FxNews—Ripple, known as XRP, exploded on November 11 and peaked at $1.3 high. This price surge was due to Donald Trump’s cryptocurrency-friendly policy. In fact, XRP is an American blockchain that is expected to favor the upcoming regulations toward cryptos.

Furthermore, the main reason behind the recent bullish momentum was that 18 U.S. states sued the SEC and its commissionaires, including Chair Gensler, which kept the cryptocurrencies suppressed in their ruling times.

Ripple Eyes $2 as Bulls Guard Key Support Level

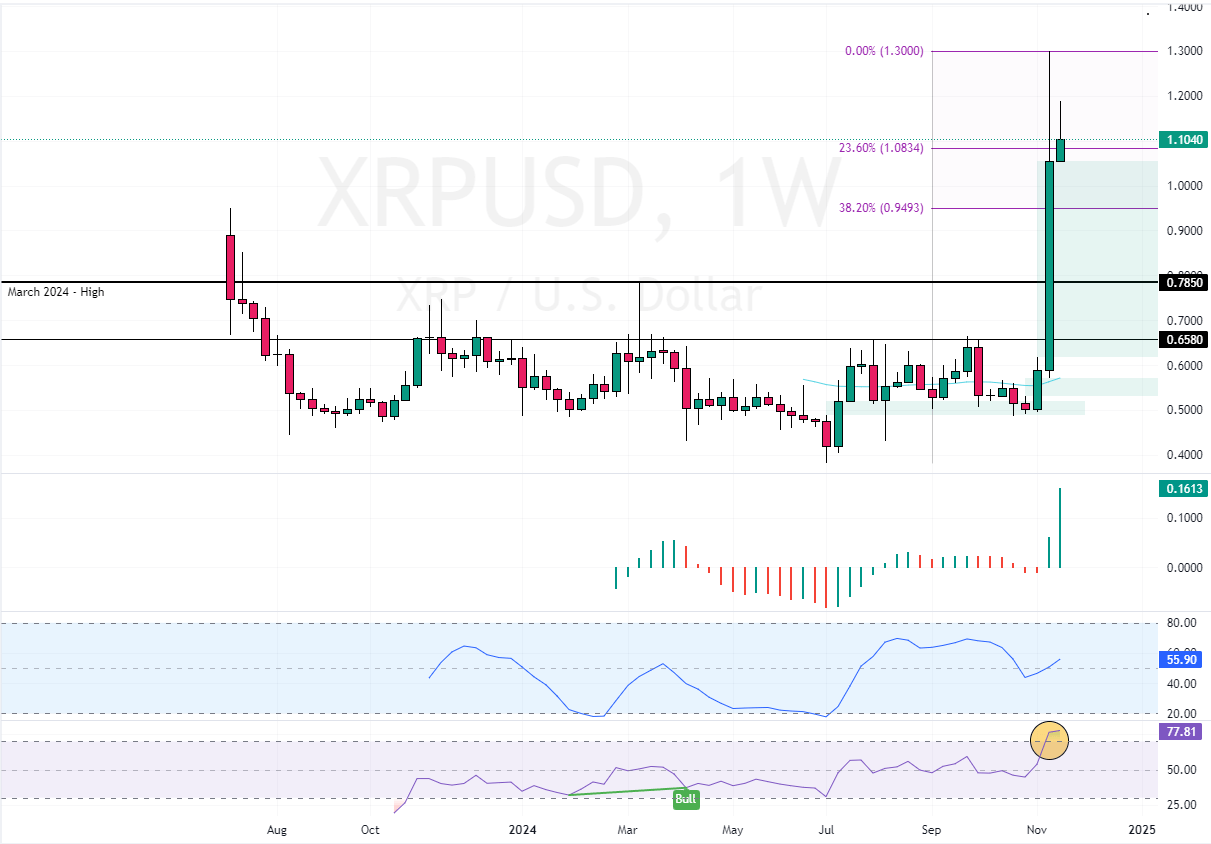

As of this writing, XRP (Ripple) trades at approximately $1.1, testing the 23.6% Fibonacci retracement level as support. Meanwhile, the RSI 14 stepped into overbought territory, signaling that the token is overpriced in the short term. Therefore, a consolidation phase could be on the horizon before the uptrend resumes.

From a technical perspective, the trend outlook remains bullish, with prices above the 38.2% Fibonacci level at $0.94. If bulls maintain their position above the support, Ripple could gradually open its way to $2.0 in the upcoming weeks.

On the other hand, a new consolidation phase could emerge if bears (sellers) push the prices below the 0.94 mark. If this scenario unfolds, the prices could dip to as low as $0.78, which is the March 2024 high.

- Support: 1.083 / 0.94 / 0.75

- Resistance: 1.30 / 1.50 / 2.0