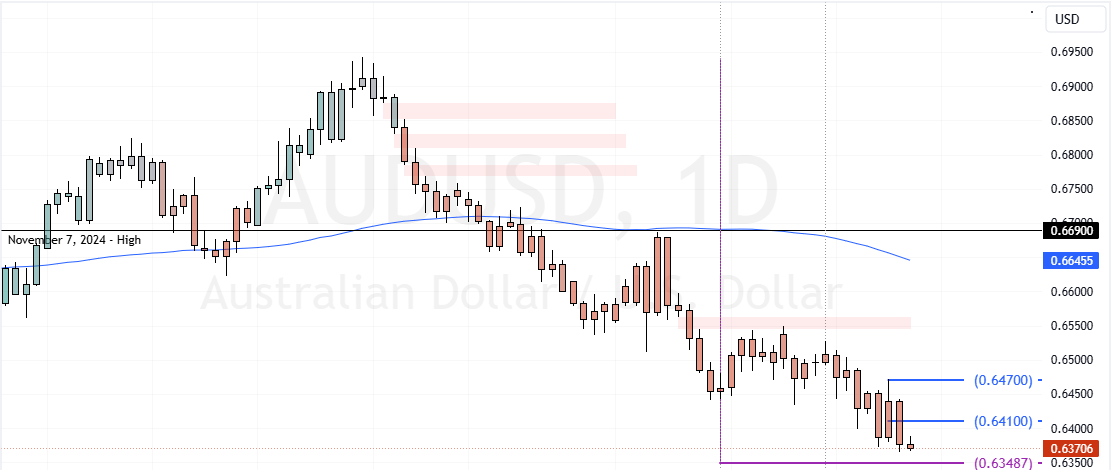

FxNews—AUD/USD resumed its bearish trajectory from $0.647, a strong resistance area backed by the 75-period simple moving average.

As of this writing, the currency pair trades at approximately $0.636 and lost 0.13% of its value in today’s trading session.

AUDUSD Technical Analysis – 11-December-2024

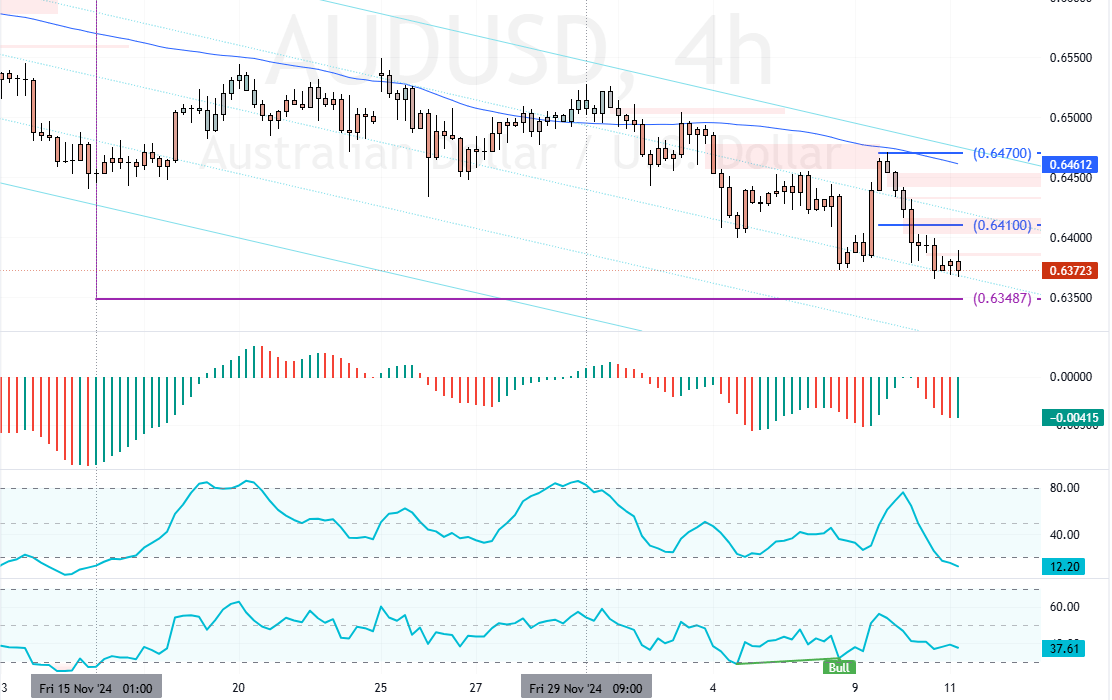

By observing the technical indicators in the AUD/USD 4-hour chart, we notice that as the prices approach the $0.634 critical support, the stochastic hints at an oversold market. This means the U.S. dollar is overpriced against the Aussie, at least for a short while.

Additionally, the RSI 14 signals a bullish divergence, signaling a trend reversal or a consolidation phase could be on the horizon.

Overall, the technical indicators suggest while the primary trend is bearish, AUD/USD could bounce from this point and test the upper resistance levels.

The Forecast

As mentioned earlier in this technical analysis, the market is oversold. Therefore, it is not advisable to enter the bear market at the current price.

- Good reads: GBPUSD Steady: Potential Rise to $1.285

That said, we suggest retail traders and investors wait for the currency pair to adjust and consolidate near the $0.641 and $0.647 resistances. Monitoring these areas for bearish signals, such as candlestick patterns, is crucial. This is because these demand zones can offer a decent ask price to join the downtrend.