According to the Japan Machine Tool Builders Association, in September 2024, Japan saw a significant reduction in machine tool orders, decreasing by 6.5% compared to the same month last year, amounting to JPY 125,297 million. This marked a further decline from the previous month’s 3.5% drop.

The decline was primarily driven by a 7% fall in domestic orders, which totaled JPY 41,875 million. International demand also weakened, with orders from overseas decreasing by 6.2% to JPY 83,422 million. This trend highlights challenges both within Japan and in global markets.

A Surprising Rebound in Monthly Orders

Despite the yearly downturn, there was a surprising spike in orders from the previous month. Orders jumped 13.1%, a sharp recovery from a 10.9% decline, indicating a possibly volatile but responsive market.

Looking at the broader picture from January to September 2024, the total machine tool orders fell by 2.8%, reaching JPY 1,100,075 million.

USDJPY Technical Analysis – 9-October-2024

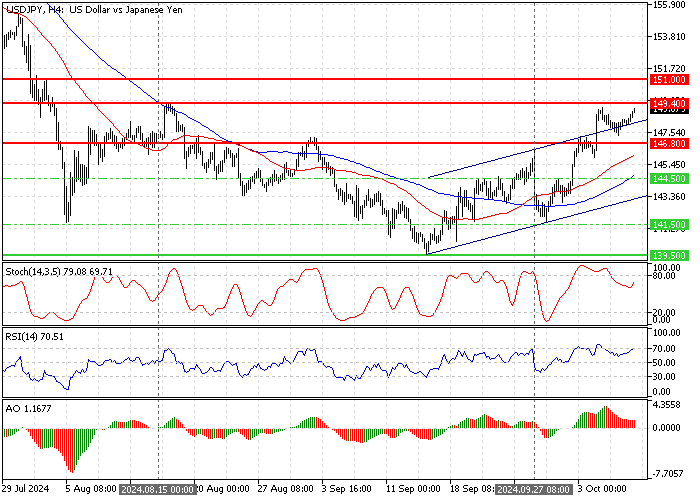

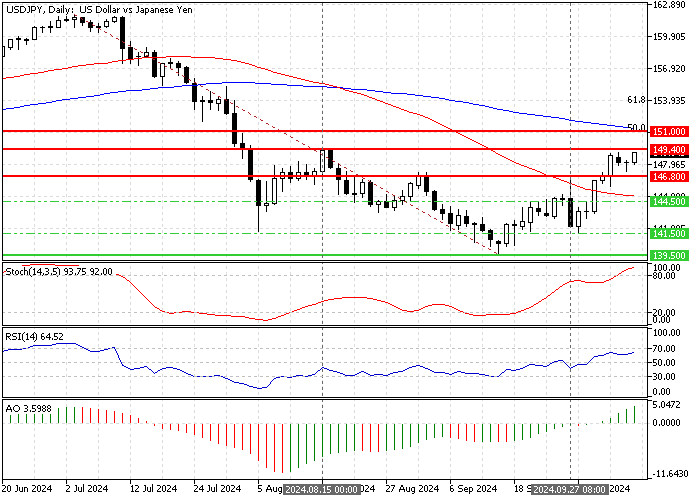

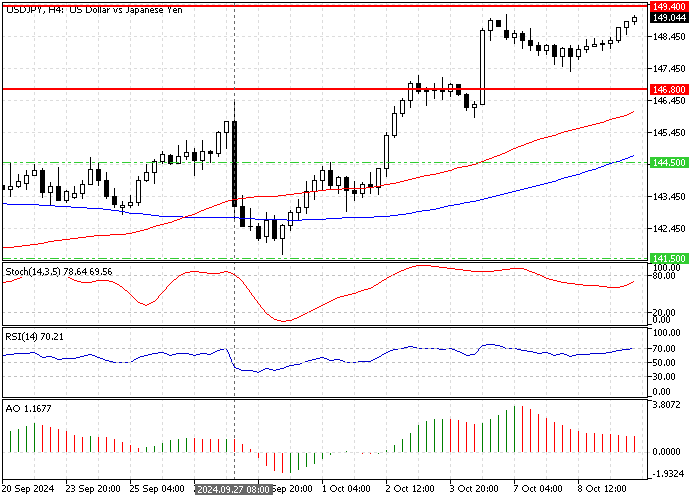

FxNews—The USD/JPY currency pair trades in a bull market above the 50- and 100-period simple moving averages, approaching the 149.4 resistance, the August 15 high.

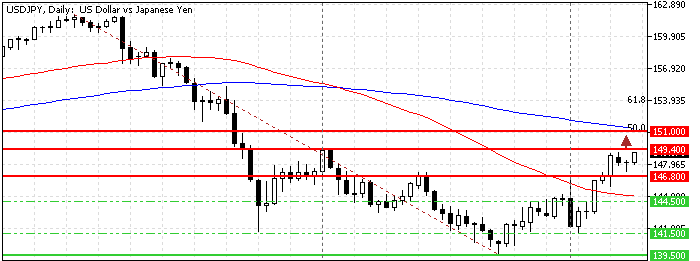

As the USD/JPY daily chart above shows, the currency pair is overbought, as the Stochastic Oscillator records 91 in the description, suggesting the bull market will likely exhaust soon.

Zooming into the 4-hour chart, we notice the Awesome Oscillator histogram turned red and decreased as the Relative Strength Index indicator flipped above the 70 levels, signaling an overbought market.

Overall, the technical indicators suggest the primary trend is bullish, but the USD/JPY has been overbought. Therefore, the price could pull back from this point.

USDJPY Forecast – 9-October-2024

The key resistance level holding the bullish trend to resume rests at 149.4. Due to the overbought condition, the USD/JPY is likely to consolidate if the 149.4 resistance remains intact. In this scenario, the Japanese Yen will have the opportunity to erase some of its losses and target $146.8, the September 27 high.

Interestingly, the 146.8 mark is backed by the 50-period simple moving average. The bull market should be invalidated if the USD/JPY price dips below this level.

USDJPY Bullish Scenario – 9-October-2024

If bulls (buyers) pull the USD/JPY price above the critical resistance of 149.4, a new bullish wave will likely be initiated. If this scenario unfolds, the next target could be the 100-period SMA of the daily chart at approximately 151.0.

- Also read: NZD/USD Sell-off Resumes as NZX 50 Jumps

USDJPY Support and Resistance Levels – 9-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 146.8 / 144.5 / 141.5

- Resistance: 149.4 / 151.0