On Wednesday, New Zealand’s main stock index, the S&P/NZX 50, rose by 1.75%, closing at 12,776. This gain ended a two-day decline following the Reserve Bank of New Zealand’s move to further ease monetary policy with a 0.5% interest rate reduction.

This decision, announced during the October meeting, lowered the official cash rate to 4.75%, following a previous 0.25% cut in August. The RBNZ highlighted that annual inflation remains within its target range of 1-3%, approaching the midpoint of 2%.

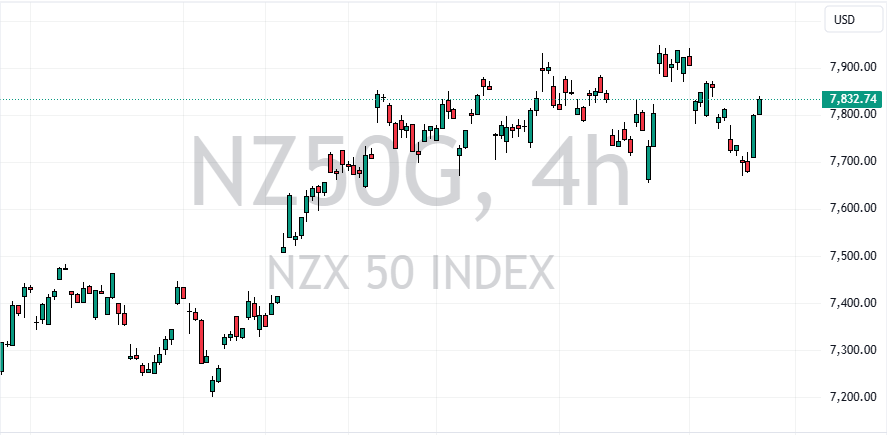

As of this writing, the NZ50 index is trading at approximately $7,830. The image below demonstrates its current price.

Impact on Retirement-home Operators and Market Heavyweights

The lower interest rates are expected to boost the housing market, making it easier for retirees to sell their homes. This optimism pushed shares of retirement home operators upward:

- Ryman increased by 4.5%, Summerset by 2.15%, and Oceania by 2.6%. Significant gains were also observed among major index players like Fisher & Paykel (up 2%), Infratil (up 2%), Mainfreight (up 4.2%), Contact Energy (up 3.5%), Spark NZ (up 2%), and A2 Milk (up 2.3%).

NZDUSD Technical Analysis – 9-October-2024

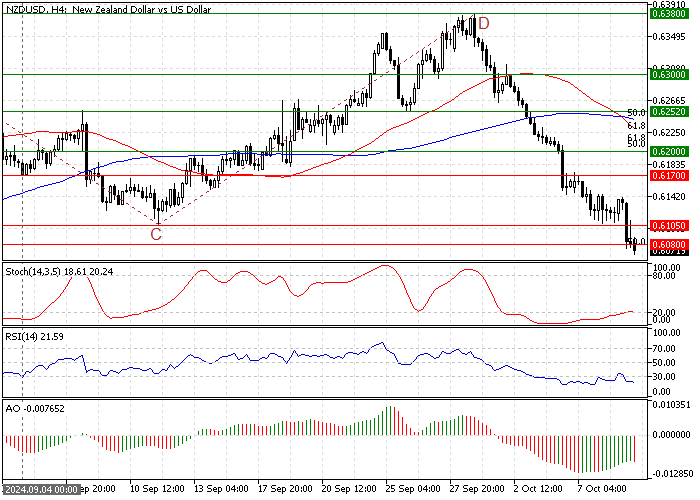

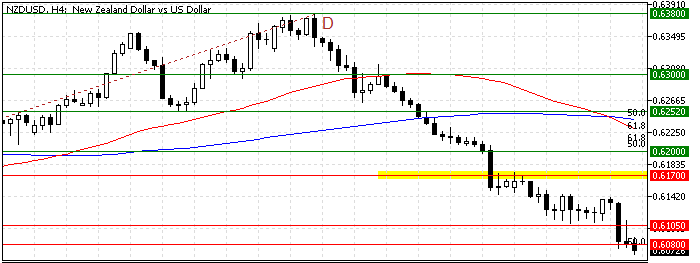

FxNews—The NZD/USD currency pair dipped to as low as $0.607 and broke below $0.608, the August 14 high. The primary trend is bearish because the currency pair’s price is below the 50- and 100-period simple moving averages.

The robust selling pressure has driven the Relative Strength Index indicator into oversold territory, meaning the New Zealand dollar is overpriced. Therefore, the market expects a consolidation phase that could pull the NZD/USD price to upper resistance levels.

NZDUSD Forecast – 9-October-2024

Please note that it is not advisable to go short when the market is oversold. Hence, we advise traders and investors to wait patiently for the NZD/USD price to consolidate near the $0.617 mark (September 24 Low).

In this scenario, retail traders and investors should monitor the $0.617 resistance for bearish signals such as a bearish engulfing pattern or a bearish longwich candlestick pattern. That said, the downtrend from $0.617 could resume if the level holds.

- Also read: Bitcoin Tests Critical Fibonacci at $61700

NZDUSD Support and Resistance Levels – 9-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.608 / $0.603 / $0.597

- Resistance: $0.610 / $0.617 / $00.620