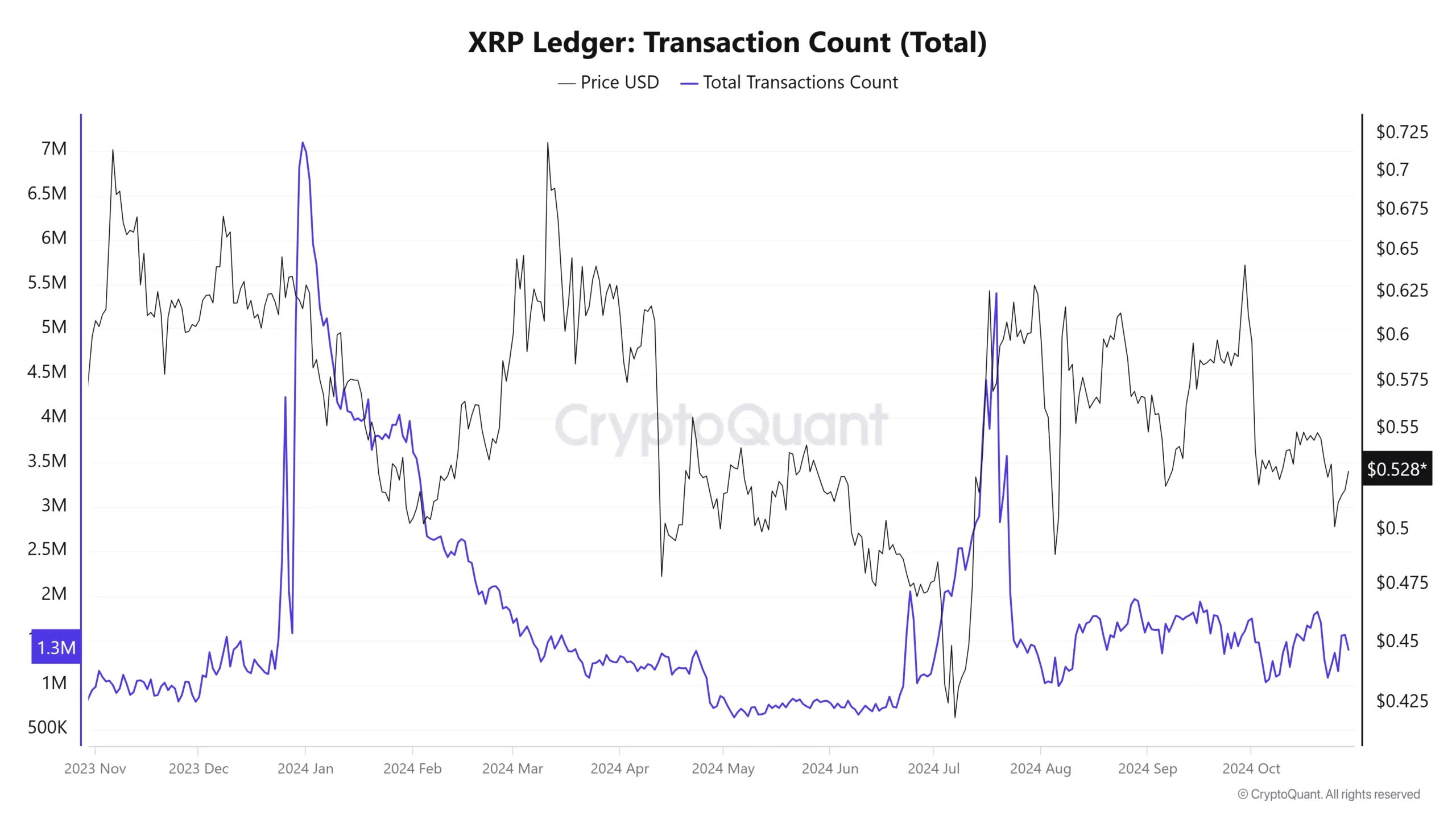

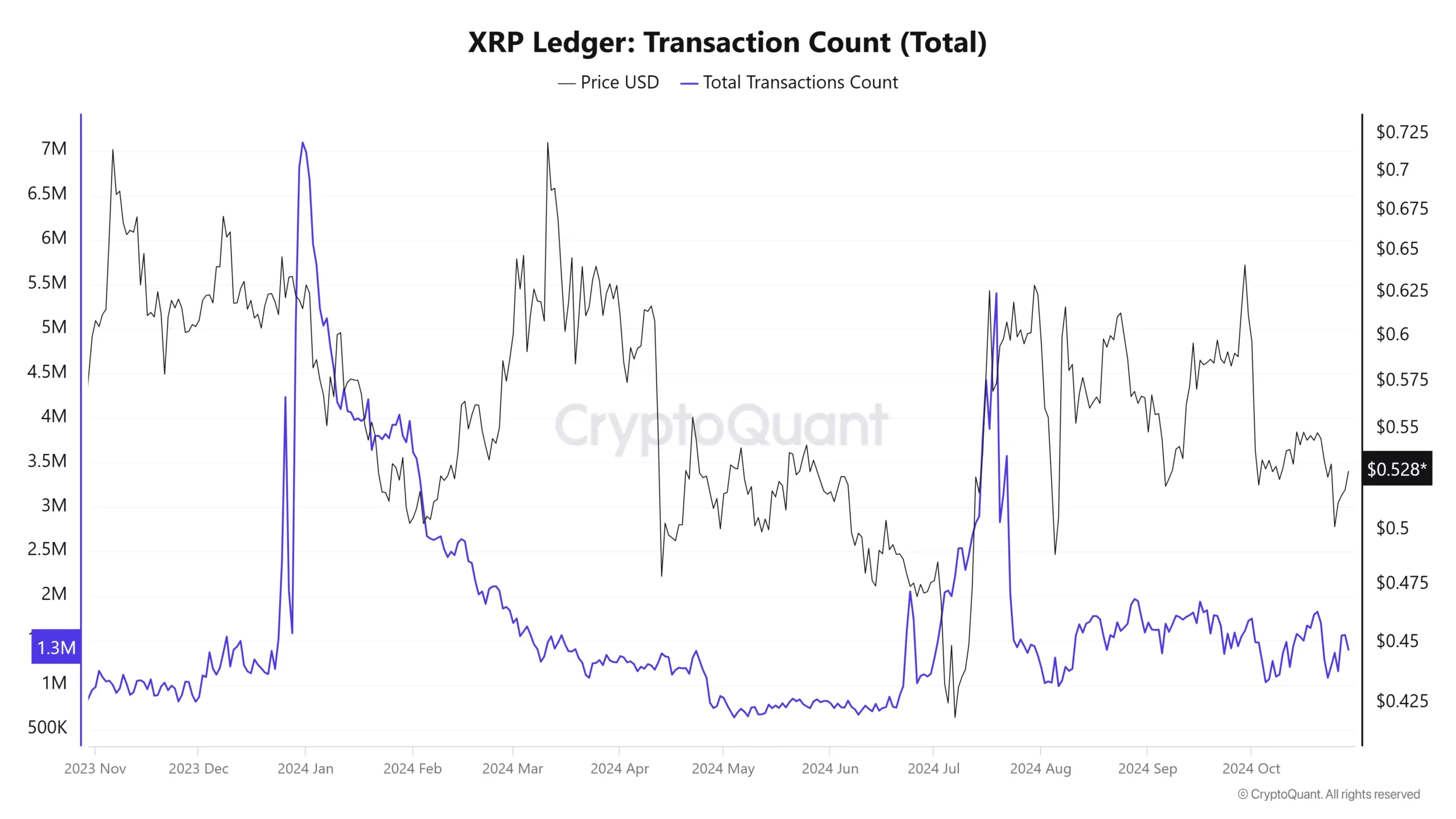

The number of transactions on the XRP network has risen to 1.5655 million, marking a 1.24% increase in the last 24 hours. This rise in transactions indicates a growing interest in the network, often associated with potential price increases.

The chart below demonstrates the 1-year Ripple (XRP) transaction count chart. As transactions continue to increase, this might suggest a strong demand for XRP, potentially leading to further price heights.

XRP Exchange Reserves Rise to 3.11 Billion Hinting at Future Sales

XRP exchange reserves are currently at 3.11 billion, up 0.36% from yesterday. An increase in these reserves can mean more XRP is being stored on exchanges, hinting at possible future sales, which could slow down price growth.

Nevertheless, a future decrease in these reserves could reduce the likelihood of sales, possibly helping a price rally.

Ripple Futures Open Interest Rises to $701M with Bullish Signals

The open interest in Ripple (XRP) futures has grown by 1.61% to $701.52 million, signifying a boost in market participation. This increase shows traders anticipate significant price movements, expecting notable developments in the altcoin market.

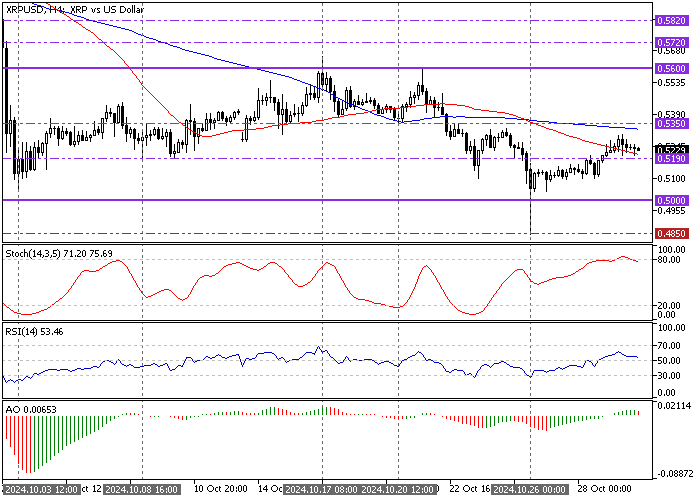

Ripple Technical Analysis – 30-October-2024

The bears failed to close and stabilize the price below the $0.5 critical resistance. As a result, XRP/USD pulled above the $0.519 (August 8 Low) and tested the 100-period simple moving average.

As of this writing, Ripple (XRP) trades at approximately $0.523, under the 100-period SMA. Meanwhile, the Stochastic Oscillator declines from the overbought territory, depicting 75 in the description. Additionally, the Awesome Oscillator’s recent bar turned red, signaling that the downtrend gained momentum.

Overall, the technical indicators suggest the primary trend is bearish, and the downtrend should resume.

Ripple (XRP) Forecast – 30-October-2024

The immediate resistance rests at $0.519. From a technical perspective, the downtrend will likely resume if Bears push the price below $0.519. In this scenario, the $0.5 support could be revisited.

Furthermore, if the selling pressure exceeds $0.5, the next bearish target will likely be the October 26 low at $0.485. Please note the downtrend strategy should be invalidated if the price exceeds the 100-SMA.

The Bullish Scenario

The immediate resistance is $0.535, backed by the 100-period simple moving average. If bulls (buyers) close and stabilize the price above $0.535, the uptick momentum from $0.485 will likely aim for the October 17 high at $0.560.

The 100-period SMA will primarily support the bullish scenario if XRP/USD exceeds it.

- Next good read: Litecoin Pullback to $74 Sparks Bullish Opportunities

Ripple (XRP) Support and Resistance Levels – 30-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.519 / 0.50 / 0.485

- Resistance: 0.535 / 0.56 / 0.572