FxNews—The surge in dollar-backed stablecoins and a rise in giant Bitcoin (BTC) transactions could pave the way for a potential BTC price increase in the coming weeks. This trend may support Bitcoin’s historical pattern of positive price movement in October.

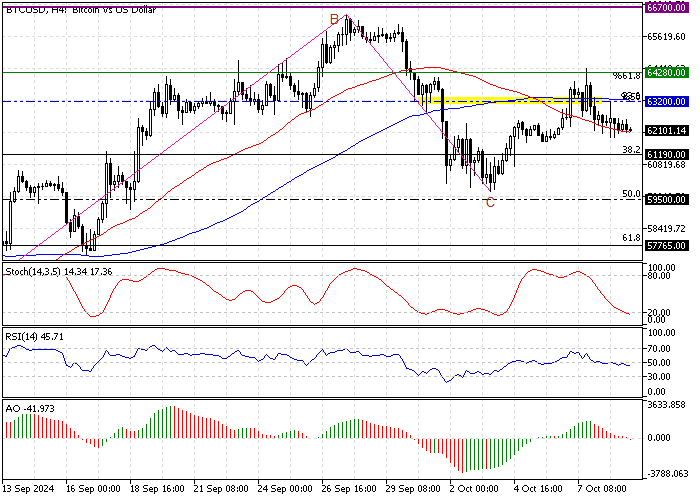

The chart below shows BTC/USD trades at approximately $62,100, testing the 50-period simple moving average as resistance.

Stablecoin Liquidity Reaches New Highs

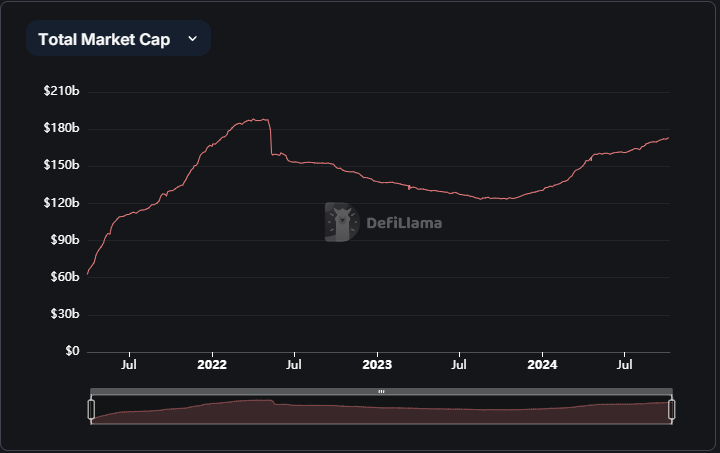

As reported by CryptoQuant, stablecoin liquidity peaked at $169 billion by the end of September, a 31% increase from the beginning of the year.

Tether’s USDT remains the top player, seeing a market cap increase of $28 billion, reaching nearly $120 billion and capturing 71% of the market. Meanwhile, Circle’s USDC has also expanded, with its market cap growing by $11 billion to $36 billion, making up 21% of the stablecoin market, reflecting a 44% growth since January.

Stablecoin Liquidity and Crypto Trading Trends

A significant portion of crypto trading, whether spot or futures, uses stablecoin pairs. The increase in stablecoin liquidity suggests that more funds could be used to buy crypto assets.

Historically, the rise in stablecoin balances on exchanges has been closely linked with higher Bitcoin prices. Over the year, stablecoins on exchanges have increased by 20%, hinting at a potential rise in crypto market activity.

The chart below shows the total market cap of 172.432 B as of this writing.

Positive Link Between Stablecoin Balances and Bitcoin Prices

According to Julio Moreno, head of research at CryptoQuant, “Larger balances of stablecoins on exchanges are positively correlated with higher bitcoin and crypto prices.” Since the beginning of the 2023 bull cycle, USDT balances on exchanges have surged by 146%, growing from $9.2 billion to $22.7 billion.

Notably, this increase happened even though Bitcoin’s price mainly remained stable during that period.

October’s Track Record for Bitcoin Price Gains

Historically, October has been a favorable month for Bitcoin, with only two October losses recorded since 2013. The month often ends with gains as high as 60% and an average return of 22%, making it one of the most profitable periods for investors.

Although Bitcoin has dropped over 6% since the start of October, price spikes of up to 16% have historically occurred after mid-October. The availability of stablecoin liquidity could be a crucial factor supporting this potential price increase.

- Also read: ARK Invest Acquires $2.2M Coinbase Shares

U.S. Election Could Influence Bitcoin’s Path

Looking ahead, the upcoming U.S. presidential election is a major event that could impact Bitcoin’s performance. The outcome of this election may shape future financial and cryptocurrency policies, potentially influencing market behavior for the next few years.

Whales Show Increased Activity in the Bitcoin Market

Data from on-chain analytics firm Santiment reveals a noticeable increase in transactions by large Bitcoin holders, often called “whales.” Due to the size of their holdings, these large investors can significantly impact market prices.

Santiment highlighted a sharp increase in previously dormant Bitcoin activity, paired with $37.4 billion in on-chain volume—marking the highest volume seen in seven months. Historically, when stagnant Bitcoin becomes active again, it often indicates an upcoming price rise.

Final Word

The high stablecoin liquidity and increased activity from major Bitcoin holders could set the stage for a potential price surge. With stablecoins offering liquidity for fresh investments and whale transactions hinting at renewed market interest, Bitcoin’s traditionally strong performance in October may continue.

Investors should monitor these developments, which could be key to shaping the market’s direction in the coming months.