FxNews—The U.S. Dollar has been in a bear market against the Swiss Franc since the May 1 high at 0.922. The bear market and the selling pressure eased this week after the USD/CHF exchange rate dipped to 0.843, the August 4 low.

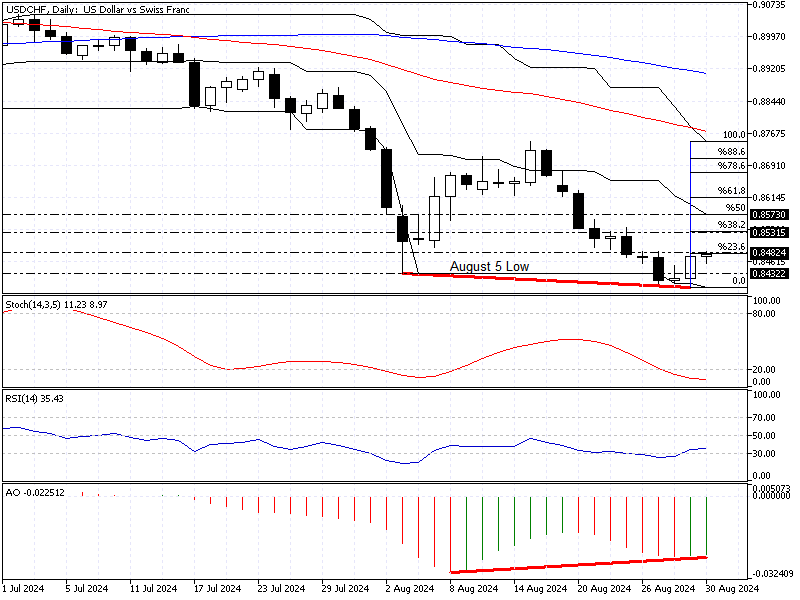

As of writing, the currency pair trades at approximately 0.848, testing the 23.6% Fibonacci level. The USD/CHF daily chart below demonstrates the price, key Fibonacci levels, and the technical indicators utilized in today’s analysis.

USDCHF Technical Analysis – 30-August-2024

The robust bear market has driven the stochastic oscillator into oversold territory, as the daily chart shows. This development means the Swiss Franc is overpriced against the American currency.

Therefore, we expect the USD/CHF price to demonstrate a consolidation phase and test the upper resistance levels soon.

Furthermore, the awesome oscillator signals divergence, a signal for a consolidation phase, or a potential trend reversal. Adding the AO’s signal to the stochastic oscillator suggests the bear market will likely lose momentum.

USDCHF Forecast – 30-August-2024

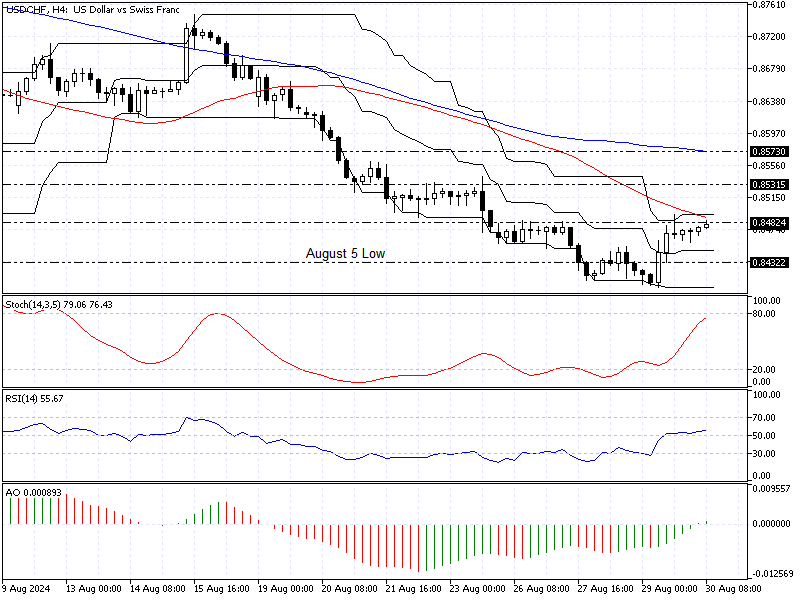

The primary trend is bearish because the price is below the 50- and 100-period simple moving averages in the daily and 4-hour charts. However, as elaborated earlier in this article, the technical indicators suggest a bullish market is on the horizon.

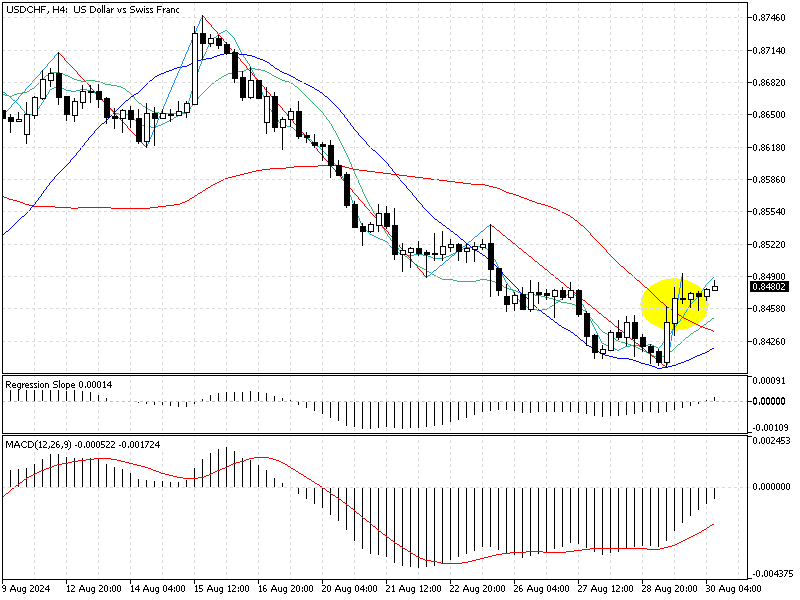

Zooming into the 4-hour chart, we notice the USD/CHF price crossed above the 100-period regression line indicator, and the regression slope indicator flipped above the signal line, meaning a trend reversal could be possible.

That said, from a technical perspective, the price of the trading security will rise toward the %38.2 Fibonacci resistance level at 0.853 if the bulls stabilize the price above the super trend indicator at about 0.847. Furthermore, if the buying pressure exceeds 0.847, the next barrier will be the %50 Fibonacci retracement level at 0.857.

Please note that the bullish technical analysis should be invalidated if the price dips below the August 5 low at 0.843.

- Also, read USD/JPY Technical Analysis – 26-August-2024

USDCHF Bearish Scenario – 30-August-2024

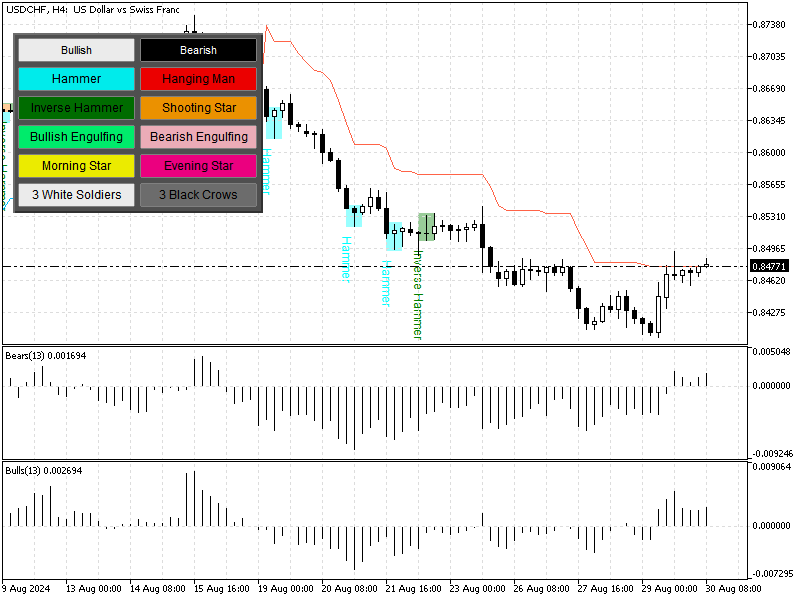

It is not advisable to go short (Sell) in an oversold market. The USD/CHF currency pair faces the same situation, with the momentum oscillators hovering in oversold territory.

Therefore, we suggest traders and investors wait patiently for the market to complete its consolidation phase near the 38.2% Fibonacci level, followed by the 50% level. Monitoring these two resistance areas for bearish signals, such as a shooting star or a bearish engulfing candlestick pattern, could again trigger the downtrend.

If this scenario occurs, the next major supply zone will be the December 2023 low at 0.833.

USDCHF Support and Resistance Levels – 30-August-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.843 / 0.833

- Resistance: 0.848 / 0.853 / 0.857

Disclaimer: This technical analysis is for informational purposes only. Past performance is not necessarily indicative of future results. Foreign exchange trading carries significant risks and may not be suitable for all investors. Always conduct your research before making any investment decisions.