FxNews—On Monday, the Australian dollar fell to approximately $0.673, halting its two-day rise. This decline was triggered by China’s recent announcement of a fiscal stimulus plan, which did not boost investor confidence as it left many details unclear, particularly the size of the stimulus.

The Australian dollar often reflects trends in the Chinese yuan due to Australia’s strong economic ties to China, primarily through exports.

Expectations of U.S. Fed Hold Affect AUD

Additionally, the Australian dollar was weakened by a robust U.S. dollar. This strength stems from widespread expectations that the U.S. Federal Reserve will avoid large-scale interest rate cuts in the upcoming meetings for the year, further straining the Australian dollar.

RBA Holds the Cash Rate, Balances Inflation, and Jobs

Inside Australia, the minutes from the Reserve Bank of Australia’s (RBA) latest meeting indicated a mixed sentiment among the board members. They explored various future possibilities, including both cuts and hikes in interest rates, pointing to significant uncertainty in the economic forecast.

Ultimately, the RBA decided that maintaining the current cash rate was the most prudent approach to balance inflation concerns and labor market stability.

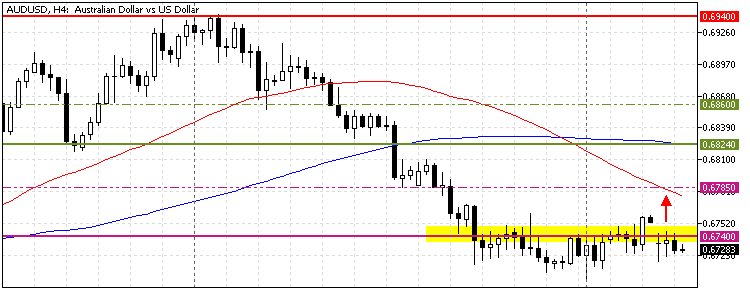

AUDUSD Technical Analysis – 14-October-2024

The Australian dollar trades in a downtrend against the U.S. dollar. The price is below the 50-period simple moving average, and the Awesome oscillator’s recent bar changed color to red.

The immediate support is at $0.669, the September 13 low. From a technical perspective, the downtrend could be triggered again if bears push the AUD/USD price below that mark.

If this scenario unfolds, the next bearish target will likely be the September 11 low at $0.662.

AUD/USD Bullish Scenario

The key resistance area for the current weak uptick momentum, which began at $0.669 last week, rests at $0.674. If bulls pull the price above $0.674 and stabilize it, the AUD/USD price could potentially consolidate.

If this scenario unfolds, the Australian dollar will likely be able to erase some of its recent losses against the green-back by targetting the September 20 low at $0.678.

AUDUSD Support and Resistance Levels – 14-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $0.669 / $0.662

- Resistance: $0.678 / $0.678