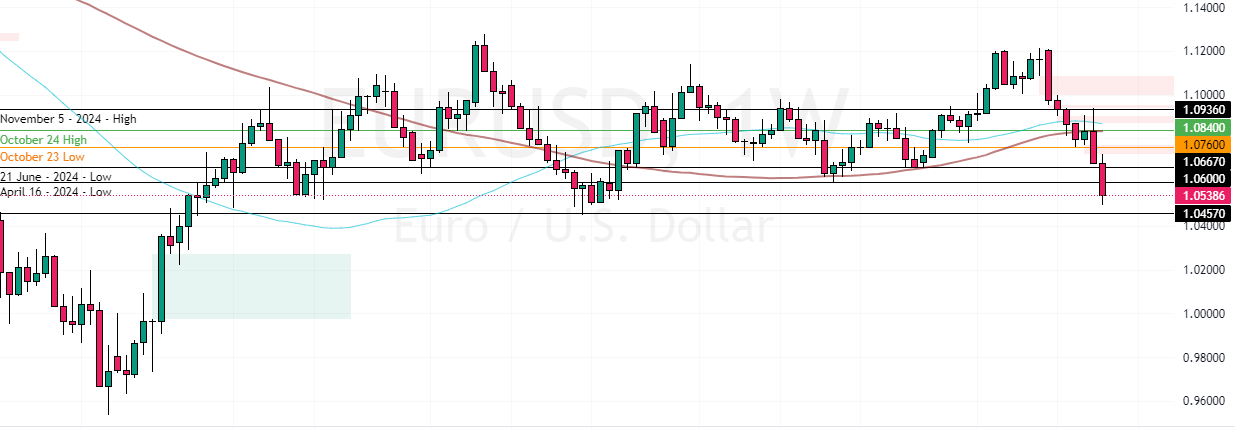

FxNews—The EUR/USD currency pair fell below $1.06 support, marking its lowest since October 2023. This drop occurred after Donald Trump’s victory in the U.S. presidential election strengthened the U.S. dollar.

Investors are worried because Trump has proposed trade tariffs that could hurt European exports, especially in the car industry. His warning that Europe would “pay a big price” for not buying enough American goods has increased fears of a trade conflict.

EURUSD Falls as German Government Collapses

Furthermore, political uncertainty in Germany is adding pressure on the Euro. Chancellor Olaf Scholz’s coalition government collapsed, leading to snap elections scheduled for February 23. This instability is making investors nervous about the Eurozone’s economic future.

Meanwhile, financial markets have adjusted their expectations for the European Central Bank’s interest rate cuts. They anticipate a 25 basis point cut in December and see a reduced likelihood of a larger cut.

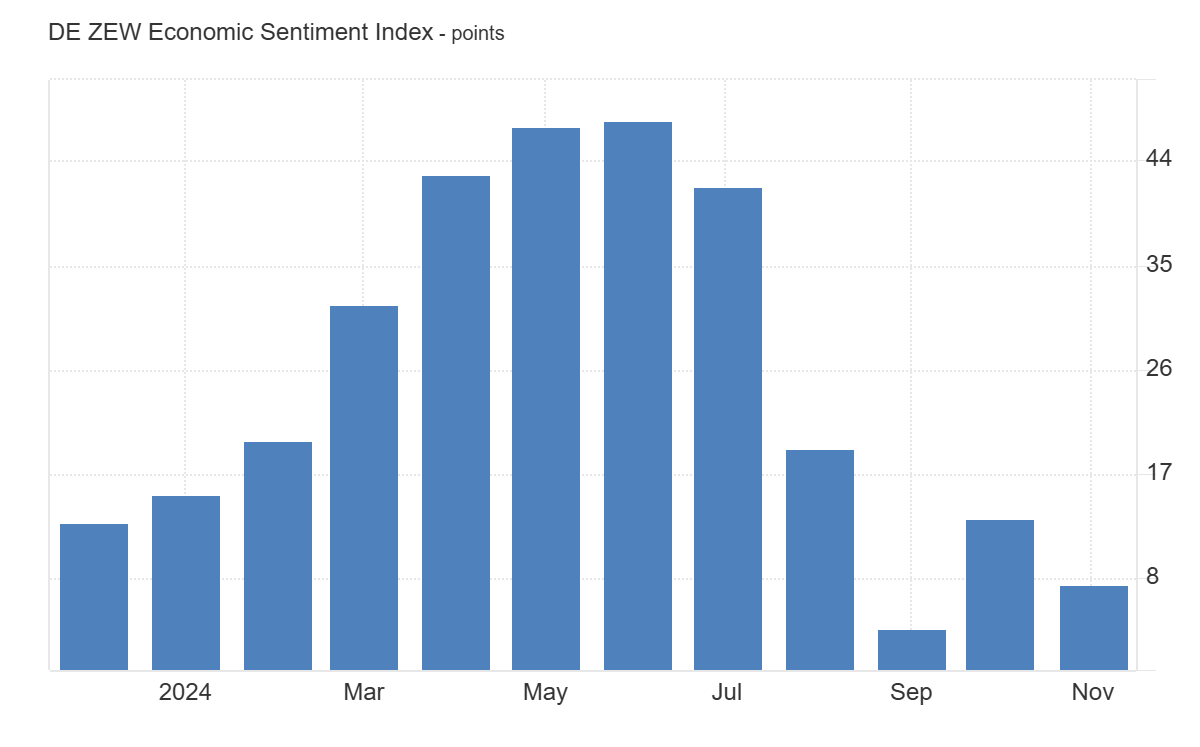

Sharp Decline in Germany’s ZEW Economic Sentiment

Additionally, a key economic survey in Germany, the ZEW Indicator of Economic Sentiment, dropped sharply. It fell to 7.4 in November from 13.1 in October, missing analysts’ expectations of 13.

This decline suggests that confidence in Germany’s economy is weakening more than expected.

EURUSD Technical Analysis – 14-November-2024

The bears closed and stabilized the prices below the $1.06 support. As we mentioned in our previous EUR/USD analysis (EURUSD Hits New Low Below $1.06 After U.S. Election), the downtrend will likely resume if prices fall below the support, active resistance.

From a technical perspective, the downtrend will remain valid as long as the price is below the June 21 low ($1.066). In the bearish scenario, the next target could be the October 2024 low at $1.045.

- Support: 1.045

- Resistance: 1.06 / 1.0667