Fxnews—Many forex traders are interested in the USDHKD pair. Our detailed USDHKD analysis reveals intriguing patterns and key levels that could potentially influence future market movements.

In-Depth USDHKD Analysis – Key Levels and Market Trends

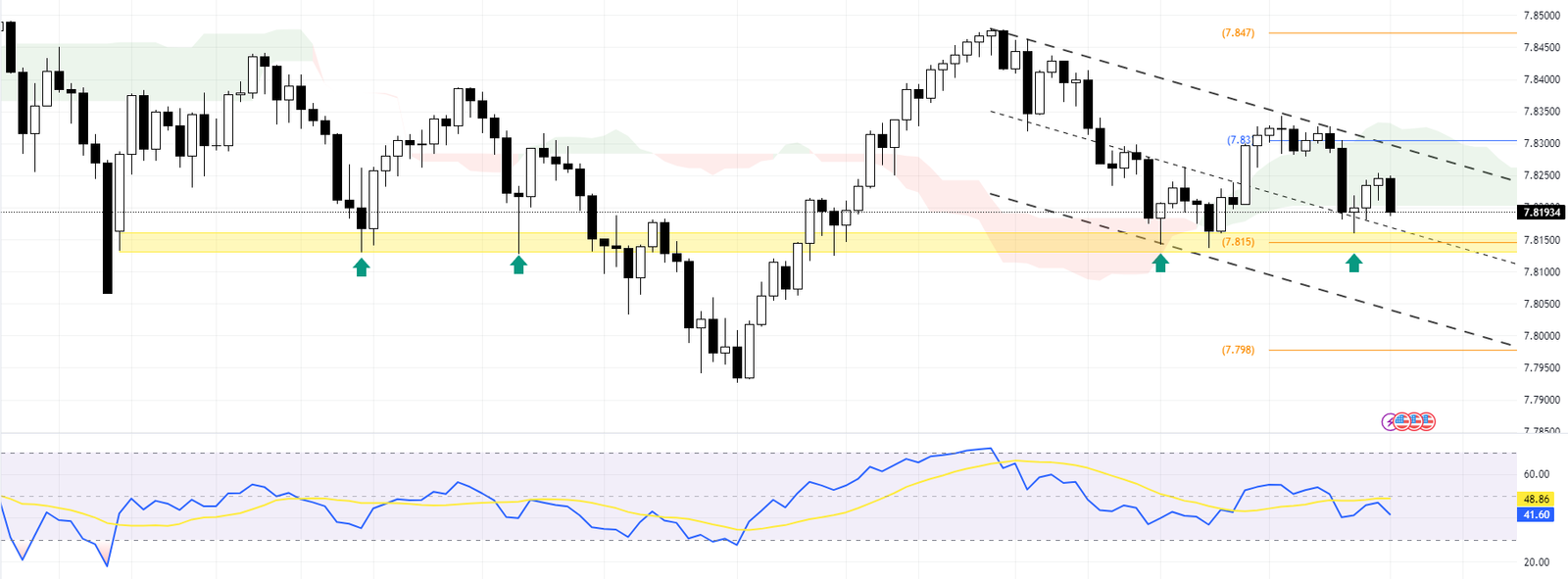

The USDHKD pair is on a downward trajectory, with the price nearing the 7.815 support area. Despite several attempts, the pair has been unable to surpass the high of 7.835 recorded on October 3. This resistance level has proven to be a significant barrier for the pair, as evidenced by the multiple bounces off this level in the USDHKD daily chart.

The Relative Strength Index (RSI) indicator adds to the bearish outlook. It is currently hovering below the 50 line, suggesting more room for the price to decline, possibly extending to the aforementioned support level.

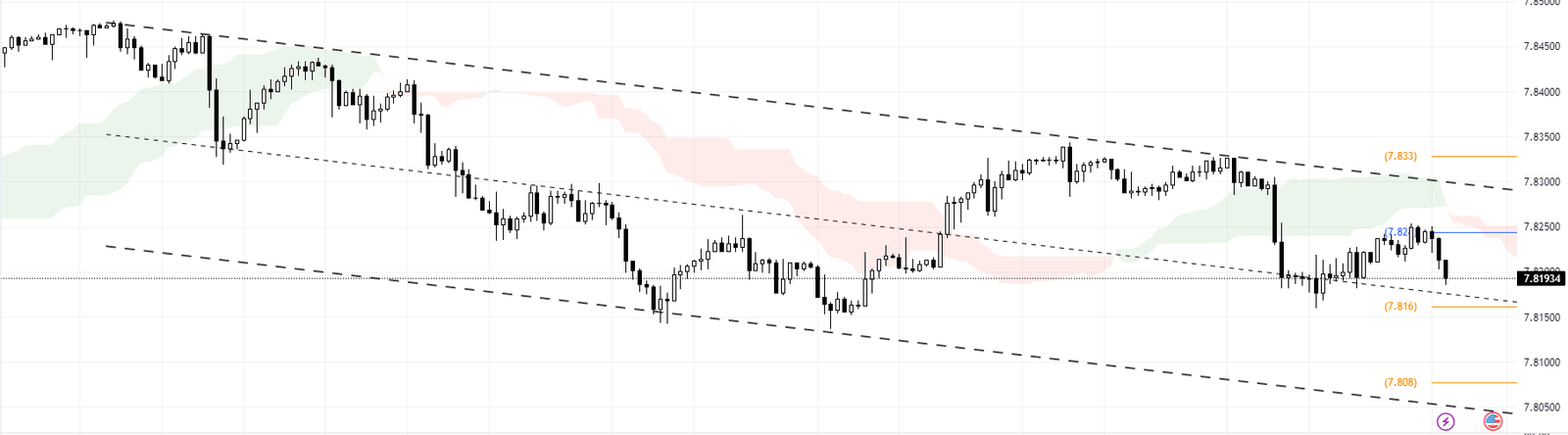

This bearish bias is evident in the daily and 4-hour (4H) charts of USDHKD. Currently, the pair is trading below the Ichimoku cloud, indicating a bearish market sentiment. The immediate target for the bears appears to be the 7.816 support level.

However, it’s worth noting that if this level is breached, it could pave the way for further declines. In such a scenario, the next support level to watch would be 7.808.

USDHKD Analysis: Key Levels

- Resistance: 7.833

- Pivot: 7.824

- Supports: 7.816 – 7.808

These levels could serve as potential turning points for the pair and should be closely monitored by traders. As always, it’s crucial to consider these levels in conjunction with other technical indicators and market news to make informed trading decisions.