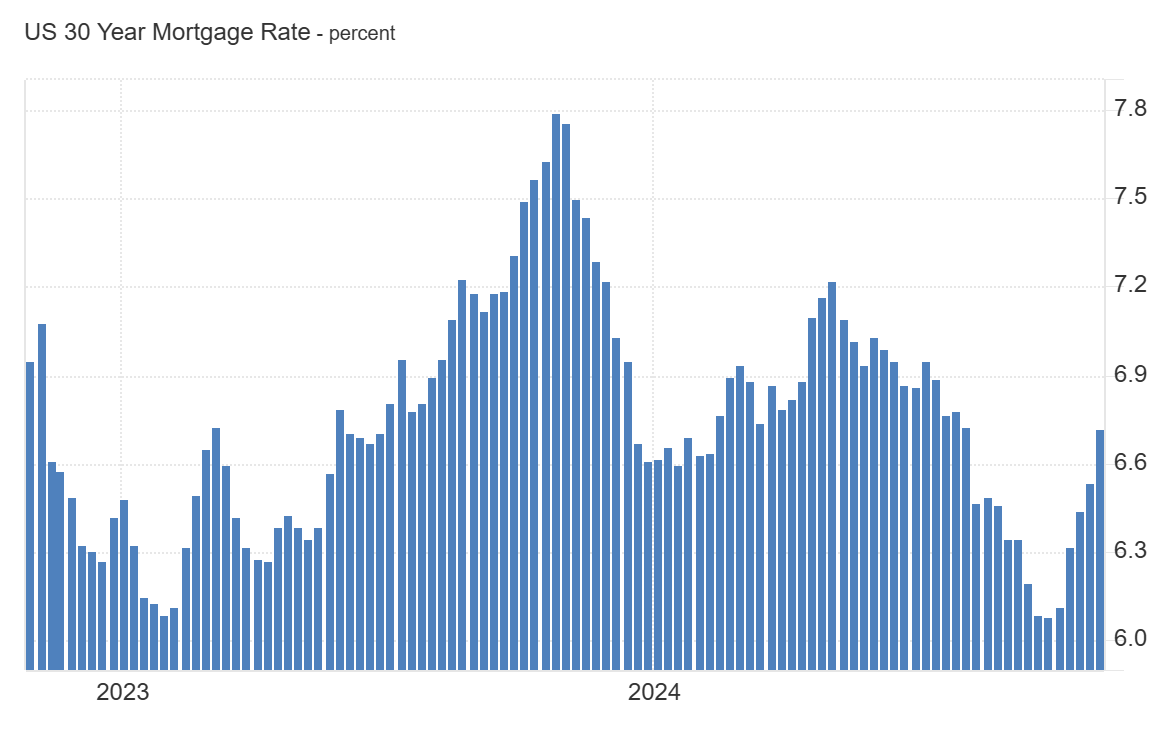

FxNews—On October 31st, 2024, the interest rate for a 30-year fixed mortgage increased to 6.72%, the highest in three months. This rise is due to positive economic news, which suggests that the Federal Reserve might reduce interest rates less than previously thought.

Mortgage Rates Hit New Highs Ahead of Key Events

Sam Khater, Freddie Mac’s Chief Economist, noted, “Mortgage rates have been increasing for five weeks and are now at their highest since early August. With important events like the jobs report, the 2024 election, and a Federal Reserve meeting about rates happening soon, we expect mortgage rates to keep changing.”

He also mentioned that although rates are currently high, they should not reach the extreme highs seen earlier in the year.

AUDUSD Technical Analysis – 31-October-2024

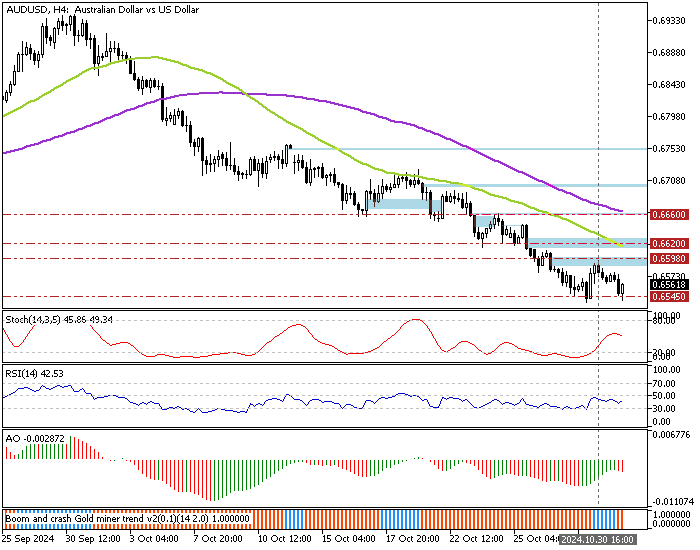

FxNews—The AUD/USD currency pair trades in a bear market below the 50- and 100-period simple moving averages. Earlier this week, the Australian dollar demonstrated a weak bullish move, which could not exceed the Fair Value Gap area at $0.659. Consequently, the downtrend resumed, and as of this writing, the currency pair is testing the October low at $0.654.

AUD/USD Eyes Downtrend on $0.654 Break

From a technical perspective, the downtrend will likely resume if AUD/USD closes below the $0.654 resistance. If this scenario unfolds, the next bearish target could be the July low at $0.648.

Please note that the bearish outlook should be invalidated if the AUD/USD price exceeds $0.662, a resistance level backed by the 50-period simple moving average.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.654 / 0.648

- resistance: 0.662 / 0.666