FxNews—The American currency is in a bear market against the Danish Krone, trading below the 50- and 100-period simple moving averages at approximately 6.7 in today’s session.

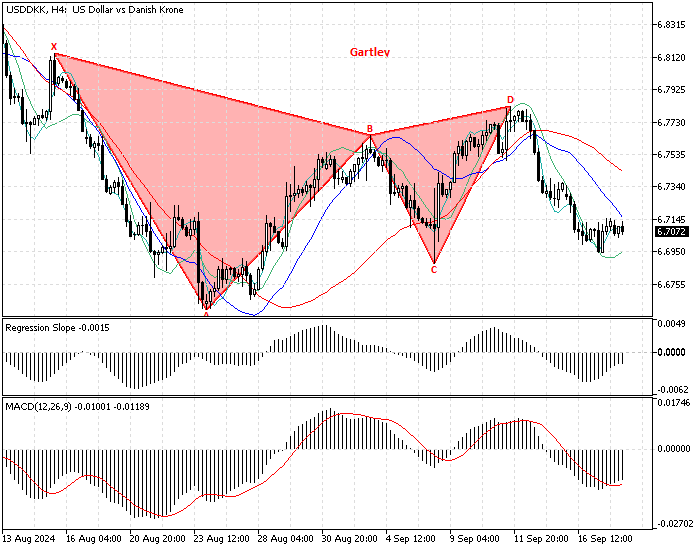

This decline in the USD/DKK was expected because a bearish Gartley pattern emerged in the 4-hour chart last week. The image below demonstrates the USD/DKK price, support and resistance levels, and the technical indicators utilized in today’s analysis.

USDDKK Technical Analysis – 18-September-2024

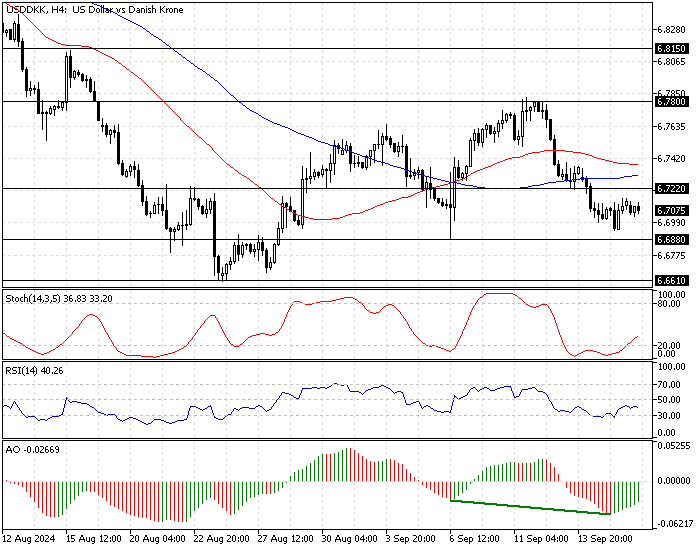

The dip from 6.78 (September 11 High) eased near the 6.68 (September 6 Low) support. Meanwhile, the Stochastic oscillator, RSI 14, and Awesome oscillator show bullish momentum.

Overall, the primary trend is bearish, and the downtrend will likely extend to lower support areas.

USDDKK Forecast – 18-September-2024

The immediate support lies at 6.68. If the USD/DKK dips below 6.68, the downtrend will likely be triggered. If this scenario unfolds, the next bearish target can be the August 26 low at 6.661.

Furthermore, if the selling pressure pushes the price below 6.661, the sellers’ path to the July 2023 low at 6.607 could be paved. Please note that the bearish scenario should be invalidated if the USD/DKK price exceeds the 100-period simple moving average.

- Also read: EUR/JPY Forecast – 18-September-2024

USDDKK Bullish Scenario 18-September-2024

The immediate resistance rests at the 100-period SMA, the 6.722 mark. A new consolidation phase will likely be triggered if the bulls close and stabilize the USD/DKK price above this mark.

In this strategy, the uptick momentum can target 6.78 (September 11 High), followed by 6.81 (August 15 High).

USDDKK Support and Resistance Levels – 18-September-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 6.88 / 6.661 / 6.607

- Resistance: 6.722 / 6.78 / 6.81