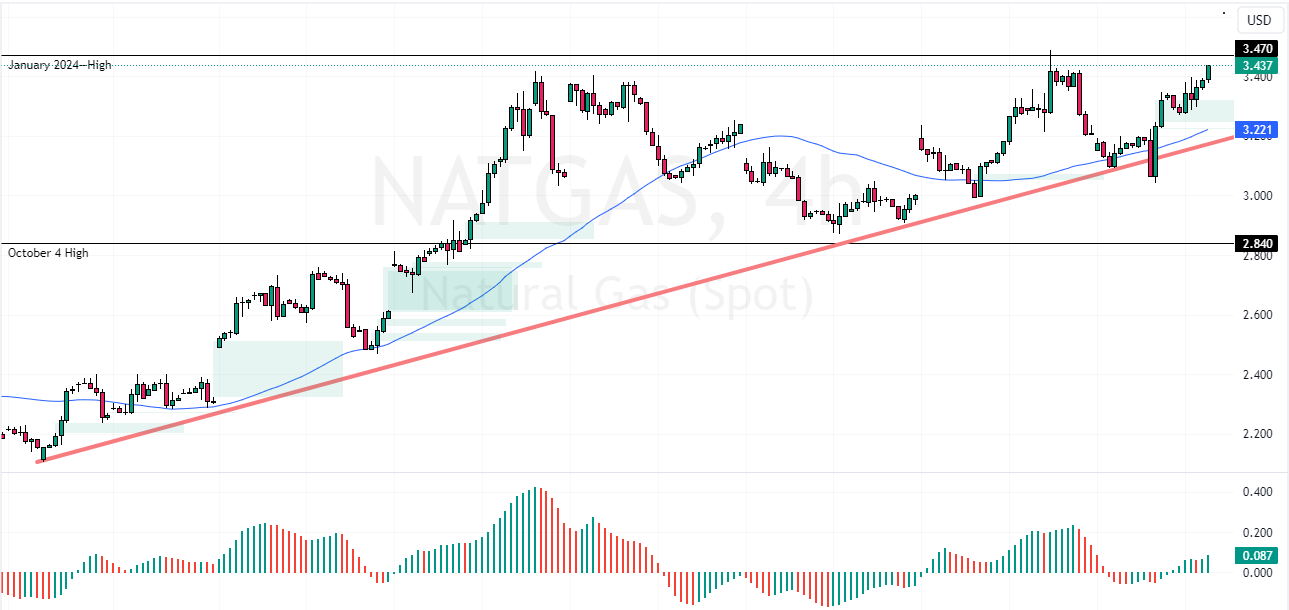

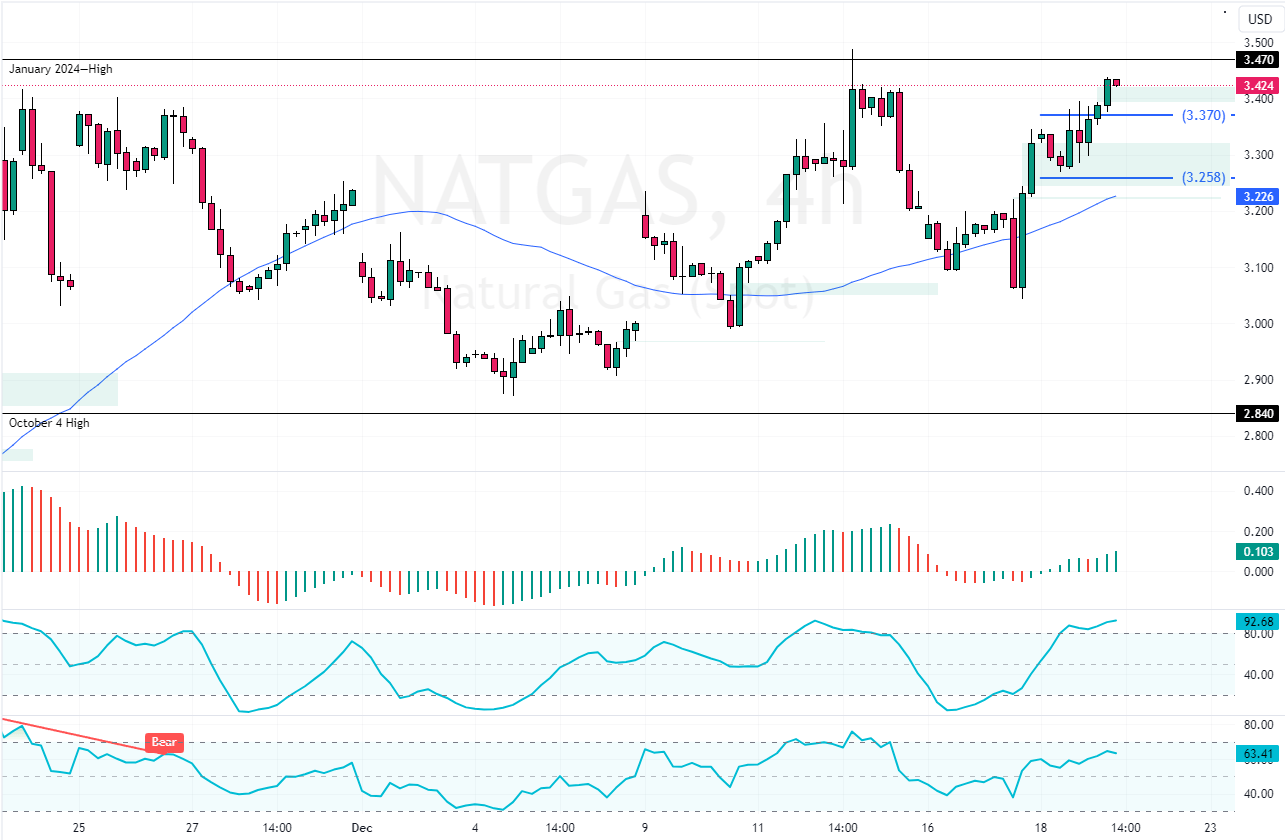

The US natural gas prices climbed to $3.43, nearing the 2024 all-time high, amid overbought signals from Stochastic Oscillator.

This increase is fueled by expectations of rising global demand for liquefied natural gas (LNG) next year, which could offset the current US supply levels. Concerns over whether the ECB will continue receiving gas supplies from Russia via Ukraine as the EU Commission tightens restrictions on Russian fossil fuels.

Trump to Support More US LNG Export

Such uncertainties are boosting the demand for US LNG, especially with the upcoming change in the US presidency. The president-elect, Donald Trump, has indicated that his administration will support the issuance of LNG export licenses.

This policy encourages companies to prioritize LNG exports over domestic sales, which are less profitable due to the abundant US gas supply.

Market Eyes EIA Data on US Gas Stocks

Meanwhile, the market is anticipating the Energy Information Administration’s (EIA) next weekly report, which could confirm that the US is in the middle of a season where gas stockpiles are typically drawn down.

NATGAS Analysis – 19-December-2024

As of this writing, the commodity in discussion trades at approximately $3.4, nearing the 2024 all-time high, the $3.47 mark. Meanwhile, the Stochastic Oscillator hints at a short-term overbought condition in the market, which could result in the NATGAS prices consolidating near the lower support levels before the uptrend resumes.

- Good read: Crude Oil Slips Below $70 After Fed Decision

Please note that the NATGAS trend outlook remains bullish as long as prices are above $3.25, backed by the 50-period SMA. That said, the next bullish target could be $4.0 after a minor consolidation if buyers close and stabilize the Natural Gas prices above $3.47.