In today’s comprehensive GBPMXN forecast, we will first scrutinize the current economic conditions in Mexico. Following that, we will meticulously delve into the details of the technical analysis of the GBPMXN pair.

Mexican Peso’s Upward Trend

Bloomberg—The Mexican peso has been on an upward trajectory, surpassing the 17.5 per USD mark and inching closer to the one-month peak of 17.45 seen on November 3rd. This surge is mainly due to investors’ expectations that Banxico, Mexico’s central bank, would stick to its stringent monetary policy, keeping interest rates steady at 11.25% in their forthcoming meeting.

Positive Economic Indicators

Intense labor and economic figures have allowed Banxico to uphold a hawkish stance. For instance, Mexico’s business confidence index has risen for two months, hitting a record high since 2014 at 54. Furthermore, the manufacturing PMI bounced back from a slump in September to 52.1 in October.

Impressive GDP Growth

In addition to these positive indicators, Mexico’s GDP growth exceeded predictions, growing by 3.3% year-on-year in the third quarter. The unemployment rate also saw a decrease, dropping to 2.9%.

Impact on Mexico’s Economy

These developments are generally seen as positive for the economy. A strong currency can help keep inflation in check by making imports cheaper. Moreover, robust economic data indicates a healthy economy, which can attract foreign investment and stimulate further growth. However, it’s important to note that an overly strong currency can hurt exporters by making their goods more expensive on the international market. Therefore, a balance needs to be maintained.

GBPMXN Forecast and Technical Analysis

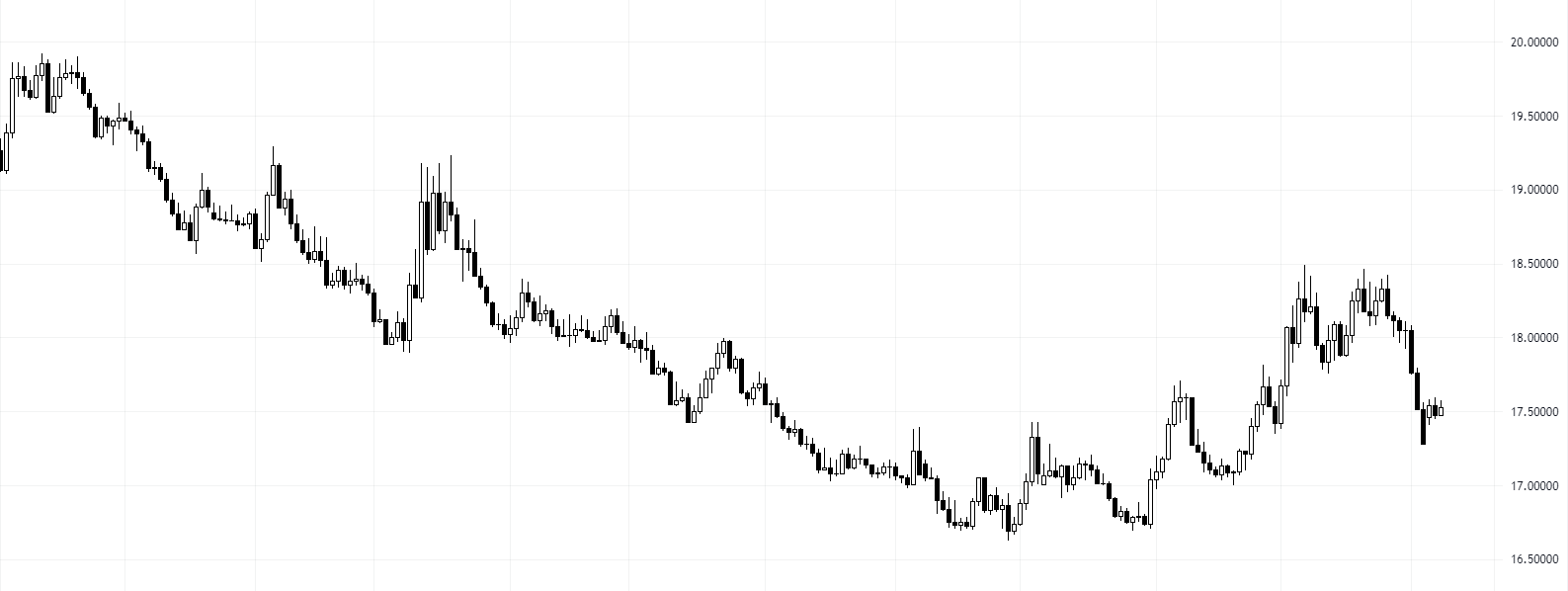

Have you been keeping an eye on the GBPMXN chart? If so, you’ll notice that the pound sterling is in a bearish channel against the Mexican Peso. We see signs of a potential downtrend with the GBPMXN price below the 21.61 pivot. A selling signal from the Lorentzian classification further confirms this.

But don’t be too quick to make assumptions! If the GBPMXN price can close and stabilize itself above the pivot, we might see a shift toward the upper band of the bearish channel.

The pivot is the star of this GBPMXN forecast. It’s holding up the bearish scenario. If it continues to hold, we could see the GBPMXN price testing the R1 (21.924 support).