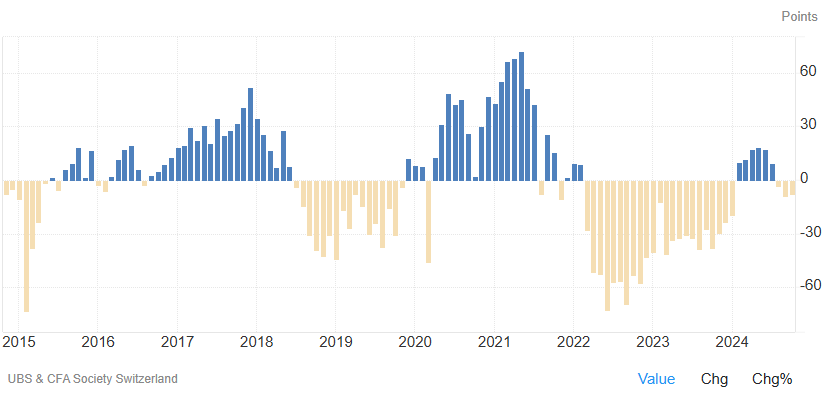

FxNews—In October 2024, Swiss investor confidence saw a slight uptick. The sentiment index increased by 1.1 points from the previous month, reaching -7.7. Despite this improvement, the index remained negative for the third consecutive month.

UBS Report Predicts Swiss Inflation Below 1% by 2025

UBS and the CFA Society Switzerland, which released this index together, reported that survey participants now expect lower inflation for Switzerland in 2025. Most believe that inflation will drop below 1%.

Additionally, the measure of current economic conditions rose by 0.4 points to 10.8 in October. This suggests a modest positive shift in investors’ views of the economy’s present state.

USDCHF Technical Analysis – 1-November-2024

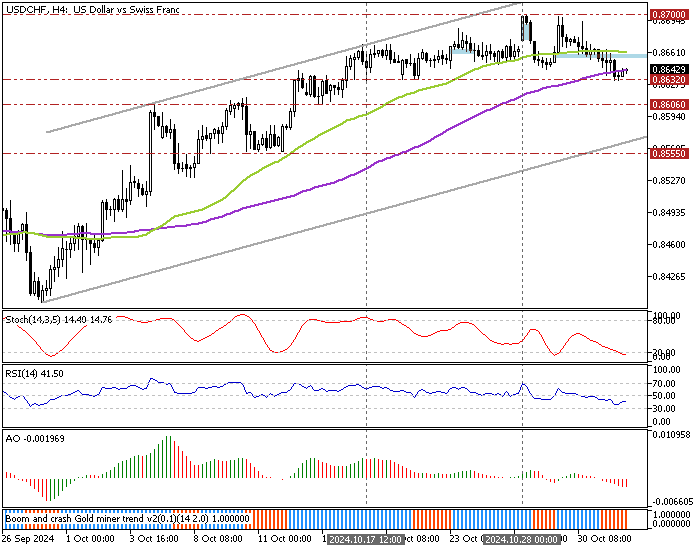

The American currency has been under mild selling pressure from 0.87 against the Swiss Franc. As of this writing, USD/CHF trades at approximately 0.864, testing the 100-period simple moving average as resistance.

As for the technical indicators, the Stochastic Oscillator stepped into oversold territory, meaning the Swiss Franc is overpriced in the short term. Additionally, the Awesome Oscillator histogram is red, below the signal line, indicating that the bear market is strengthening.

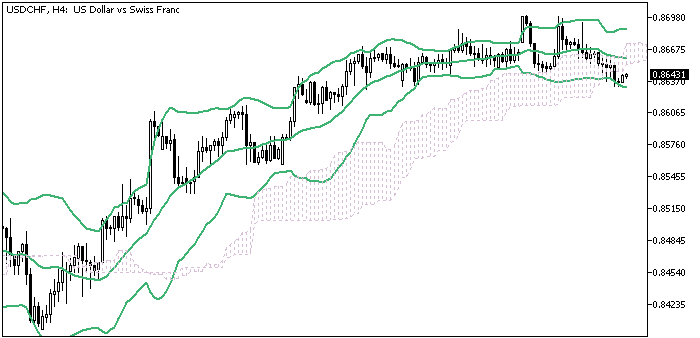

Also, the price flipped below the Ichimoku cloud, which suggests that the primary trend might have changed from a bull market to a bear market.

Overall, the technical indicators suggest while USD/CHF tests the 100-period SMA, the bears have the potential to push the price lower.

USDCHF Poised for Bullish Wave at Key 0.866 Level

From a technical perspective, if buyers pull the USD/CHF price above the 0.866 mark, it signals a new bullish wave that will likely extend to revisiting the October all-time high at 0.87. If this scenario unfolds, the 100-period SMA will play the primary support.

Please note that the bullish outlook should be invalidated if the USD/CHF dips below the 0.863 support.

Bearish Scenario

On the flip side, the bearish wave from 0.870 could extend to 0.860 (the October 15 low) if USD/CHF closes below the immediate support of 0.863.

Please note that the primary resistance for the bearish strategy rests at 0.866, backed by the 50-period simple moving average. So, the strategy should be invalidated if the price exceeds the 50-SMA.

Key Support and Resistance Levels

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: 0.866 / 0.863 / 0.855

- Resistance: 0.866 / 0.870