FxNews—On Thursday, New Zealand’s main stock index, the S&P/NZX 50, dropped by 0.4% and closed at 12,639 points. This decrease continued from the previous day, partly because technology stocks in the U.S. did poorly.

Investors are cautious because important U.S. economic updates, including inflation data, job numbers, and the presidential election, are coming soon.

China’s Manufacturing Boost Lifts New Zealand’s Hopes

Good news came from China—a key partner for New Zealand—as its manufacturing industry is doing better than expected. Back in New Zealand, people feel more hopeful about the economy because of recent cuts in interest rates, which have made businesses more optimistic.

Some of the biggest companies, like Infratil, Ebos Group, Contact Energy, and Spark NZ, saw their stock prices fall by 2.3%, 1.35%, 1.3%, and 3%, respectively.

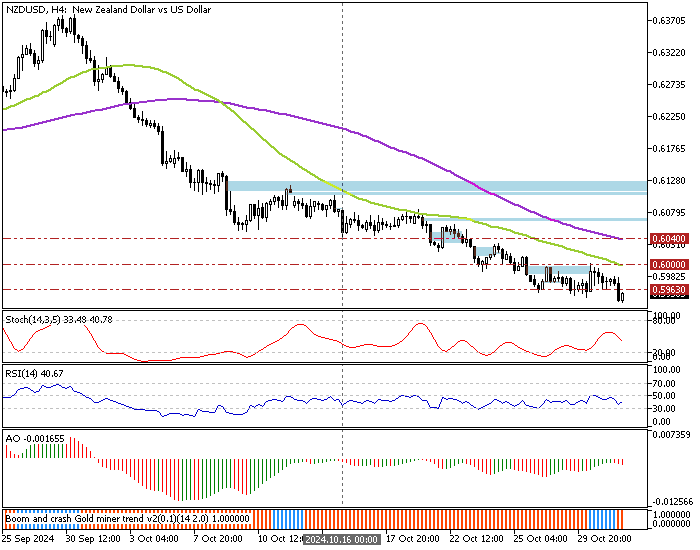

NZDUSD Technical Analysis – 31-October-2024

The NZD/USD currency pair is in a robust bearish market, closing below the critical $0.596 resistance level today. Furthermore, the bearish breakout caused indicators to signal a sell.

From a technical perspective, the immediate resistance to the current downtrend lies at $0.60, supported by the 50-period simple moving average. The NZD/USD trend outlook remains bearish as long as the price stays below $0.60. The next bearish target in this scenario will likely be the $0.591 support level.

Bullish Scenario

Please note that if NZD/USD exceeds $0.60, the bearish outlook will be invalidated. In this scenario, the price may potentially test the 100-SMA at $0.604.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.591

- Resistance: 0.60 / 0.604