Market News—WTI crude oil futures significantly rose, reaching $76.5 per barrel this Monday, marking the highest price in six weeks. This increase follows a substantial 9.1% rise from the previous week. The price surge is primarily due to escalating tensions in the Middle East.

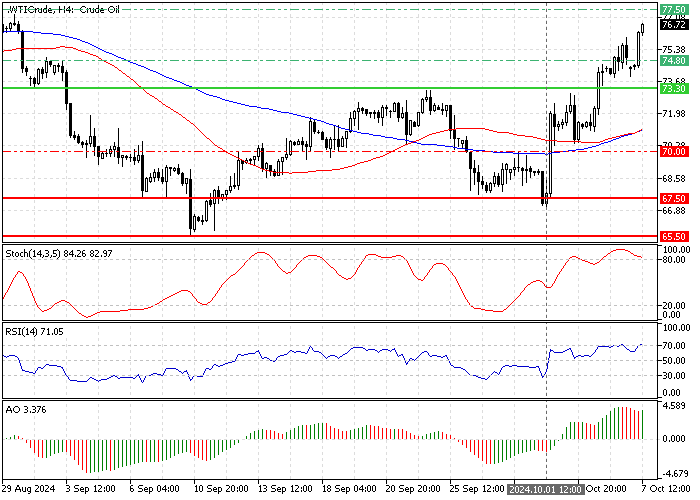

The 4-hour chart below demonstrates the Oil price.

Investor Focus: Possible Israeli Response

Market watchers are particularly keen on Israel’s next steps following a recent Iranian missile strike. There’s ongoing concern about a potential broader conflict in the region, as Israel has not only faced threats from Iran but has also been active militarily in both Gaza and Lebanon.

Amid these tensions, U.S. President Biden has advised against any direct military retaliation on Iran’s oil fields and suggested considering alternative strategies. This stance comes at a time when Iran’s oil production is nearly at its peak, which could be jeopardized if the conflict escalates.

Global Demand and Supply Queries

Despite the geopolitical unrest, the overarching questions about worldwide oil demand continue, focusing on China. The Chinese government is poised to announce new economic stimulus measures, potentially impacting oil demand further. Meanwhile, the global oil supply remains substantial.

Saudi Arabia has adjusted its oil pricing strategically. They have increased prices for their Asian customers while cutting prices for the United States and European markets. This pricing strategy reflects varying market dynamics across different regions.

Oil Technical Analysis – 7-October-2024

FxNews—Oil is approaching the $78.5 resistance rapidly. Meanwhile, the Stochastic oscillator indicates that the market is overbought.

The critical resistance rests at $78.5. If this level holds, Oil may consolidate near the lower support levels, starting with the $74.3 mark.

On the other hand, if the price exceeds $78.5, the bulls’ path to the next resistance level at $80 will likely be paved.