FxNews—The FTSE 100 index increased by 0.2% on Thursday, which was helped by good company earnings. Barclays announced a Q3 net profit of £1.6 billion, beating the expected £1.17 billion and showing a 23% increase compared to last year.

The bank’s revenue of £6.5 billion was also better than expected, pushing its share price up by 4.2%, the highest since October 2015. Unilever’s shares increased by 3.1% after it topped sales predictions, while Anglo-American shares rose 3% as it kept its production targets.

On the downside, a flash PMI report showed the slowest growth for UK businesses in 11 months.

GBPJPY Technical Analysis – 24-October-2024

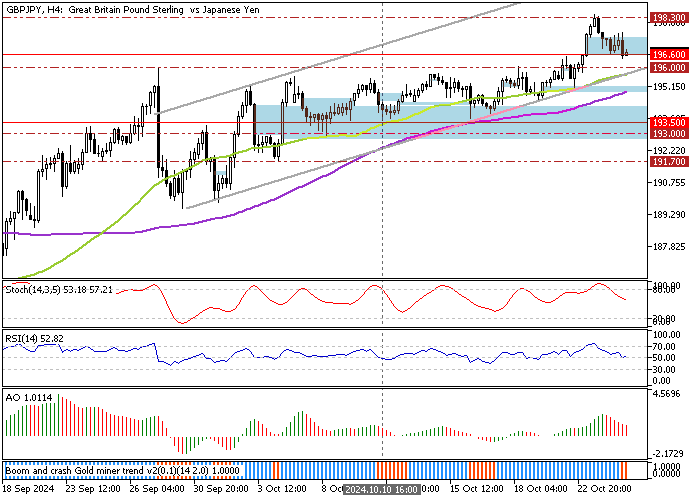

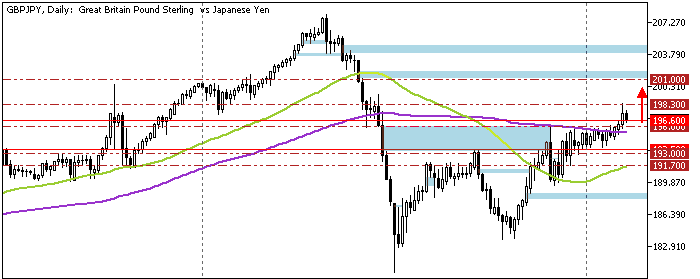

The British pound trades in a bull market against the Japanese yen because the currency pair’s price is above the 50- and 100-period simple moving averages. Today, GBP/JPY dipped from 198.3 amid Stochastic’s overbought signal. As of this writing, the pair fills the fair value gap at approximately 196.6.

From a technical perspective, the primary trend remains bullish as long as the price is inside the bullish channel and above the 50-period SMA. That said, the critical support level is at 196.0, the October 18 high.

GBPJPY Price Forecast – 24-October-2024

A new bullish wave will likely form if the GBP/JPY price exceeds the 196.0 mark. In this scenario, the GBP/JPY could revisit the 198.3 resistance.

Furthermore, if the buying pressure exceeds 198.3, the buyers’ path to the next resistance area at 201.0 (May 29 High) can be potentially paved.

GBPJPY Bearish Scenario

The bullish outlook should be invalidated if bears close and stabilize GBP/JPY below the 196.0 support. If this scenario unfolds, the bearish wave from 198.3 could extend to the October 10 low at 193.5.

GBPJPY Support and Resistance Levels – 24-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 196.0 / 193.5 / 191.7

- Resistance: 198.3 / 201.0