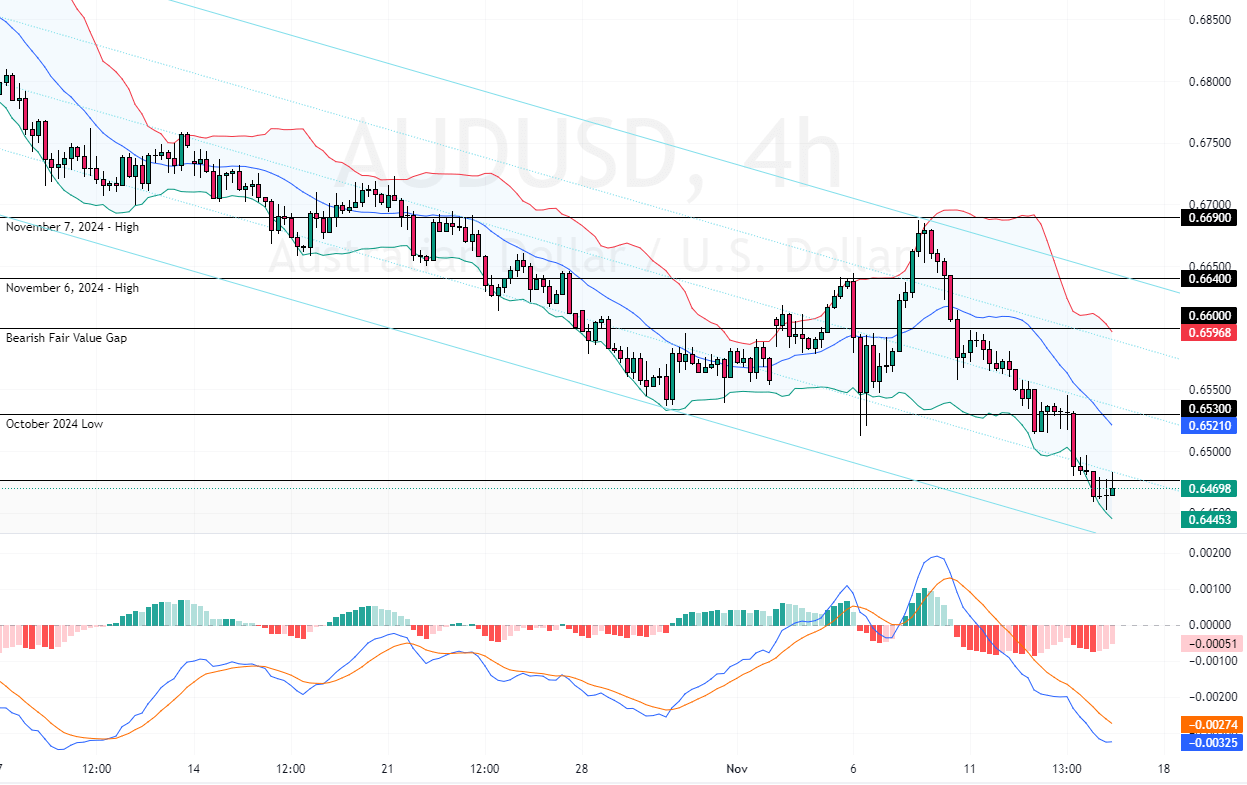

FxNews—On Thursday, the Australian dollar fell below the 0.653 support, hitting its lowest point in three months. This drop is mainly due to a stronger US dollar and investors closely watching economic data.

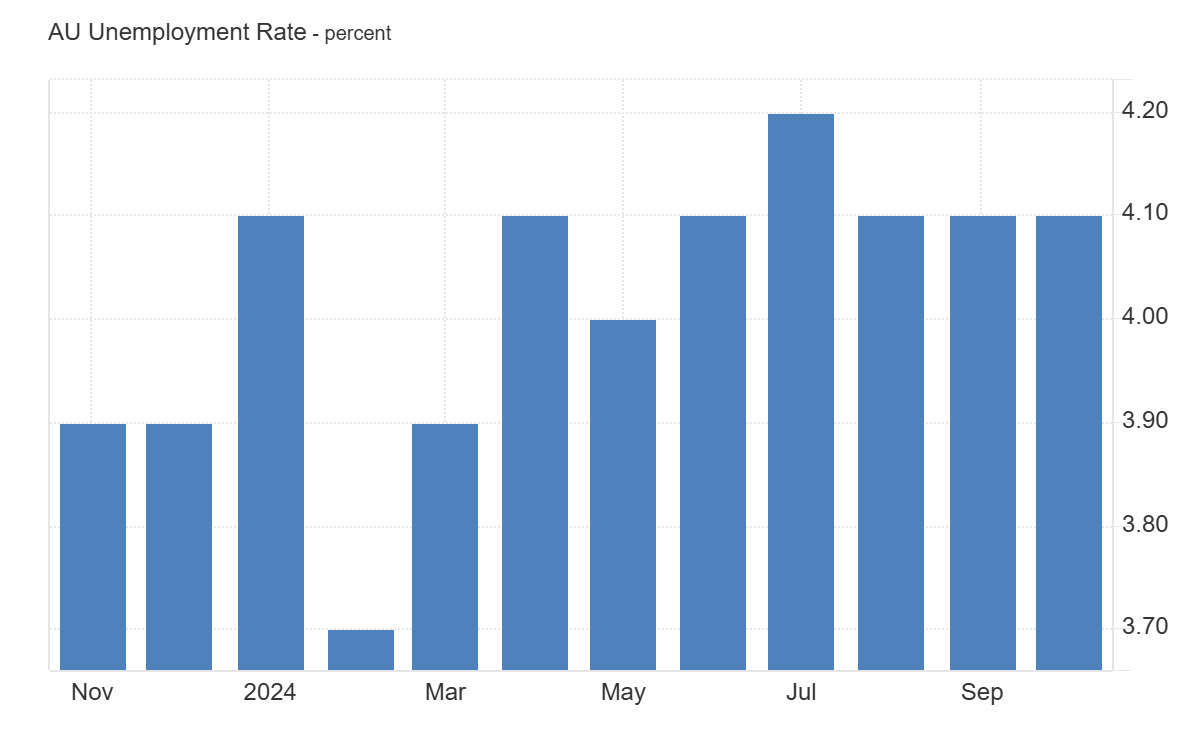

Australia Misses Job Growth Forecast in October

In October, Australia’s unemployment rate remained at 4.1% for the third month, which was expected. However, employment increased by only 15,900 jobs, missing the forecasted rise of 25,000.

Despite these figures, the Reserve Bank of Australia’s monetary policy outlook didn’t change much. RBA Governor Michele Bullock reiterated that interest rates are already high enough and will stay the same until the central bank ensures that inflation is under control.

Meanwhile, the Australian dollar continued to face pressure from the strengthening US dollar. Traders are engaging in certain investment strategies, sometimes called “Trump trades,” even though many expect the Federal Reserve to gradually lower borrowing costs.

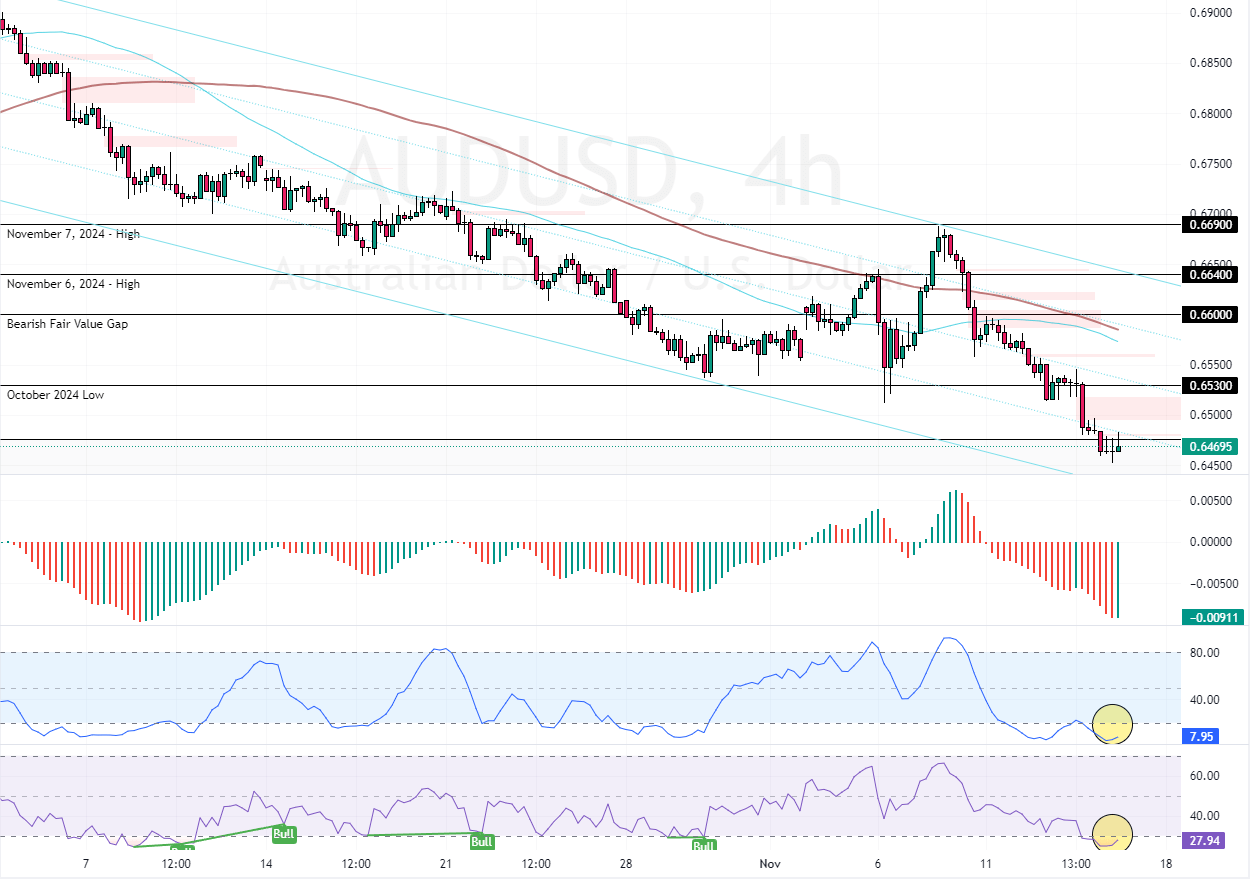

AUDUSD Technical Analysis – 14-November-2024

The currency pair‘s primary trend is bearish because the prices are below the 100-period simple moving average. Meanwhile, the Stochastic Oscillator and RSI 14 signal oversold by recording 9 and 30 in the description, respectively.

As of this writing, AUD/USD trades at approximately $0.647, testing the 78.6% Fibonacci retracement level as support. From a technical perspective, the downtrend will likely resume after a minor consolidation, which could lead to the prices testing the $0.653 resistance.

In this scenario, the next bearish target could be $0.641. Furthermore, if the selling pressure pushes AUD/USD below $0.641, the downtrend could extend to the August Low at $0.635.

Please note that the downtrend should be invalidated if the AUD/USD price closes above the 0.66 critical resistance, which the 100-period SMA backs.

- Support: 0.647 / 0.641 / 0.635

- Resistance: 0.653 / 0.660 / 0.664