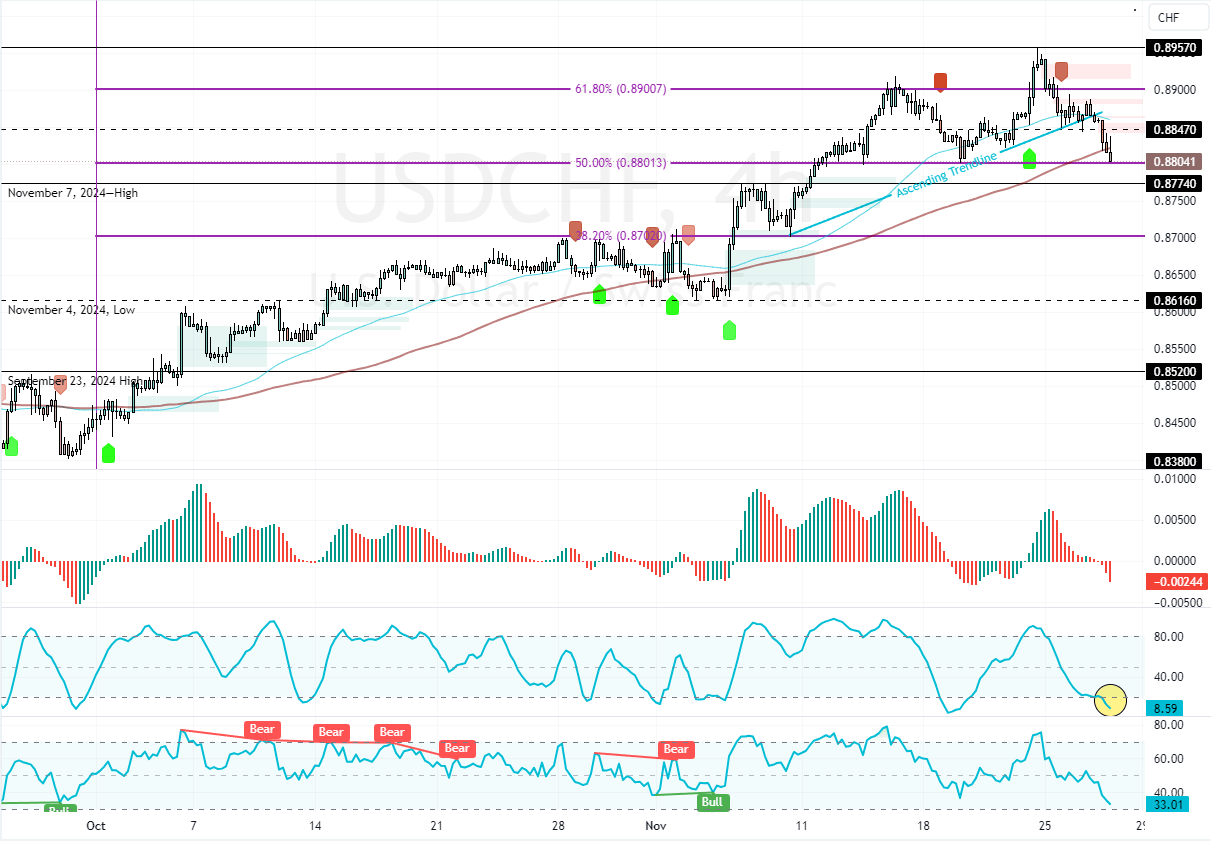

FxNews—The USD/CHF‘s downtrend from 0.895 extended to the 50% Fibonacci level at 0.880, backed by the 100-period simple moving average. The buying pressure on the Swiss Franc resulted in the Stochastic Oscillator to shift below 20, depicting 8 in the description.

This means the Franc is overpriced in the short term, and the currency pair could initiate a correction phase from this point.

USDCHF Technical Analysis

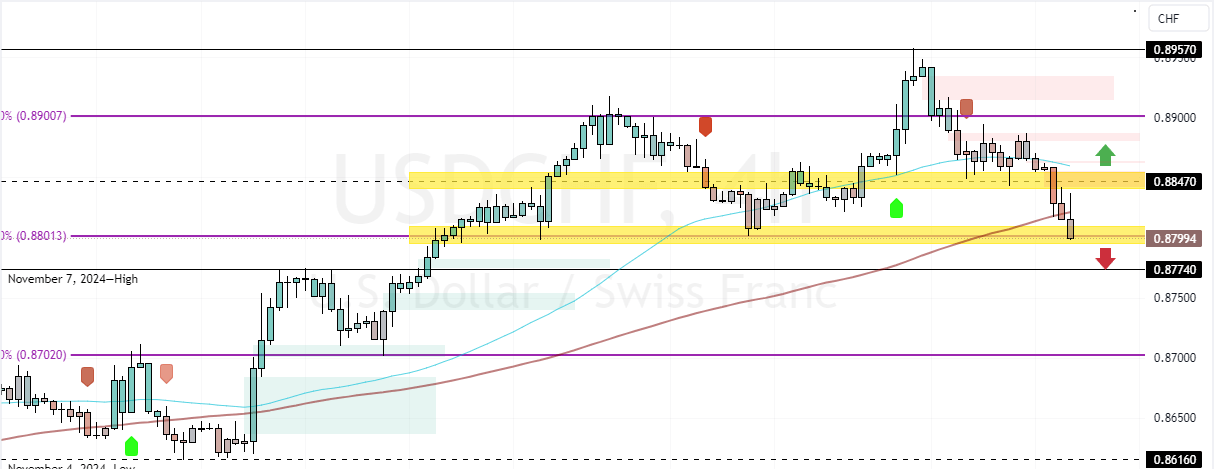

Please be aware that 0.880 provides immediate support that might keep the USD/CHF price from declining further, while 0.884 is the immediate resistance.

From a technical perspective, the downtrend could extend to lower support levels if the USD/CHF closes and stabilizes below the immediate support (0.880). In this scenario, the next bearish target could be the November 7 high at 0.877.

Furthermore, if sellers push the prices below 0.877, the downtrend can potentially extend to the 28.2% Fibonacci retracement level at 0.870.

- Good read: AUDUSD Nears Trigger Point for Bearish Turn

Bullish Scenario

Please note that the bearish outlook should be invalidated if USD/CHF prices exceed the immediate resistance (0.884). If this scenario unfolds, the uptrend will likely continue, targeting the 61.8% Fibonacci resistance at 0.890.