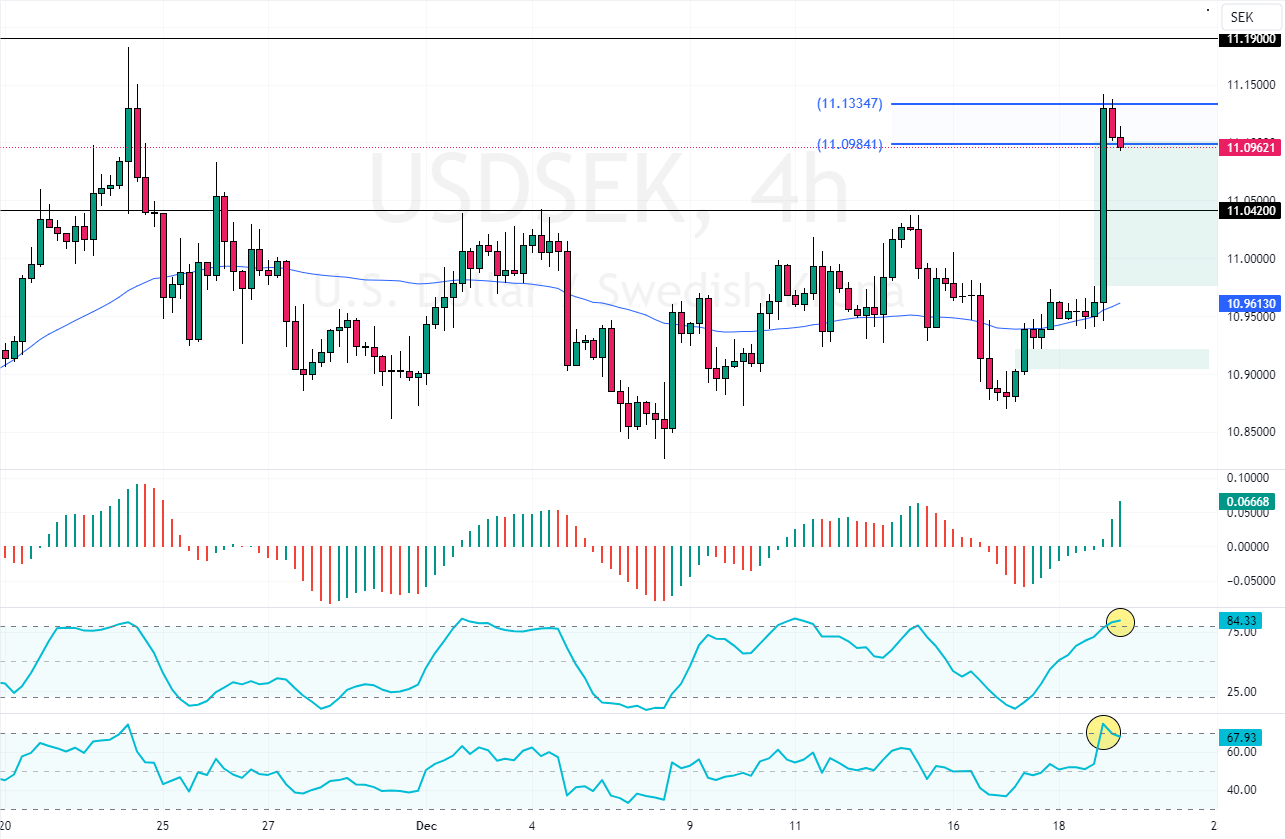

The American dollar is in a bull market against the Swedish Krona at approximately 11.1. The uptrend escalated after prices broke the 11.04 resistance in yesterday’s trading session.

However, the USD/SEK bull run eased after it reached the 11.13 high. Concurrently, the Stochastic and RSI 14 indicators hint at an overbought market, depicting 85 and 69 in the description.

These developments in the technical indicators suggest that the American dollar is overpriced, at least temporarily. Therefore, USD/SEK could begin a consolidation phase.

USDSEK Forecast – 19-December-2024

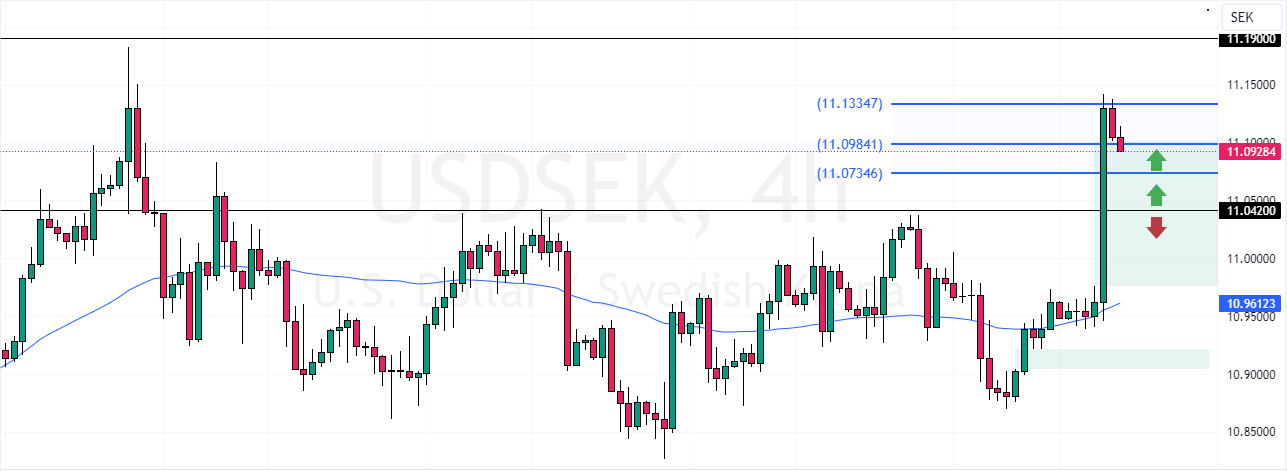

The immediate support is at 11.09. From a technical perspective, USD/SEK could erase some of its gains if bears push and stabilize the prices below 11.09. In this scenario, a new consolidation phase would begin, aiming toward 11.04.

Please note that 11.09, 11.07, and 11.04 provide decent, low-risk bid prices to join the bull market. Therefore, retail traders and investors should closely monitor these levels for bullish signals, such as candlestick patterns.

Additionally, the uptrend should be invalidated if USD/SEK falls below the 11.042 critical support.