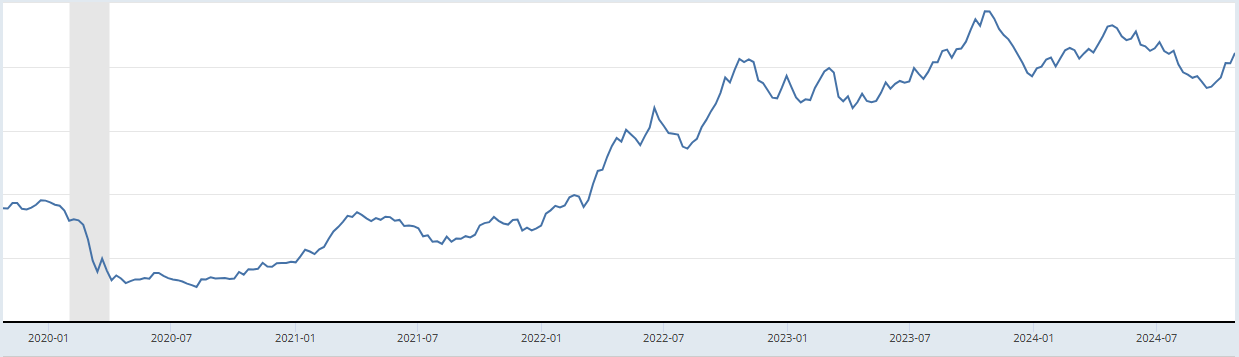

FxNews—On Tuesday, the interest rate on the 10-year U.S. government bond remained just below 4.3%. Investors are waiting for important economic information from the U.S. that could indicate future actions by the Federal Reserve.

Key U.S. Job Data and Economic Reports This Week

Data about job openings and employee changes will help understand the job market’s condition on the same day. Other significant reports, including early estimates of GDP growth, consumer inflation, and employment numbers outside the farming sector, are scheduled throughout the week.

Additionally, the U.S. Treasury will announce its plans for bond sales this week as part of its regular financial updates. Despite these updates, the main interest rate remains near its highest point in almost four months. This stability reflects confidence in the U.S. economy, which reduces the likelihood of significant interest rate reductions by the Federal Reserve.

After a substantial initial decrease in September, the market anticipates a smaller rate cut of 25 basis points in November.

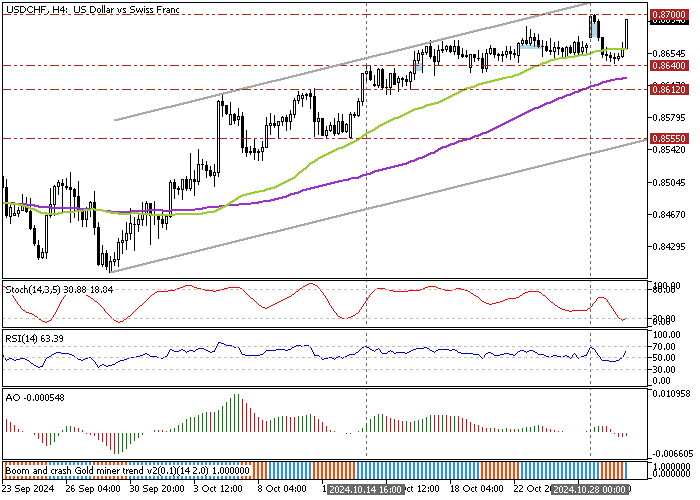

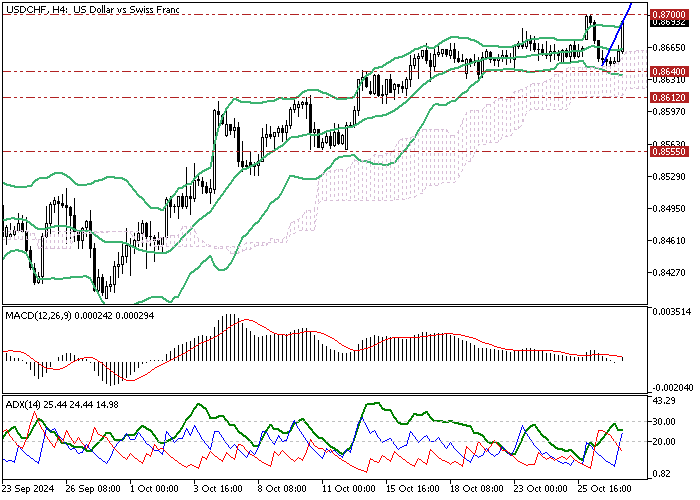

USDCHF Technical Analysis – 29-October-2024

USD/CHF trades bullish because the price exceeds the 100-period simple moving average. Today, the currency pair bounced off the 50-period SMA at approximately 0.864, trading at roughly $0.868.

The Stochastic Oscillator was in oversold territory when the price dipped to $0.864 in yesterday’s trading session, offering a decent bid for retail traders to join the bull market.

Currently, the RSI 14 flipped above the median line, giving a bullish signal, backed by Boom and Crash Gold Miner blue histogram.

Overall, the technical indicators suggest the primary trend is bullish and will likely resume to upper resistance levels.

USDCHF Forecast – 29-October-2024

With the immediate support at 0.864 intact, the bulls’ initial target could be revisiting the October 28 high at 0.870. Furthermore, if the buying pressure exceeds 0.870, the next bullish target could be the August 15 high at 0.875.

USDCHF Support and Resistance Levels – 29-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.864 / 0.861 / 0.855

- Resistance: 0.870 / 0.875