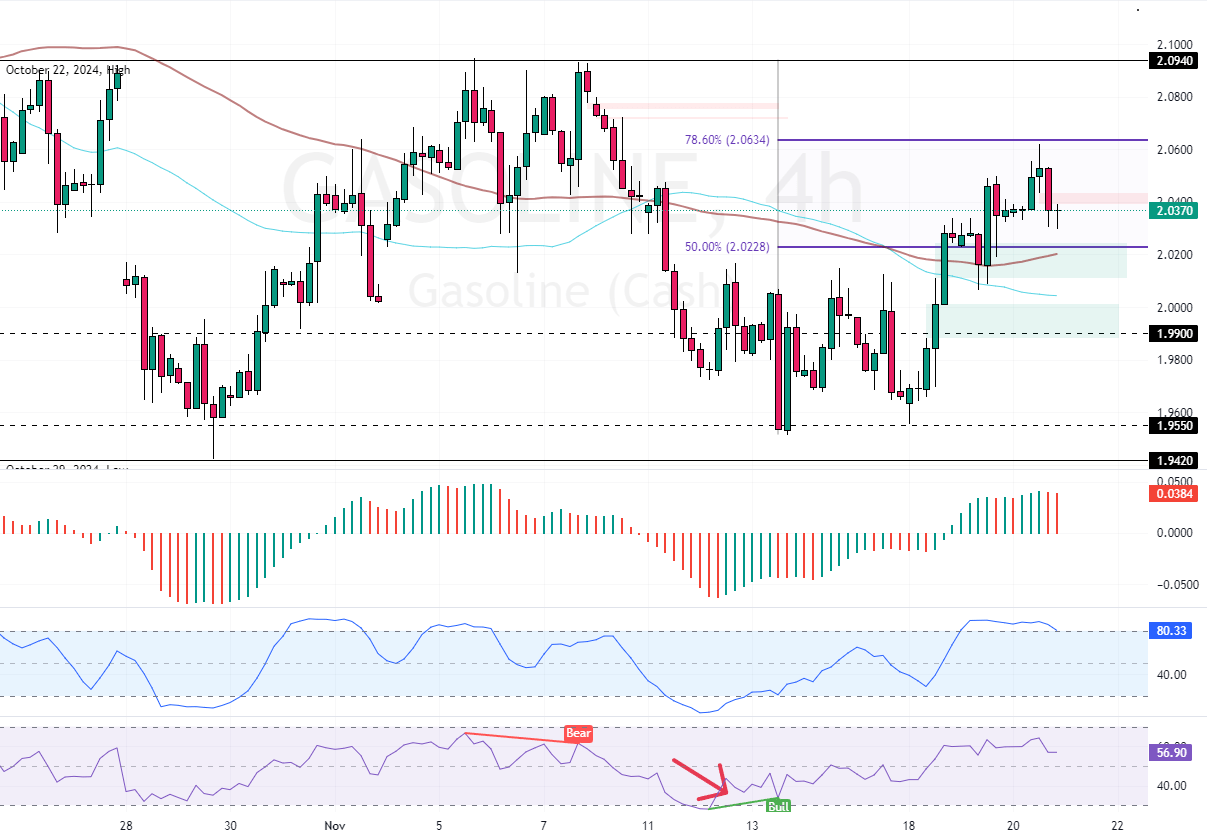

Gasoline futures in the U.S. peaked at $2.05 per gallon, marking the highest price in two weeks. The market reacted to conflicting reports about fuel supplies and the influence of global political tensions on oil costs.

API Reveals Major Decrease in Gasoline Stocks

A notable update from the API showed a decrease of 2.48 million barrels in gasoline stocks, which helped boost prices. On the other hand, the EIA indicated an unexpected increase in gasoline inventories by 2.05 million barrels for the week ending November 15th, which was higher than the anticipated 1.62 million barrels. This update has calmed fears of tight supplies.

Additionally, U.S. crude oil stocks went up by 545,000 barrels, exceeding expectations. This aligns with predictions that there might be an excess in 2024 due to reduced demand from China and historically high production levels, potentially lowering crude oil prices.