In today’s comprehensive EURHUF forecast (Euro to Hungarian Forint), we will examine Hungary’s current economic conditions and meticulously examine the EURHUF pair’s technical analysis.

EURHUF Forecast – Bullish Channel Breakout – What’s Next?

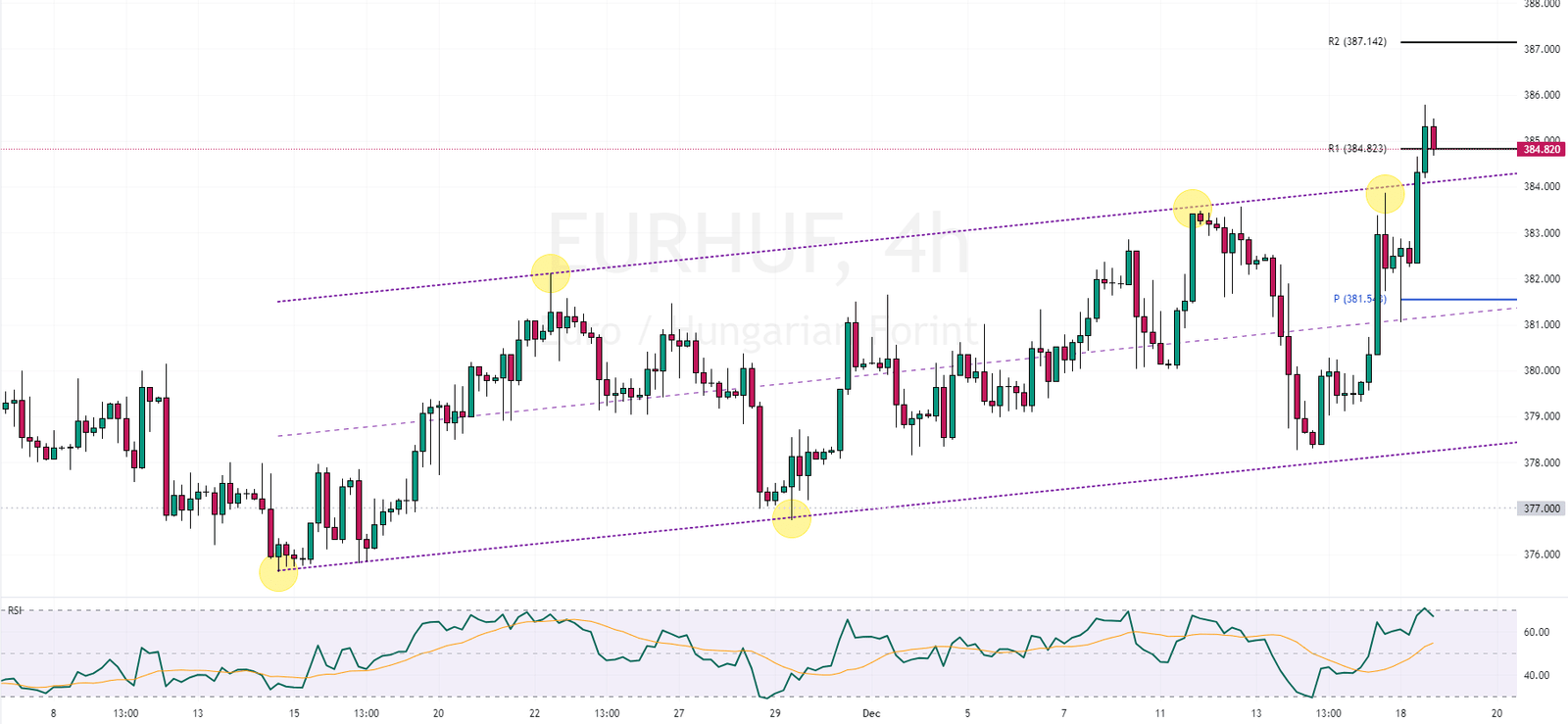

FxNews—The currency pair recently achieved a significant milestone by breaking out of its bullish channel. Currently, the Relative Strength Index (RSI) is stepping outside the overbought zone, suggesting a consolidation in momentum. Simultaneously, the pair explores the possibility of retesting the previously broken resistance level.

The upper line of the bullish channel is now acting as a support. As long as the EURHUF maintains its trading above this critical level, R2 emerges as a potential target for this ongoing bullish wave. This suggests a continuation of the upward trend in our EURHUF forecast.

However, there is an alternative scenario to consider. If bearish forces drive the price back within the flag, it will likely lead to a reassessment of the pair’s bullish technical analysis. In such a situation, the pivot point could become a likely target for sellers. This shift would indicate a change in the market dynamics, potentially altering the current EURHUF forecast.

Hungary’s Construction Output Sees Growth

Bloomberg—In October 2023, Hungary experienced a modest yet significant uptick in its construction output, marking a 0.1% increase compared to the same month in the previous year. This rise signals a noteworthy recovery, especially after witnessing a 6% drop in the preceding month. October’s figures represent the first instance of growth following two months of consecutive declines.

This improvement was primarily driven by a rebound in building activity, which saw a 2% increase, starkly contrasting the 9.5% decline in September. However, it’s important to note that civil engineering works did not follow this positive trend, as their output fell by 2.6%, down from a 0.4% growth previously. On a seasonally adjusted monthly basis, the overall construction output in Hungary was 1% higher than in the preceding month.