FxNews—WTI crude oil prices dropped significantly, falling over 2.5% to $73.5 per barrel this Monday. This decline was largely due to growing worries about the economic health of China, a major player in global oil markets.

China’s Finance Briefing Disappoints Investors

Investors felt let down following a Saturday briefing by China’s Finance Ministry. The meeting ended with few substantial measures, missing the expected major fiscal stimulus. Although there was talk of supporting the real estate market and possibly increasing borrowing, these steps didn’t meet market expectations.

In another blow to confidence, China reported a September inflation rate decrease. This development has sparked concerns about falling fuel demand from the world’s top crude oil buyer, as lower inflation often points to a slowing economy.

U.S. Advises Israel Amid Iran-Israel Oil Risks

Despite the ongoing geopolitical risks, including potential supply disruptions due to tensions between Israel and Iran, the market focused on China. After Iran’s missile strike on October 1, there were fears of an Israeli counterattack that could affect Iranian oil facilities. However, the United States has advised Israel to avoid targeting these energy infrastructures, slightly easing tensions.

Oil Technical Analysis – 14-October-2024

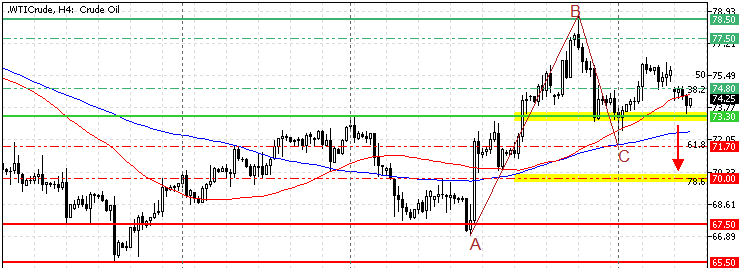

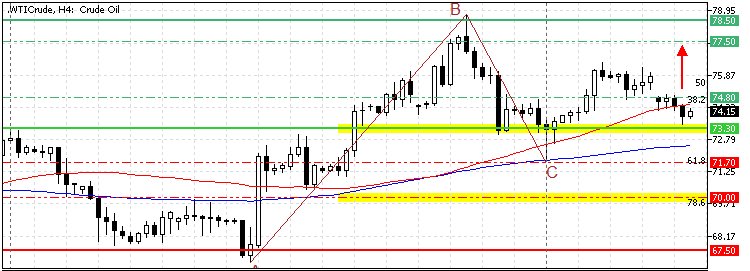

Oil trades bullish above the 50- and 100-period simple moving averages. Meanwhile, the Stochastic Oscillator and RSI 14 decline, depicting 60 and 44 in the description, respectively. Additionally, the Awesome Oscillator flips below the signal line, interpreted as rising bear market momentum.

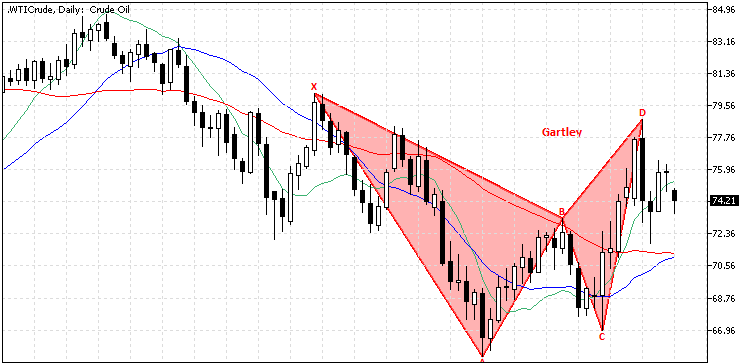

Furthermore, the daily chart formed a ‘Gartley’ harmonic pattern, which indicates the possibility of a trend reversal.

Overall, the technical indicators suggest the primary trend is bullish, but the trend has the potential for the oil price to break below the $73.3 (September 24 High) resistance.

Oil Price Forecast – 14-October-2024

From a technical perspective, if bears push the oil price below the immediate $73.3 support, the downtrend from $78.5 could extend to the lower support levels. In this scenario, the next bearish target could be the 71.7, the 61.8% Fibonacci retracement level.

Please note that the bearish outlook should be invalidated if the Oil price exceeds the immediate support at $74.8, backed by the BC wave’s 38.2% Fibonacci retracement level.

WTI Crude Oil Bullish Scenario

The immediate resistance is at $74.8. If buyers pull the Crude Oil price above $74.8, the uptick from $71.7 could result in the price revisiting October’s high at $78.5.

Oil Support and Resistance Levels – 14-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $73.3 / $71.7 / $70.0

- Resistance: $74.8 / $77.5 / $78.5