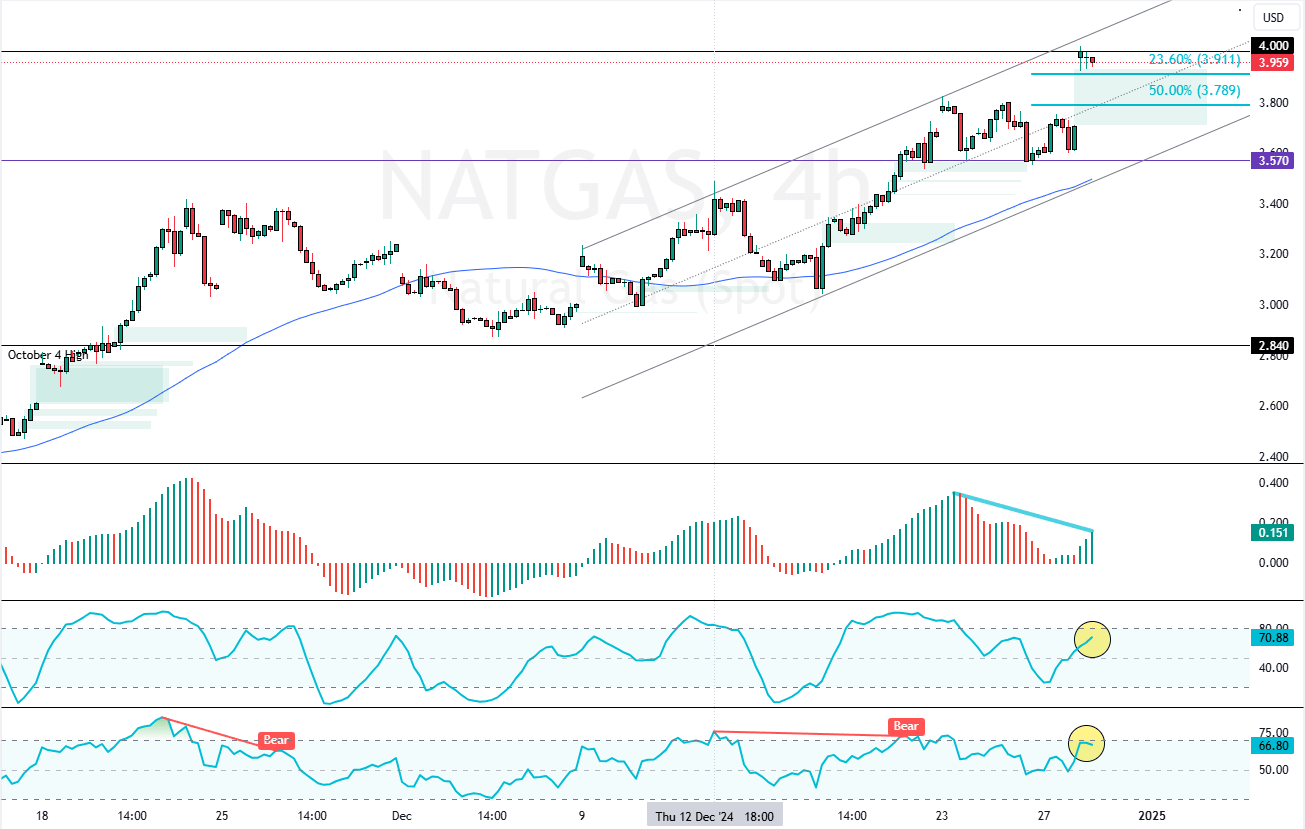

NATGAS hit $4.0, trading in a robust uptrend. The Awesome Oscillator signals divergence, which could result in the prices consolidating. A Dip below the immediate support at $3.91 can trigger a new bearish wave, targeting $3.78.

NATGAS Technical Analysis – 30-December-2024

The U.S. Natural gas has been in a bull market, above the 75-period simple moving average, and has gained 12.0% since December 26. However, the buying pressure eased at $4.0. As of this writing, the commodity trades at approximately $3.95, testing the 23.6% Fibonacci resistance level as support.

Regarding the technical indicators:

- The RSI 14 depicts 66 in the description and declining, meaning the uptrend lost momentum.

- The Stochastic Oscillator shows 70 in the description and rising, meaning the uptrend should resume.

- The Awesome Oscillator histogram is green, above zero, and signals divergence, interpreted as the prices could reverse or consolidate.

Overall, the technical indicators suggest that while the NATGAS’s primary trend is Bullish, but the market could begin a consolidation phase toward lower support levels due to AO’s divergence signal.

NATAS is Hit $4 As the Year Ends

The immediate support is at $3.91. From a technical perspective, the downtrend could extend to lower support levels if bears (sellers) push NATGAS below $3.91.

If this scenario unfolds, the next bearish target could be the $3.78 mark, which is the %50 Fibonacci support level.

- Gold Exceeded $2665: Now Overbought!

- Bullish Symmetrical Triangle Signals NATGAS Breakout

- Crude Oil Holds at $72.8 After Initial Price Dip

The Bullish Scenario

The immediate resistance is at $4.0. From a technical perspective, the uptrend from $3.57 will likely resume if the value of NATGAS exceeds $4.0. In this scenario, the next bullish target could be $4.1.

NATGAS Support and Resistance Levels – 30-December-2024

Traders and investors should closely monitor the [] key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

| NATGAS Support and Resistance Levels – 30-December-2024 | |||

|---|---|---|---|

| Support | $3.91 | $3.78 | $3.7 |

| Resistance | $4.0 | $4.1 | $4.2 |