FxMews—In today’s comprehensive GBPAUD forecast, we will first scrutinize the current economic conditions in the United Kingdom. Then, we will meticulously delve into the details of the technical analysis of the GBPAUD pair.

GBPAUD Forecast: UK Stock Market Sees Modest Gains

Bloomberg—In the first trading session of November, the FTSE 100 index experienced a slight uptick of approximately 0.3%, ending the day at 7,342. This resulted from investors juggling numerous corporate earnings reports and economic data while watching the upcoming policy decisions from the Federal Reserve and the Bank of England.

Investors are particularly interested in Fed Chair Jerome Powell’s remarks, as they could provide insight into the potential duration of higher rates, especially considering the current strength of the US economy. Meanwhile, domestically, recent data from the S&P Global/CIPS UK Manufacturing PMI indicates that UK factories had a more challenging October than initially anticipated.

On the corporate side, Next emerged as the standout performer, with its shares climbing 4.4% after it raised its full-year profit forecast in light of encouraging results. Conversely, GSK saw its early gains erased, with its shares falling 2.2% despite raising its full-year profit and sales forecasts for the second time. Energy and mining stocks also experienced a downturn.

GBPAUD Technical Analysis: Bearish Market Bias

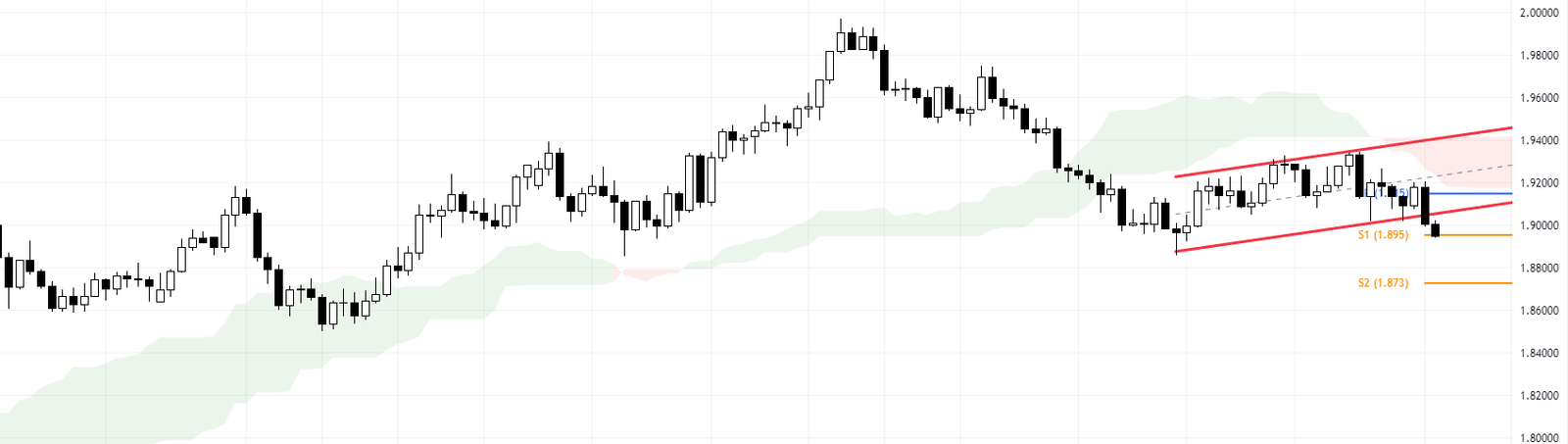

The GBPAUD pair has broken out of the bearish channel, with bears currently testing the 1.895 support level. The market bias for GBPAUD is bearish, as evidenced by the pair’s position below the Ichimoku cloud.

For a detailed insight into the GBPAUD forecast, let’s zoom into the 4-hour chart. The decline has extended close to the lower line of the bearish channel. With the RSI indicator nearing the oversold area, a pullback to the middle line of the bearish channel is expected. Given the current selling pressure, the next target could be the 1.884 support level.

Conversely, 1.917 serves as a pivot point. The bearish scenario would be invalidated if the price breaks this pivot or the upper line of the channel.

This analysis provides traders with key levels to watch in their GBPAUD forecast. forex trading involves risk, and proper risk management techniques are essential.