FxNews—The Japanese yen has recently dropped beyond 149 against the dollar, approaching its lowest rate since the beginning of August.

This decline is primarily due to the strengthening dollar, bolstered by strong expectations that the U.S. Federal Reserve will not implement significant rate reductions in its upcoming sessions this year.

China’s Fiscal Stimulus Plan Shakes Yen

The fall of the yen was also influenced by the weakening of the Chinese yuan following China’s announcement of a fiscal stimulus plan. The plan’s details, revealed last weekend, did not boost market confidence as investors were left uncertain about the scale of the stimulus.

No Direct Policy Proposal from Ishiba to BOJ

Earlier in the month, Japan’s Prime Minister Shigeru Ishiba indicated that the current economic situation might not justify further interest rate increases.

Nevertheless, other senior officials later clarified this statement. During their discussion, Chief Cabinet Secretary Yoshimasa Hayashi mentioned that Prime Minister Ishiba had not directly proposed policy changes to Bank of Japan Governor Kazuo Ueda.

USDJPY Technical Analysis – 14-October-2024

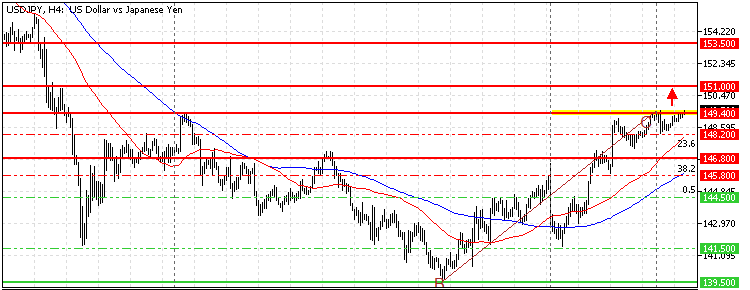

The USD/JPY currency pair is in a robust uptrend, testing the 149.4 critical resistance. The RSI 14 and Stochastic oscillator are still overbought territory, meaning the uptrend will likely resume.

- The Awesome Oscillator histogram is also green and rising, signifying the bull market prevails.

Overall, the technical indicators suggest the primary trend is bullish and should resume.

USDJPY Forecast – 14-October-2024

The immediate resistance is at 149.4 (October 10 High). From a technical perspective, the uptrend could resume if buyers (bulls) close and stabilize the price above the 149.4 mark. In this scenario, the next bullish target can potentially be 153.5, the 61.8% Fibonacci resistance level.

USDJPY Bearish Scenario

Primary support rests at 148.2, backed by the 50-period simple moving average. If bears (sellers) close and stabilize the price below the 148.2 mark, a new consolidation phase will likely begin.

If this scenario unfolds, the USD/JPY price can dip to the BC wave’s 38.2% Fibonacci retracement level at approximately 145.8, which the 100-period SMA also backs.

USDJPY Support and Resistance Levels – 14-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 148.2 / 146.8 / 145.8 /

- Resistance: 149.4 / 153.5