FxNews—Cryptocurrencies experienced a significant recovery on Friday, bouncing back from the previous day’s lows. Bitcoin notably reclaimed the $63,000 mark as investors quickly set aside their concerns about rising inflation. Instead, their focus shifted to the anticipated updates on fiscal policy from China, which were expected today.

Bitcoin Defies Trends with a Strong Rebound

Bitcoin increased 7% from its low point on Thursday, under $59,000. This rise came after the U.S. reported higher-than-expected inflation figures.

Contrary to the pattern observed during the U.S. trading hours earlier in the week, Bitcoin managed a 5.5% increase over 24 hours, surpassing the broad-market CoinDesk 20 Index, which advanced by 4.7%.

- Also read: Zhao Warns Against Deepfake Scams

Altcoins Follow Suit with Notable Gains

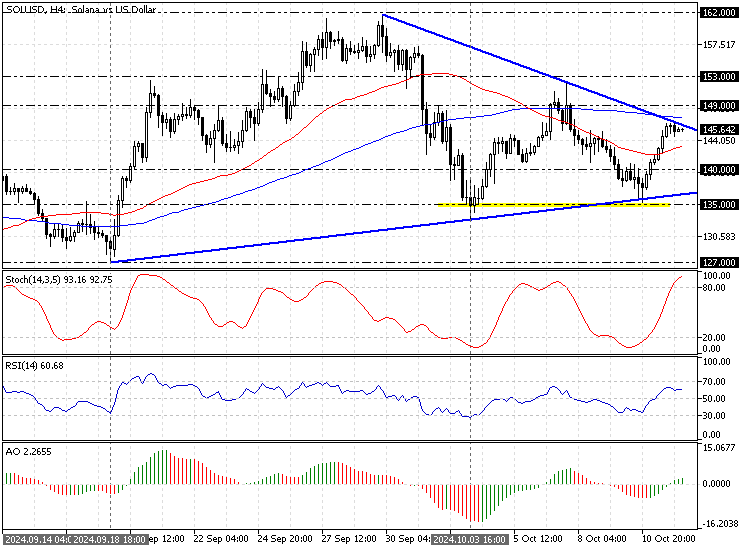

Major altcoins like Solana, Avalanche, and Render posted gains between 6% and 8%. In contrast, Uniswap was the only cryptocurrency that saw a slight decline, following its previous gains spurred by news of launching its layer-2 network.

Stock Market Rises Alongside Cryptos

The rally in cryptocurrencies coincided with gains in the stock market. The Dow Jones Industrial Average and the S&P 500 closed the week at new highs.

Meanwhile, the U.S. dollar index briefly paused after its sharp rise over the past week. It was influenced by expectations of potential changes in the Federal Reserve’s interest rate policies following strong job reports and higher inflation.

Boost in Crypto-Related Stocks

Companies linked to cryptocurrencies also reflected this positive trend. Bitcoin mining companies like MARA Holdings, Riot Platforms, and Bitdeer saw 5% and 10% increases. Coinbase ended the day up by 7%.

MicroStrategy, which holds the largest corporate-owned Bitcoin stash valued at nearly $16 billion, saw its stock surge by 16%, reaching its highest level since March 2000. The gap between the company’s share price and its Bitcoin assets widened to its largest margin since 2021.

Upcoming Chinese Fiscal Announcement: A Potential Game-Changer for Crypto

The forthcoming fiscal policy announcement from China’s finance minister could be a pivotal moment for cryptocurrency markets. As traditional markets will be closed, crypto markets may see increased activity as traders use them to speculate on the impact of China’s fiscal measures.

Recent data from the U.S. has shown a resilient economy and job market, diminishing fears of an upcoming recession. This stability suggests that risk assets like cryptocurrencies might see strong performance as the year ends. With significant market movements expected, proactive traders are positioning themselves to capitalize on these trends.