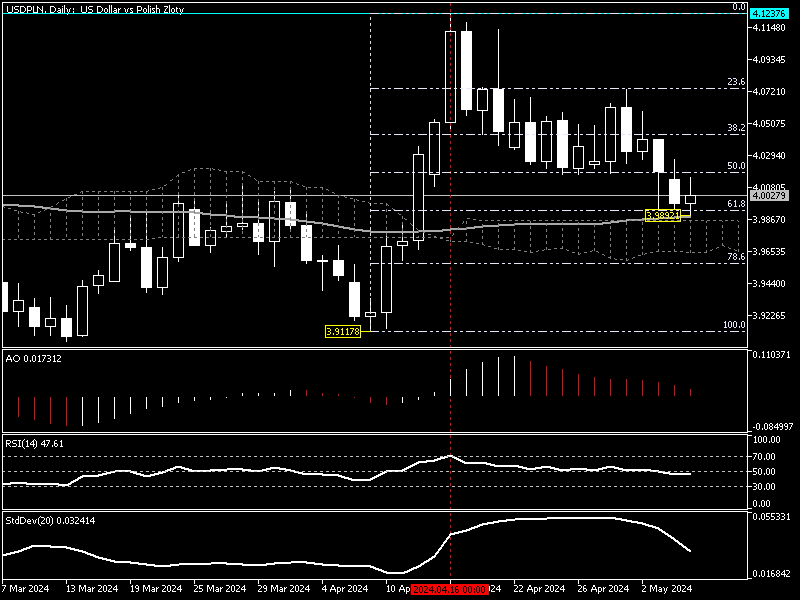

The U.S. Dollar is trading at about 4.0 against the Polish Zloty in today’s trading session. The USDPLN currency pair has been downtrend since it peaked at 4.12 on April 16.

USDPLN Dips to 3.98 Amid Selling Pressure

Selling pressure drove the USDPLN pair down to 3.98, a strong supply zone supported by EMA 50, the Ichimoku cloud, and the %61.8 Fibonacci retracement level. Therefore, the market will likely experience a pullback from the 3.98 mark. However, to conduct a detailed technical analysis and find the key points, we zoomed into the 4-hour chart.

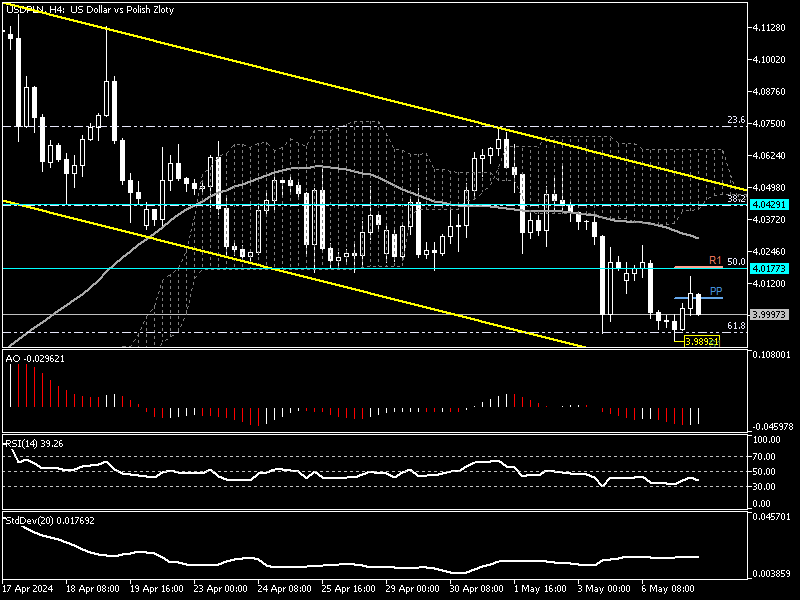

USPLN Forecast – Price Action in Focus

The 4-hour chart shows the USDPLN trades inside the bearish flag and shows uncertainty around the pivot, which is at the 4.0 mark. The technical indicators also provide mixed signals and can’t be considered in today’s technical analysis. Therefore, we can rely on price actions and the key levels.

From a technical standpoint, if the price maintains its position above 3.98, the pullback would extend to the upper band of the bearish flag, which is in conjunction with the %38.2 Fibonacci, the 4.04 mark.

The Bearish Scenario

Conversely, if the USPLN dips below the 3.98 mark, the downtrend will likely resume, and the next bearish target could be the %78.6 Fibonacci, the 3.95 mark. If this scenario comes into play, the primary trend will shift from a bull market to a bear market, and we expect the Polish Zloty to gain more ground against the U.S. dollar and revisit April’s all-time low, the 3.911 mark.

USPLN Key Weekly Support and Resistance Zones

- Support: 3.989, 3.9575

- Pivot: 4.006

- Resistance: 4.01, 4.042