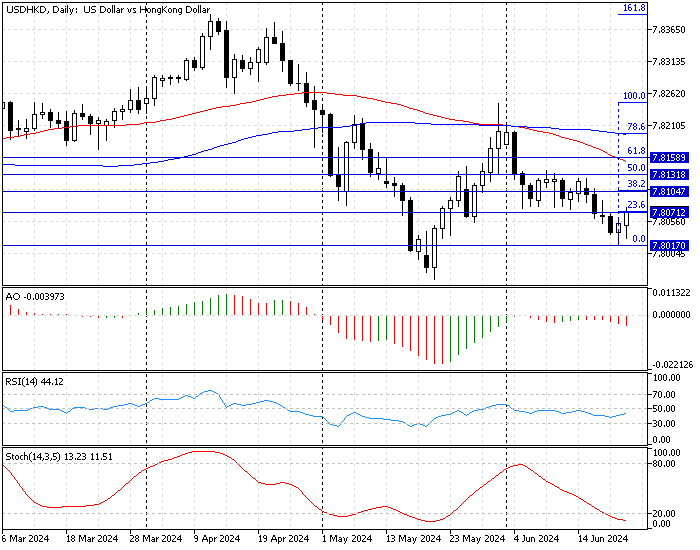

FxNews—The USD/HKD chart below shows the U.S. dollar is in a downtrend against the Hong Kong dollar, as the currency pair trades below the 50-period simple moving average.

The daily chart shows that the severe selling pressure has driven the stochastic oscillator into oversold territory. This decline in the stochastic value indicates that the market is oversold and might step into a consolidation phase. The daily chart below demonstrates the USD/HKD chart in the daily time frame, the current price, and the technical tools used in today’s analysis.

USDHKD Technical Analysis – June-24-2024

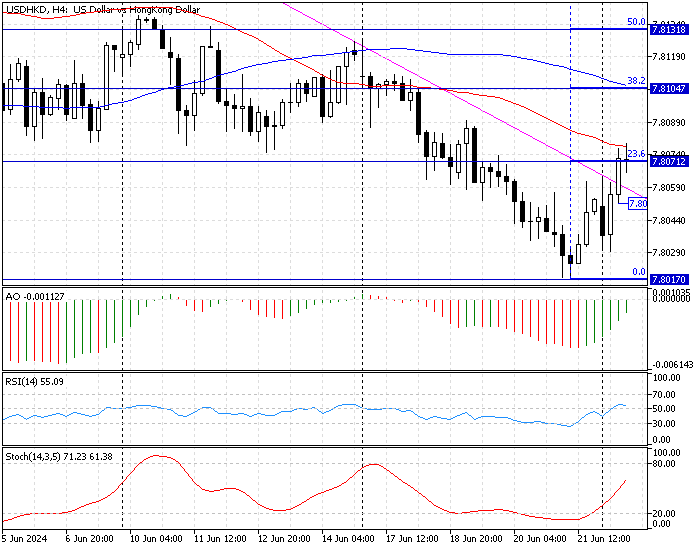

The downtrend is more apparent in the 4-hour chart. As of writing, the USD/HKD trades at about 7.807, testing the 50-period moving average in the 4-hour time frame. Interestingly, the price broke above the descending trendline, trying to stabilize itself beyond the 23.6% Fibonacci at 7.807, which is considered immediate resistance in our analysis.

The technical indicators suggest the downtrend eases, and the pullback initiated from 7.801 might extend to higher resistance levels.

- The awesome oscillator bars are green, with a value of -0.0011 and rising. This growth in the AO value indicates that the bullish wave is strengthening.

- The Relative strength index indicator is above 50, showing a value of 55 in the description, signaling the uptrend is gaining more momentum.

- The stochastic oscillator aligns with the other technical indicators. The %K line value is rising, but it is not the overbought territory, suggesting the pullback can be extended further.

USD/HKD Forecast – 24-June-2024

The recent development in the U.S. currency resulted in the price crossing above the descending trendline. From a technical standpoint, if the USD/HKD price stabilizes itself above the 23.6% Fibonacci level and the 50-period moving average at 7.807, the next bullish target could be the 38.2% Fibonacci at 7.810, backed by the 100-period moving average. Furthermore, if the bullish pressure exceeds 7.810, the next ceiling will be the 50% Fibonacci at 7.813.

The bullish scenario should be invalidated if the USD/HKD exchange rate dips below the broken trendline at about 7.805.

USD/HKD Bearish Scenario

The immediate support is at 7.085, and the key resistance level is July’s all-time low at 7.801. If the bears push the USD/HKD price below the 7.085 mark, it signals that the downtrend will likely resume, and initially, they might target the key resistance area at 7.801. Also, if the selling pressure exceeds 7.801, the next supply level will be May’s low at 7.796.

The 50-period simple moving average is the main resistance level for the selling strategy. The bear market remains valid if the U.S. Dollar’s value is below the SMA 50.

USD/HKD Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 7.805 / 7.801

- Resistance: 7.807 / 7.810

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.