FxNews—Cardano sideway trading resumes below the 23.6% Fibonacci at $0.492. As of writing, the ADA/USD cryptocurrency pair trades at about $0.458.

The Cardano daily chart below demonstrates the Fibonacci levels and the essential technical indicators.

Cardano Analysis – 6-June-2024

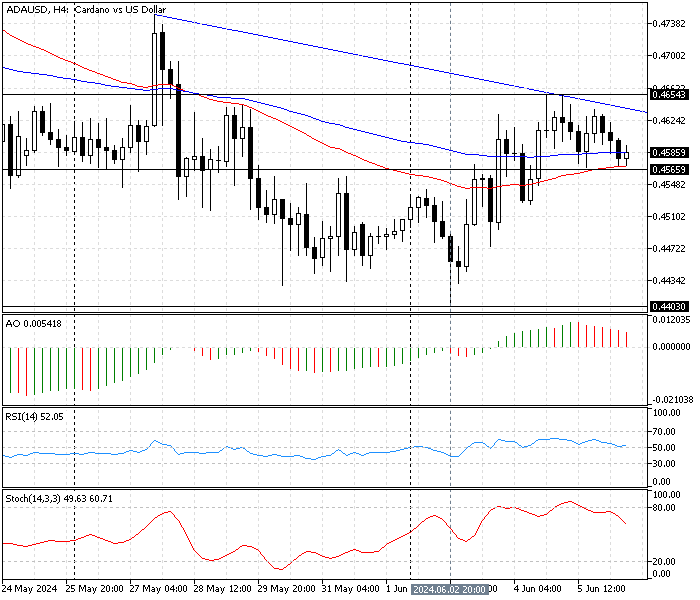

The ADA/USD 4-hour chart below shows the pair is trying to stabilize the price above the simple moving averages of 50 and 100 while other technical indicators give the following signals:

- The awesome oscillator bars are red, depicting 0.005 above the zero line. This means the bullish momentum that began in early June has weakened.

- The relative strength index indicator value is 50, attached to the median line, signifying the Cardano market lacks momentum.

- The stochastic oscillator stepped outside the overbought territory, recording 60 in the description and declining. This indicates the bullish momentum weakens, and the bearish momentum strengthens.

These developments in the technical indicators and the fact that the 4-hour chart formed a long-wick bearish candlestick pattern suggest the ADA/USD price might dip to lower support areas.

Cardano Price Forecast – 6-June-2024

From a technical standpoint, the primary trend is bearish, and SMA 50 at $0.456 plays the immediate resistance. If the ADA/USD price dips below the immediate resistance, the decline from yesterday’s low will likely target the June 2 low at $0.440.

If the selling pressure exceeds the June 2 low, the May 13 low at $0.423 will be the next target.

Please note that the descending trendline and the $0.465 act as resistance in the bearish scenario. If the primary resistance and the descending trendline are breached, the bearish scenario should also be invalidated.

Bullish Scenario

Immediate resistance is at $0.465, yesterday’s peak. The bulls must close above this level for the mild uptrend to resume. If this scenario comes into play, the bullish wave that started on June 2 from $0.440 will likely target the 23.6% Fibonacci retracement level at $0.492.

Cardano Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.456 / $0.440

- Resistance: $0.465 / $0.492

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.