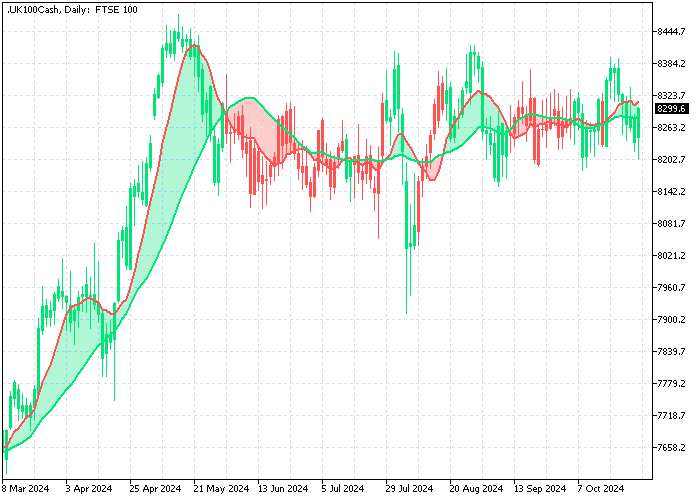

FxNews—In Monday afternoon’s session, the FTSE 100 index rose by 0.5% to close at 8,286, partly recovering from last week’s declines due to promising company updates as market participants looked forward to the upcoming UK Budget announcement.

Airline Stocks Rise as Israel Avoids Response to Iran

Melrose Industries experienced an over 8% increase following the publication of a report that addressed several recent investor concerns regarding profits and cash flow.

Meanwhile, airline stocks saw notable rises, led by EasyJet, with a 2.7% increase, and IAG, with a 1.8% rise, after Israel chose not to respond militarily to Iran’s missile attack. This avoided further disruptions in the Middle East oil supply and led to lower jet fuel costs.

However, the reduced oil prices caused shares of BP and Shell to drop by nearly 1.5% each. Furthermore, BT’s shares dipped by 1.2% amid rumors of a potential sale of its Radianz unit as a strategic move in its restructuring efforts.

GBP/USD Stays Bearish Below 50 and 100 SMAs

The pound sterling trades in a bear market against the U.S. dollar below the 50- and 100-period simple moving averages. As of this writing, the GBP/USD currency pair trades at approximately $1.298. It tested the October 11 low at $1.3 as resistance, which is backed by the 50-period SMA.

Bears Eye Key $1.295 Support Level for Next Move

From a technical perspective, the downtrend will likely resume if bears push the price below the $1.295 support area. In this scenario, a new bearish wave could be formed with its next target at $1.287.

GBP/USD Bullish Move Likely Above $1.30 Resistance

Conversely, the bearish outlook should be invalidated if GBP/USD exceeds the $1.30 resistance. If this scenario unfolds, the consolidation phase could extend to the 100-period simple moving average at approximately $1.3039, backed by the Fair Value Gap zone.