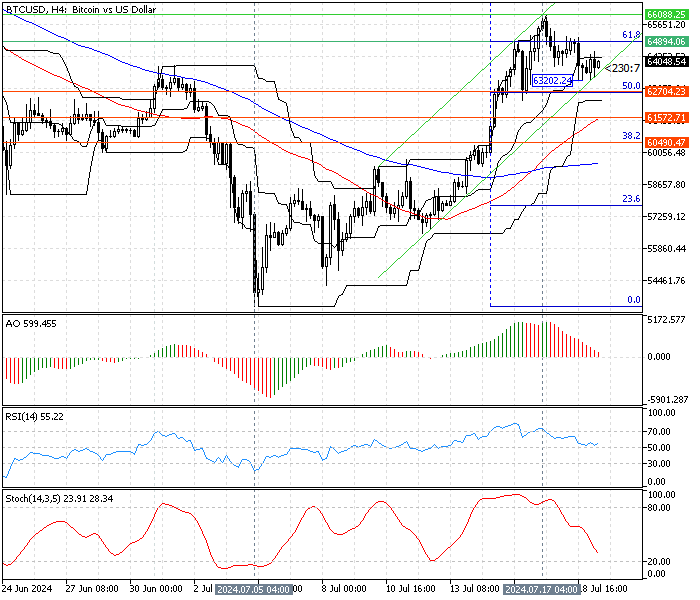

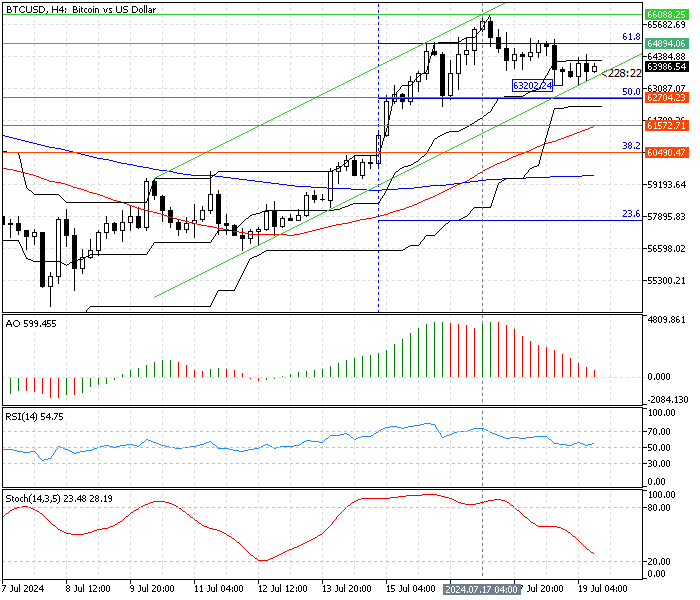

FxNews—Bitcoin‘s uptrend eased near $66,088, and as of writing, the price dipped to the ascending trendline at approximately $63,202. The BTC/USD pair is currently trading at about $63,780, and the chart below shows the price, key support and resistance level, and the technical indicators utilized in today’s analysis.

Bitcoin Technical Analysis – 19-July-2024

The technical indicators in the BTC/USD 4-hour chart suggest that the primary trend is bullish but weakening, and the consolidation phase might extend to the lower resistance levels.

- The bitcoin price is above the 50 and 100-period simple moving average, indicating a bullish primary trend.

- The awesome oscillator value is 807, declining with red bars, meaning the bearish momentum strengthens.

- The stochastic oscillator value is declining with the %K period at approximately 34, meaning the market is not oversold, and the price has room to dip more.

- The relative strength index indicator value clings to the median line, a signal for a low momentum market.

Bitcoin Price Forecast – 19-July-2024

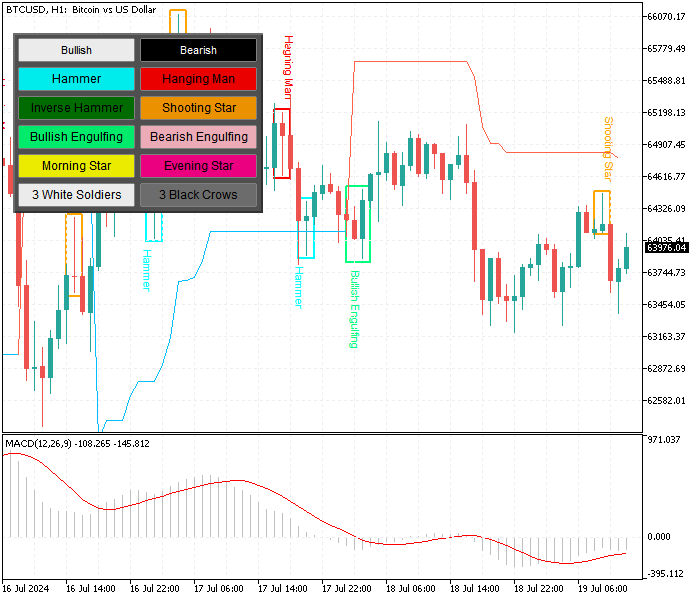

The %50 Fibonacci at $62,704 is the immediate resistance, which is also a pivotal price between the bull and the bear market. Zooming into the one-hour chart, we notice the bears formed a shooting star candlestick pattern, a bearish signal, and the price is below the super trend indicator.

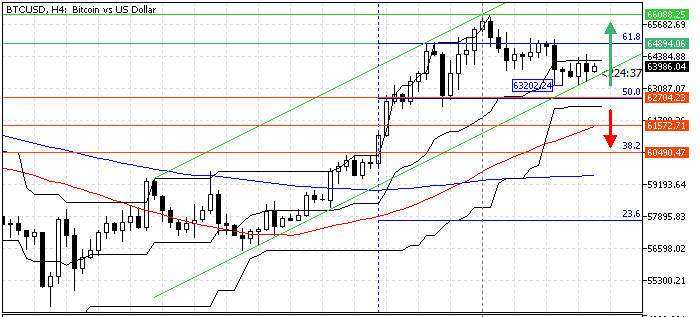

If Bitcoin price dips below the immediate resistance, the bearish momentum from the July 17 high at $66,088 will likely extend to test the 50-period simple moving average at $61,572. Furthermore, if the selling pressure exceeds $61,572, the next support level will be at the 38.2% Fibonacci at $60,490.

Bitcoin Bullish Scenario

If the BTC/USD price holds above the %50 Fibonacci at $62,704, the uptrend will likely resume. If this scenario unfolds, the July 17 high at $66,088 will likely be tested again. Furthermore, if the price closes above $66,088, the next resistance level will be 78.6% Fibonacci at $68,060.

Please note that the bull market should be invalidated if the price dips below 50%50 Fibonacci.

Bitcoin Key Levels – 19-July-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $62,704 / $61,572 / $60,490

- Resistance: $64,894 / $66,088 / $68,060