In the previous USDDKK technical analysis, we forecasted that the downtrend would likely continue if the price stayed below 6.98. That forecast came into play, and the U.S. Dollar dipped to 38.2% Fibonacci support (the 6.89 mark) against the Danish Krone on Friday, a level further supported by the lower line of the bearish channel depicted in the 4-hour chart.

Fibonacci Levels and the Consolidation Phase

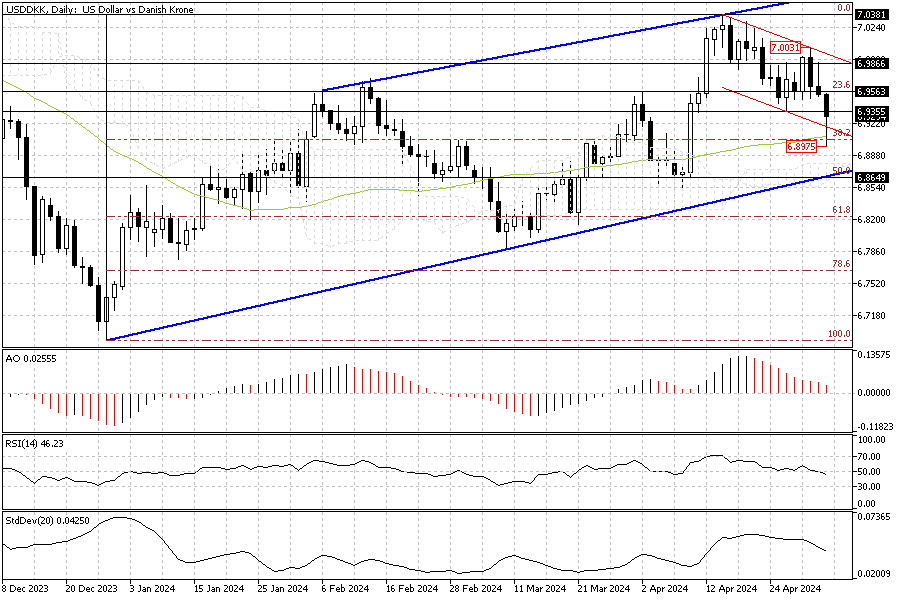

The USDDKK daily chart provides a broad outlook on price movement. The chart below shows that the primary trend is bullish because the price is above the Ichimoku cloud (daily chart) and the %50 Fibonacci level. Therefore, the dip that began from the 7.03 mark should be considered a consolidation phase.

According to the technical indicators on the daily chart, the correction phase may extend further to the %50 Fibonacci level, a deck that is supported by the ascending trendline in blue, Ichimoku cloud, and the %50 Fibonacci level, the 6.68 mark.

To locate a decent entry and exit point for the USDDKK pair, we zoon into the 4-hour chart.

Potential Extension for USDDKK if Bulls Surpass 6.93

Massive selling pressure drove the RSI into the oversold area below 30. Consequently, the price bounced, and the Friday trading session closed with the pair testing the 6.93 resistance.

If the bulls cross above the 6.93 barrier, the current pullback in the USDDKK currency pair would extend to the 23.6% Fibonacci resistance (the 6.95 mark), an area of resistance that provides a decent bid for the new sellers to join the market, and with a new pressure the price will likely dip again to 6.897 mark.

Therefore, forex traders and investors closely monitor the market behavior around the 6.95 mark.

The Bullish Scenario

For the primary bullish trend to resume, the USDDKK bulls must close and stabilize the market above the Ichimoku cloud, the 7.0 mark. In this case, the bearish technical analysis should be invalidated, and the bull’s path to 7.03, followed by 7.06, will be paved.