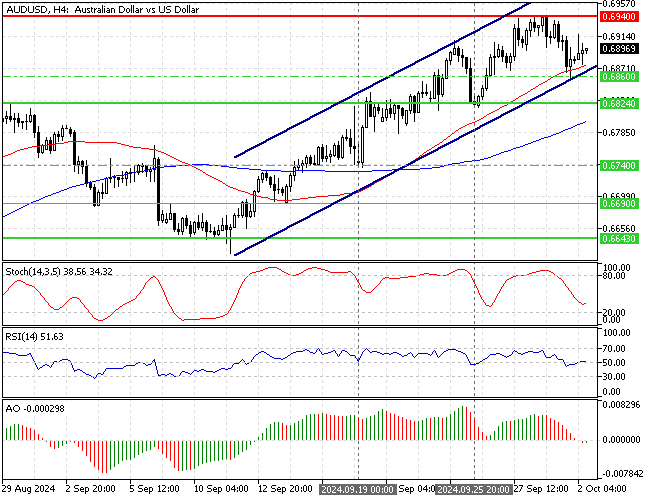

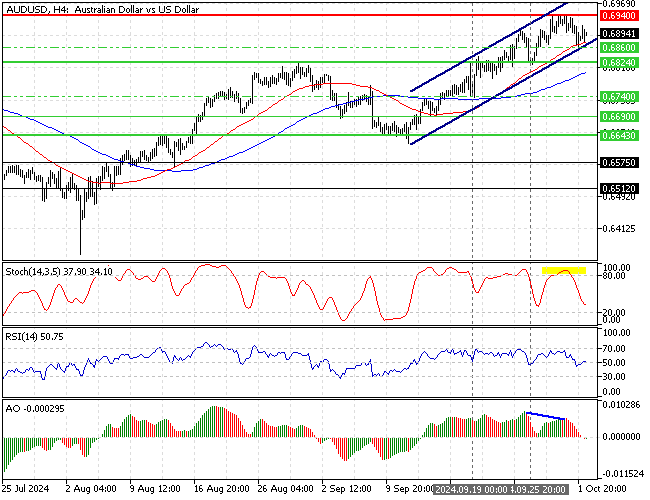

FxNews—The Australian dollar’s pullback from $0.694 (September 30 High) saw the currency pair test the lower line of the bullish black. As of this writing, the AUD/USD currency pair trades at approximately $0.698 and is rising.

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

AUDUSD Technical Analysis – 2-October-2024

The consolidation phase was anticipated because the Awesome oscillator signaled divergence, and the Stochastic was overbought when AUD/USD peaked at $0.694.

Despite the recent decline in the pair’s value, the primary trend is bullish because it trades above the 50- and 100-period simple moving averages.

AUDUSD Forecast – 2-October-2024

As shown in the 4-hour chart, immediate support rests at $0.686, backed by the 50-SMA and the ascending trendline. From a technical perspective, the uptrend will likely resume if the AUD/USD bulls maintain the price above the $0.686 support. In this scenario, the September 30 high at $0.694 could be revisited in the upcoming trading sessions.

Furthermore, if the AUD/USD buyers pull the price above $0.694, the next bullish target could be $0.7, followed by the January 2023 high at $0.713.

Please note that the bullish scenario should be invalidated if the AUD/USD rate falls below $0.682.

AUDUSD Bearish Scenario – 2-October-2024

If the bears (sellers) close and stabilize the price below the 50-period simple moving average or the $0.658 mark, the consolidation phase from $0.694 can potentially extend to $0.682 resistance (September 25 Low).

Furthermore, if the selling pressure pushes the price below $0.682, the sellers’ path to the September 19 low at $0.674 will likely be paved.

- Also read: GBP/USD Technical Analysis – 2-October-2024

AUDUSD Support and Resistance Levels – 2-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.674 / $0.669 / $0.664

- Resistance: $0.694 / $0.70 / $0.713