The Australian dollar recovers in today’s trading session, maintaining a position slightly above $0.674. This comes despite reaching near four-week lows, influenced by mounting speculations that the US Federal Reserve might slow down its pace on reducing interest rates.

These speculations are fueled by recent robust US employment and inflation figures and hints from a prominent Fed official who suggested a possible pause in rate adjustments this November.

Anticipation of Economic Stimulus from China

The financial world also monitors China, Australia’s major trading ally, as new economic support measures are expected. The Chinese finance ministry is expected to hold a press conference this Saturday to unveil key developments. This announcement is highly anticipated as it could significantly affect trade and economic dynamics between the two nations.

Insights from Australia’s Central Bank

During the latest assembly of the Reserve Bank of Australia (RBA), the discussion covered various potential moves regarding interest rates, reflecting the unpredictable economic climate.

Although there was talk of decreasing and increasing rates, the RBA decided that maintaining the current cash rate was prudent. This decision aims to effectively navigate the intertwined risks of inflation and job market stability.

AUD/USD Technical Analysis – 11-October-2024

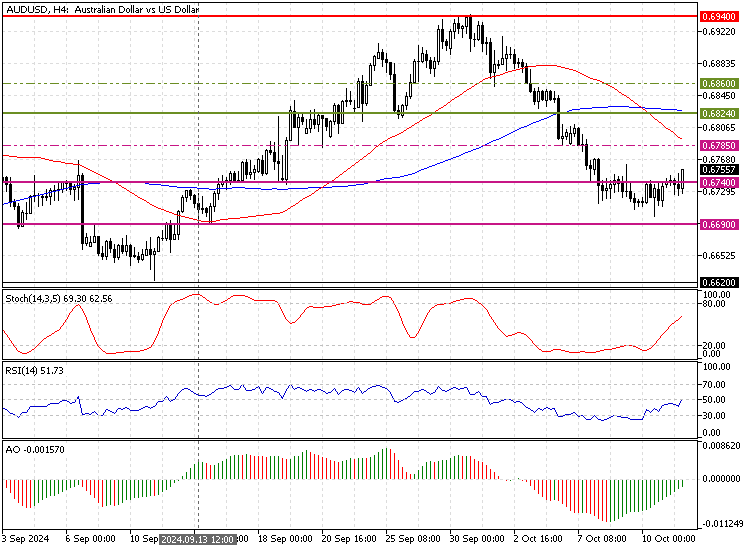

FxNews—The Australian dollar rose above $0.674 (September 19 Low), trading at approximately $0.675 as of this writing. Today’s recovery of the Aussie was anticipated because the RSI 14 was deep inside the oversold territory, signaling that the U.S. Dollar is overpriced in the short term.

Additionally, the Awesome Oscillator histogram has been green for two consecutive trading days, approaching the signal line from below. This development in the AO’s histogram suggests that the bear market is losing strength.

Despite the signals the chart provides from RSI and Awesome Oscillator, the AUD/USD price is still below the 50- and 100-period simple moving averages, meaning the primary trend is bearish.

Overall, the technical indicators suggest a bear market prevails in the long term, but the AUD/USD is poised to erase some of its recent losses.

AUD/USD Forecast – 11-September-2024

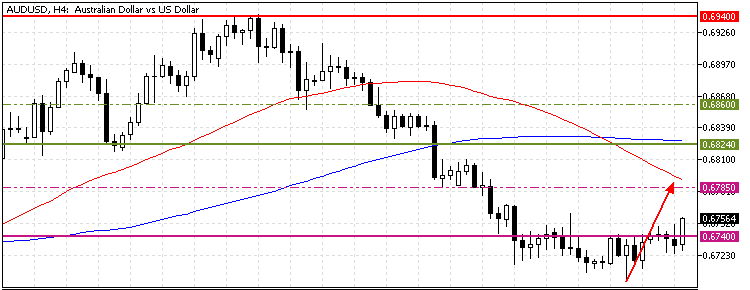

The September 13 low at $0.669 is the critical support level that kept the AUD/USD price from declining further.

From a technical perspective, if the $0.660 resistance level holds, the Australian dollar can potentially target the 50-period moving average at approximately $0.678 as resistance. Furthermore, if the buying pressure exceeds $0.678, the next bullish target could be the 100-period SMA at $0.682.

Please note that the bullish strategy should be invalidated if the AUD/USD price dips below $0.669.

AUD/USD Bearish Scenario

If bears (sellers) close and stabilize the price below the $0.669 key resistance, the downtrend from $0.694 will likely extend to the September low at $0.662.

Notably, the 50-period simple moving average will play the primary resistance to the bearish strategy.

AUD/USD Support and Resistance Levels – 11-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.669 / $0.662

- Resistance: $0.678 / $0.682