FxNews—The euro is in a bear market against the Japanese Yen, trading at approximately 157 in today’s trading session. The primary trend is bearish because the EUR/JPY price is below the 100-period simple moving average and the 160.0 mark (August 29 Low).

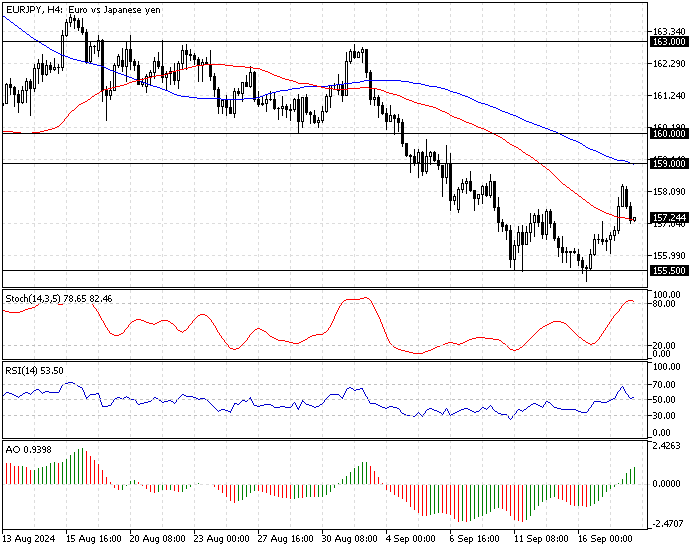

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators used in today’s analysis.

EURJPY Technical Analysis – 18-September-2024

The Stochastic oscillator is in overbought territory, meaning the European currency is overbought against the Yen. The relative strength index indicator declines, nearing the median line, indicating a strengthening bear market.

The Awesome oscillator bars are green and above the signal line, suggesting a bull market, which contradicts the other technical data we receive from the chart.

Overall, the technical indicators suggest the primary trend is bearish, and the downtrend will likely resume.

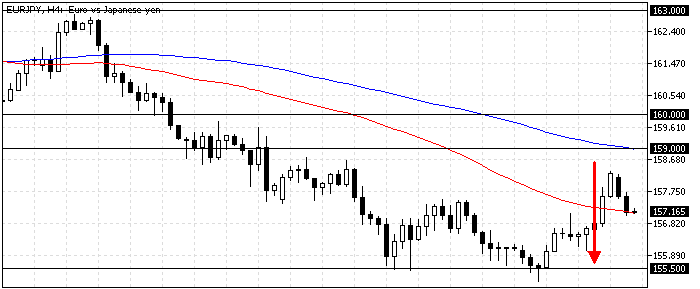

EURJPY Forecast – 18-September-2024

The immediate resistance area expands from the 100 SMA and the August 29 low between 159 and 160. From a technical perspective, the downtrend will likely resume if the EUR/JPY price holds below the immediate resistance.

In this scenario, the current bearish momentum can potentially retest 155.5 (September 16 Low), followed by the August low at 154.4.

The bearish scenario should be invalidated if the EUR/JPY price exceeds the 160 resistance.

EUR/JPY Bullish Scenario

Suppose the bulls (buyers) cross and stabilize the price above 160. In that case, it will likely initiate a new consolidation phase that can potentially result in the EUR/JPY price testing the September 2 high at 163.0.

EUR/JPY Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 155.5 / 154.4

- Resistance: 159.0 / 160.0. 163.0