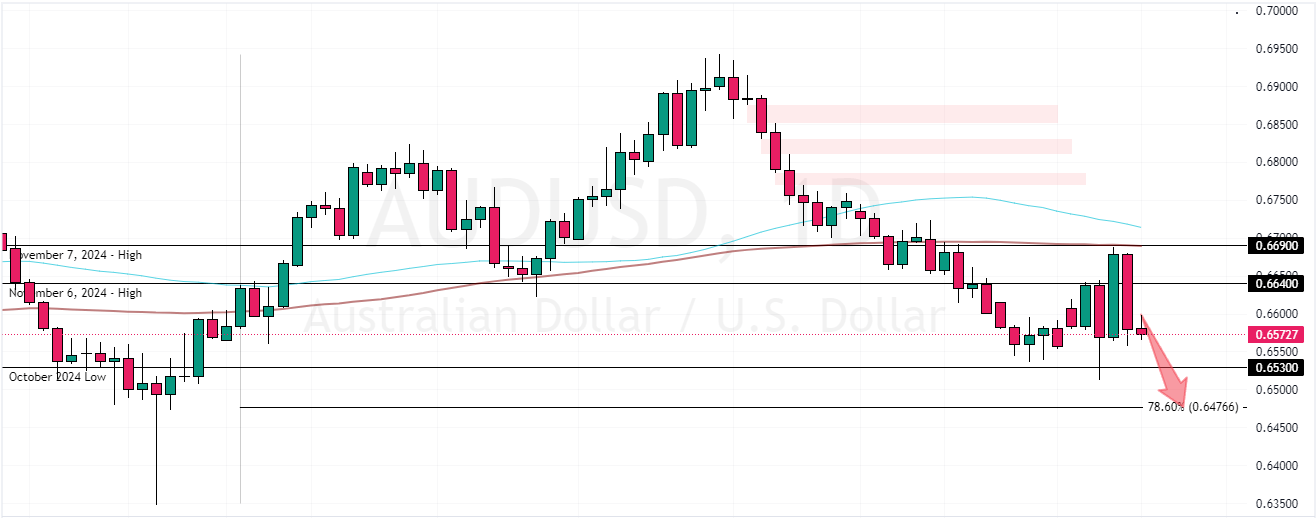

FxNews—The AUD/USD pair began a new bearish wave from $0.669 after the bulls failed to maintain the price above the 100-period simple moving average. Consequently, the currency pair again shifted below the moving average, resuming its bearish trajectory.

As of this writing, the Australian dollar is trading at approximately $0.657, stabilizing below the bearish Fair Value Gap.

AUDUSD Technical Analysis – 11-November-2024

As for the technical indicators, the Stochastic Oscillator records show 19 in the description, meaning the U.S. dollar is overvalued in the short term. On the other hand, the recent bar in the Awesome Oscillator histogram changed color to green, meaning the bearish pressure eased.

Overall, the technical indicators suggest while the AUD/USD primary trend is bearish, the market could consolidate in a narrow range area before the downtrend resumes.

AUDUSD Forecast – 11-November-2024

The critical resistance level that separates the bear market from the bull market is the November 6 high, the 0.664 mark. The AUD/USD trend outlook remains bearish as long as the price is below $0.664. In this scenario, the following bearish target could be revisiting the October low at $0.653.

Furthermore, if the selling pressure pushes the price below $0.653, the next downtrend can potentially extend to the %78.6 Fibonacci retracement level ($0.647), as the daily chart shows.

Please note that the bearish strategy should be invalidated if bulls pull the prices above the $0.664 critical resistance.

- Support: 0.653 / 0.647

- Resistance: 0.660 / 0.664 / 0.669