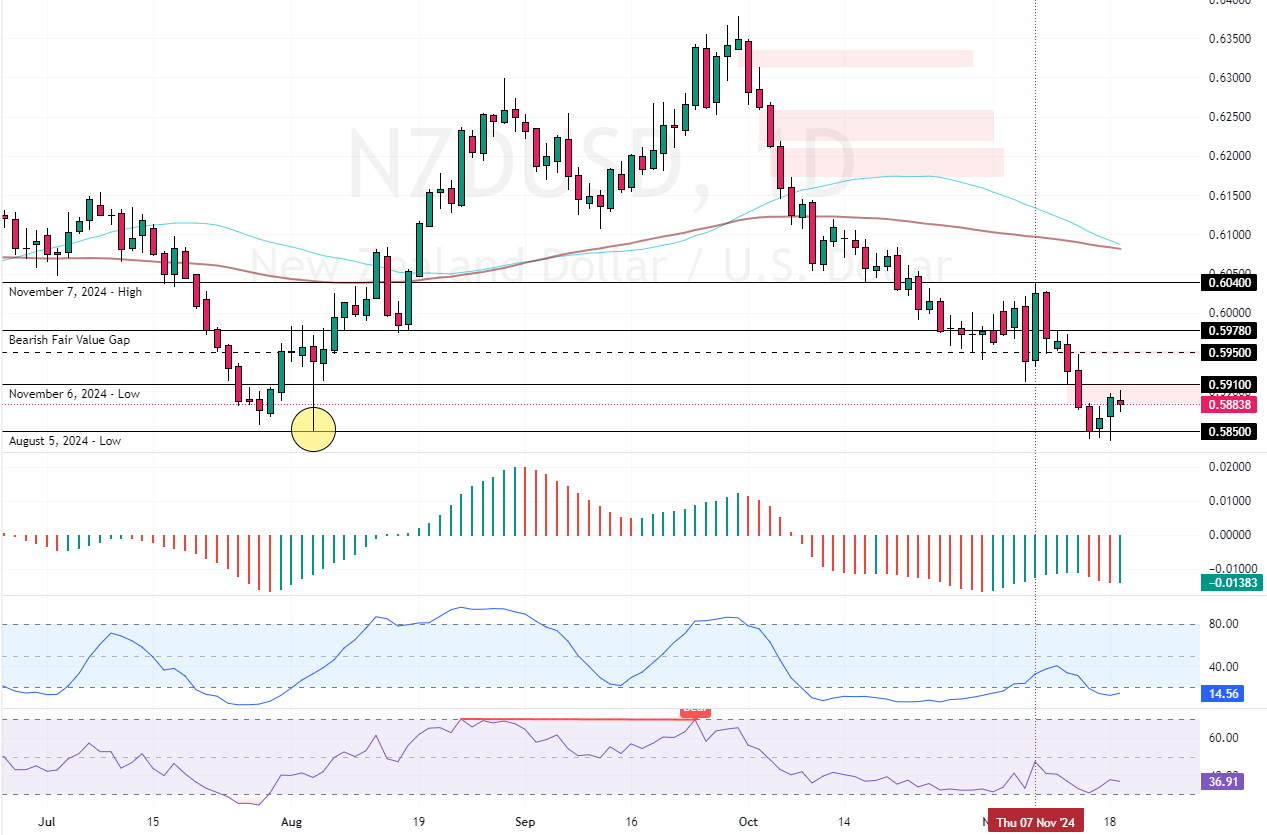

The New Zealand dollar remained steady around $0.588, benefiting from a pause in the U.S. dollar’s rally. However, the Kiwi is facing pressure due to expectations that the Reserve Bank of New Zealand (RBNZ) will adopt a more dovish monetary policy.

RBNZ Likely to Slash Rates Next Week

Investors widely anticipate that the RBNZ will lower its current cash rate of 4.75% by 50 basis points at next week’s policy meeting, with the possibility of another similar cut early next year. This outlook aligns with recent data showing the country’s inflation has slowed to its lowest point in over two years.

Additionally, economic growth is projected to recover only slightly in the third quarter and remain sluggish through the end of 2024. Furthermore, declining investor confidence in China—New Zealand’s largest trading partner—adds extra pressure on the Kiwi.