In today’s comprehensive EURUSD technical analysis, we will first scrutinize the currency pair’s price action and then meticulously delve into the fundamental analysis of this trading instrument.

EURUSD Technical Analysis – Bulls Aiming for 1.1

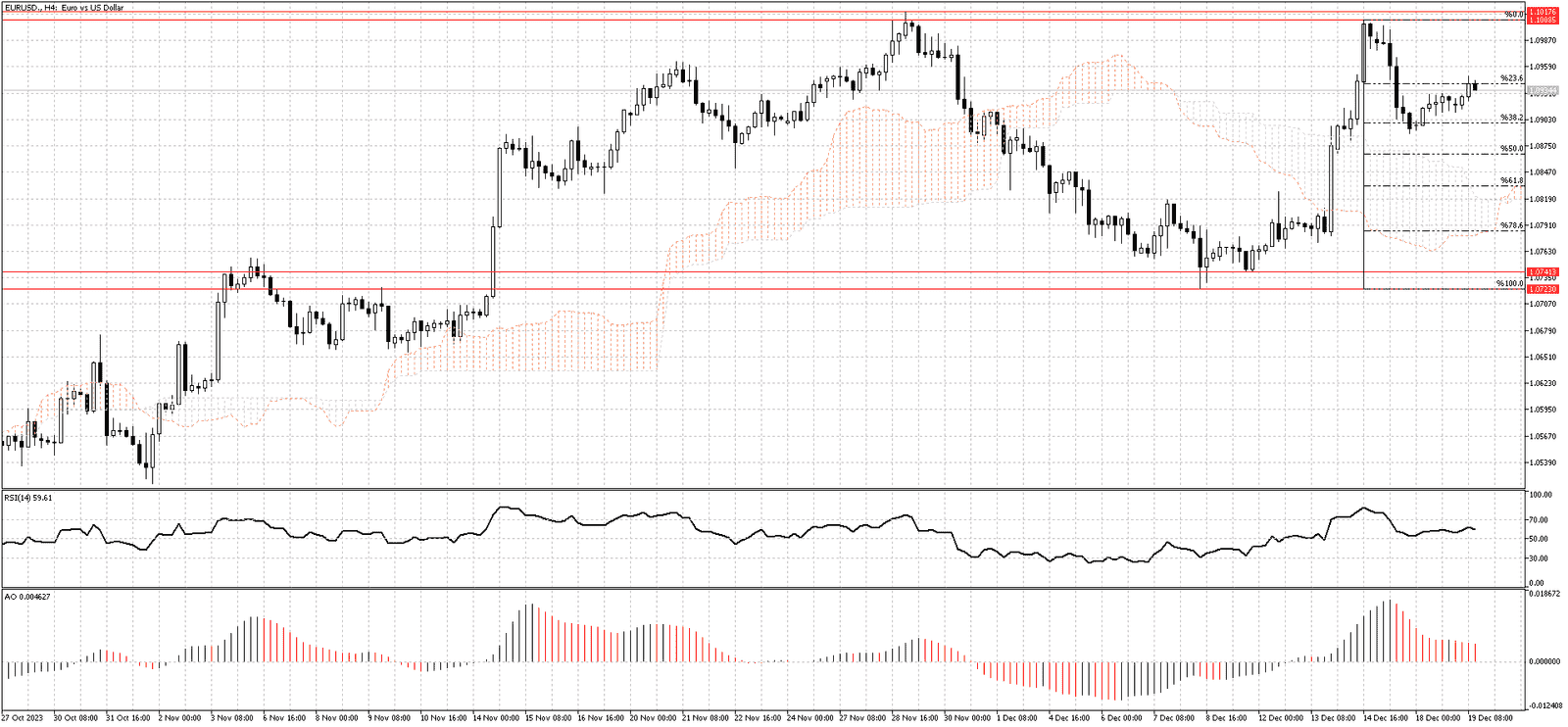

FxNews – The currency pair is currently challenging the 23.6% Fibonacci resistance level, following a predicted rebound from the 38.2% level. This upward movement aligns with our expectations, considering the ongoing bullish trend and the fundamental factors at play. Should the bulls secure a close above the 23.6% mark, we anticipate the bullish momentum to carry the pair towards 1.1008, matching the recent highs.

Conversely, if the pair stabilizes below the 38.2% Fibonacci level, it would doubt the current bullish technical analysis. In such a case, we could see the pair’s decline extending toward the Fibonacci cloud, signaling a potential shift in the market trend.

Eurozone Rate Cut Expectations Affect Euro

The euro recently traded below the $1.1 mark, driven by investor expectations of a potential decrease in Eurozone interest rates. On Tuesday, Francois Villeroy de Galhau from France hinted at a possible rate decrease next year to bring inflation back down to 2% by 2025. This statement suggests a cautious approach to monetary policy in the Eurozone. In contrast, Yannis Stournaras of Greece took a firmer stance.

He emphasized that inflation should be controlled to below 3% by the middle of next year before any reduction in borrowing costs is considered. This difference in opinions highlights the varying perspectives among European Central Bank policymakers regarding the appropriate timing and pace of changing interest rates.

Despite a drop in inflation to 2.4% in November, economists are still concerned about the potential for inflation to rise later in the year. This ongoing concern about inflation dynamics is a key factor influencing investor sentiment and the euro’s value in the currency markets.