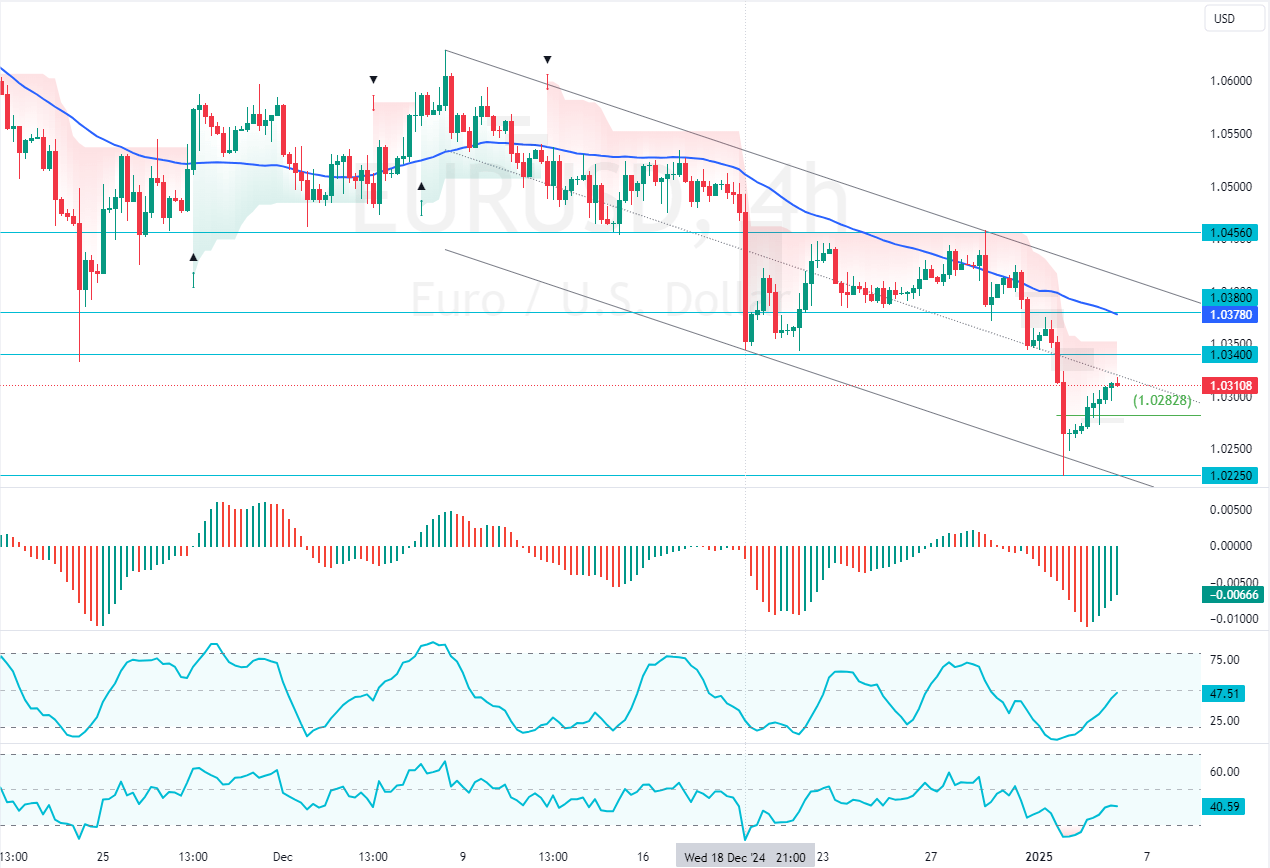

EURUSD bounced from 1.022 and aims toward the December 18, 2024 low at 1.034, which is valid resistance. The primary trend is bearish. A Dip below the immediate support at $1.028 can trigger the downtrend, targeting $1.022, followed by $1.01.

EURUSD Technical Analysis – 6-January-2025

FxNews—The European currency has been in a bear market, below the 75-period simple moving average. However, the euro gained 0.8% since January 2 on oversold signals given by RSI 14 and Stochastic. As of this writing, the EUR/USD pair trades at approximately $1.031, aiming toward the $1.034 resistance.

Regarding the technical indicators:

- The RSI 14 depicts 40 in the description and moving sideways, meaning the market is consolidating with mildly bearish sentiment.

- The Stochastic Oscillator shows 51 in the description, indicating the bull markets strengthened.

- The Awesome Oscillator histogram is green, below zero, interpreted as the bear market weakened.

Overall, the technical indicators suggest that while the primary trend is bearish, EUR/USD has the potential to erase more of its recent losses.

EURUSD Price Forecast – 6-January-2024

The immediate support is at $1.028. From a technical perspective, the downtrend could extend to lower support levels if bears (sellers) push EUR/USD below $1.028.

If this scenario unfolds, the next bearish target could be the January 02 low at $1.022, followed by $1.01.

- GBPUSD Analysis: Technical, Fundamental & News

- EURUSD Analysis: Technical, Fundamental & News

- EURUSD began consolidating from 1.017: rose 0.85%

The Bullish Scenario

The immediate resistance is at $1.034. From a technical perspective, the uptrend from $1.022 will likely resume if the value of EUR/USD exceeds $1.034. In this scenario, the next bullish target could be $1.037.

EURUSD Price Forecast – 6-January-2024

Traders and investors should closely monitor the below EUR/USD key levels to make informed decisions and adjust their strategies accordingly as market conditions shift.

| EURUSD Support and Resistance Levels – 6-January-2025 | |||

|---|---|---|---|

| Support | 1.028 | 1.022 | 1.01 |

| Resistance | 1.034 | 1.038 | 1.045 |