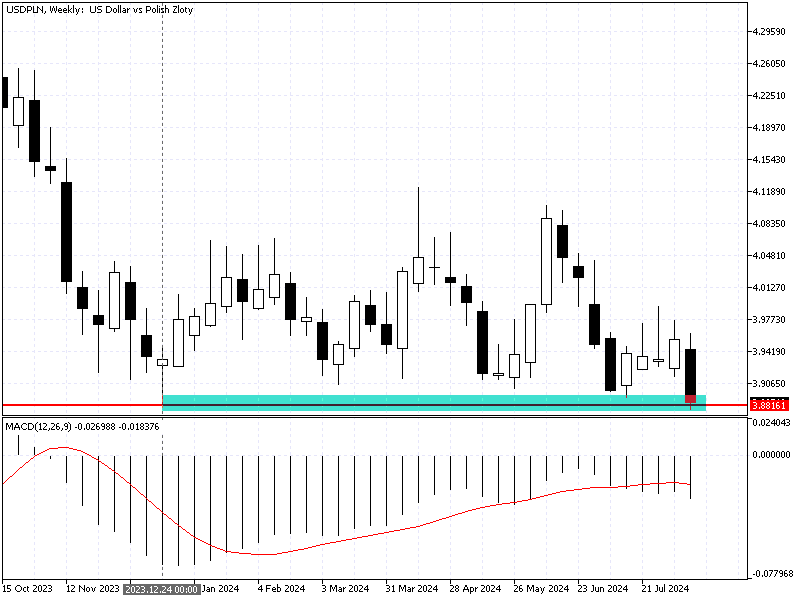

FxNews—The U.S. Dollar downtrend resumed, trading at about 3.881 against the Polish Zloty. This mark is the lowest price in 2024, aligning with the 2023 all-time low. The USD/PLN weekly chart below depicts the price and the 2023 all-time low, the key resistance to the bear market.

USDPLN Technical Analysis – 15-August-2024

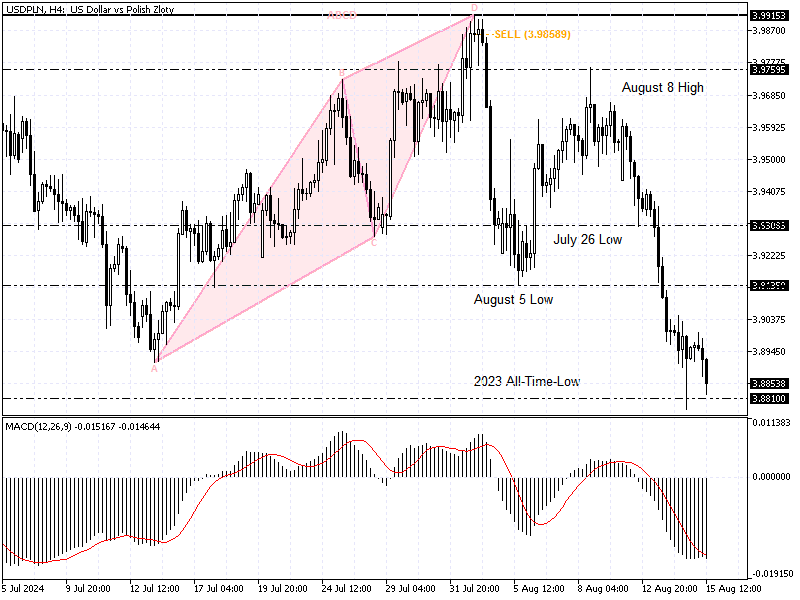

Looking at the 4-hour chart harmonic pattern, we notice the ABCD harmonic pattern, which emerged in July this year. This pattern signals a trend reversal from bullish to bearish. As a result, the price declined from 3.991, which was the August all-time high.

The robust downtrend has driven the stochastic oscillator and the relative strength index into the oversold territory, suggesting a consolidation phase could be on the horizon.

Interestingly, the awesome oscillator bars turned green but remained below the signal line. This development in the AO bars indicates that selling pressure is easing, and buyers are showing more strength. That said, the price is below the 50- and 100-period simple moving average, which signifies that the bear market prevails.

Overall, the technical indicators in the USD/PLN 4-hour chart suggest the primary trend is bearish, but the market is oversold. Hence, we expect the American currency soon to erase some of its losses against the Polish Zloty.

USDPLN Forecast – 15-August-2024

The key resistance level rests at the 2023 low, 3.881. From a technical perspective, if this level holds, the USD/PLN price could bounce to test the August 5 low active resistance at 3.913. Furthermore, if the buying pressure exceeds 3.913, the next bullish barrier will be the July 26 low at 3.930.

Please note that the currency pair is oversold, and the price might slightly slip below the key resistance (3.881). However, this does not change the fact that the USD/PLN pair has room for consolidation toward upper resistance levels.

Therefore, traders and investors should wait patiently for the price to complete the consolidation phase and seek to join the bear market near the following key resistance levels.

- 3.913

- 3.930

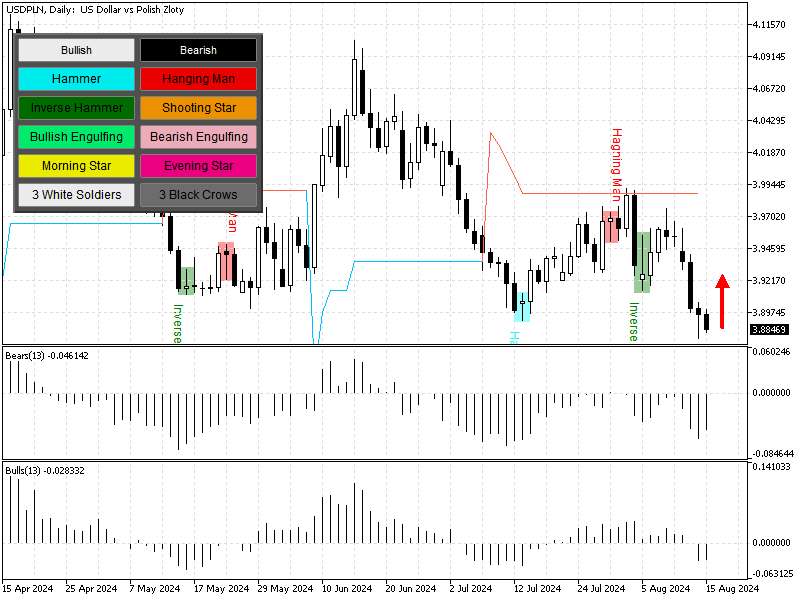

One of the best signals could be spotting a bearish candlestick pattern or a bearish harmonic pattern such as Gartley, butterfly, or ABCD. Hence, traders and investors should monitor the above resistance zones closely and meticulously to make informed trading decisions.

- Also read: USD/MXN Forecast – 14-August-2024

USDPLN Support and Resistance Levels – 15-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 3.913 / 3.930 / 3.975

- Resistance: 3.881 / 3.884 / 3.812

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.