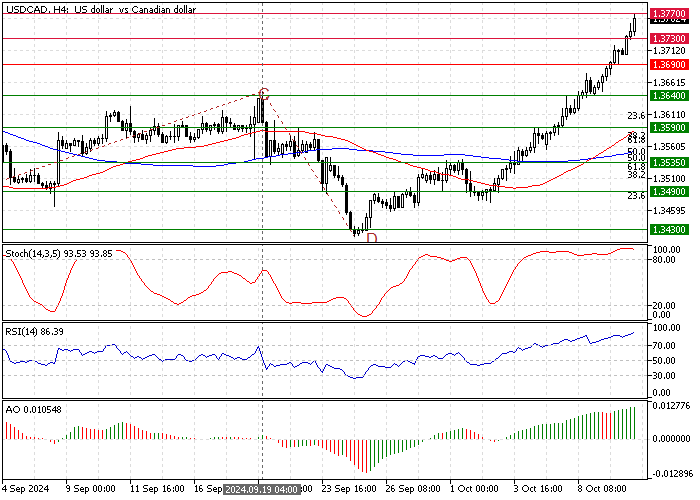

FxNews—In October, the Canadian dollar fell to 1.37 against the US dollar, marking its lowest point in nine weeks. This drop happened because less money was coming into Canada from other countries, and the US dollar strengthened.

Expanding Trade Deficit

Canada’s trade gap widened, reaching CAD 1.10 billion in August, the biggest since May. This increase in the deficit came after a 1.0% fall in what Canada exports, especially a 4.1% reduction in crude oil sales, which is one of its main products.

Lower energy prices, mainly due to reduced economic support from China, significantly contributed to this decrease.

- Also read: UK House Prices Exceed Forecasts

Labor Market Concerns

There’s a worry that upcoming job market data, which will be released on Friday, might show a slowdown. This has led people to think that Canada’s central bank, the Bank of Canada, might cut interest rates to boost the economy.