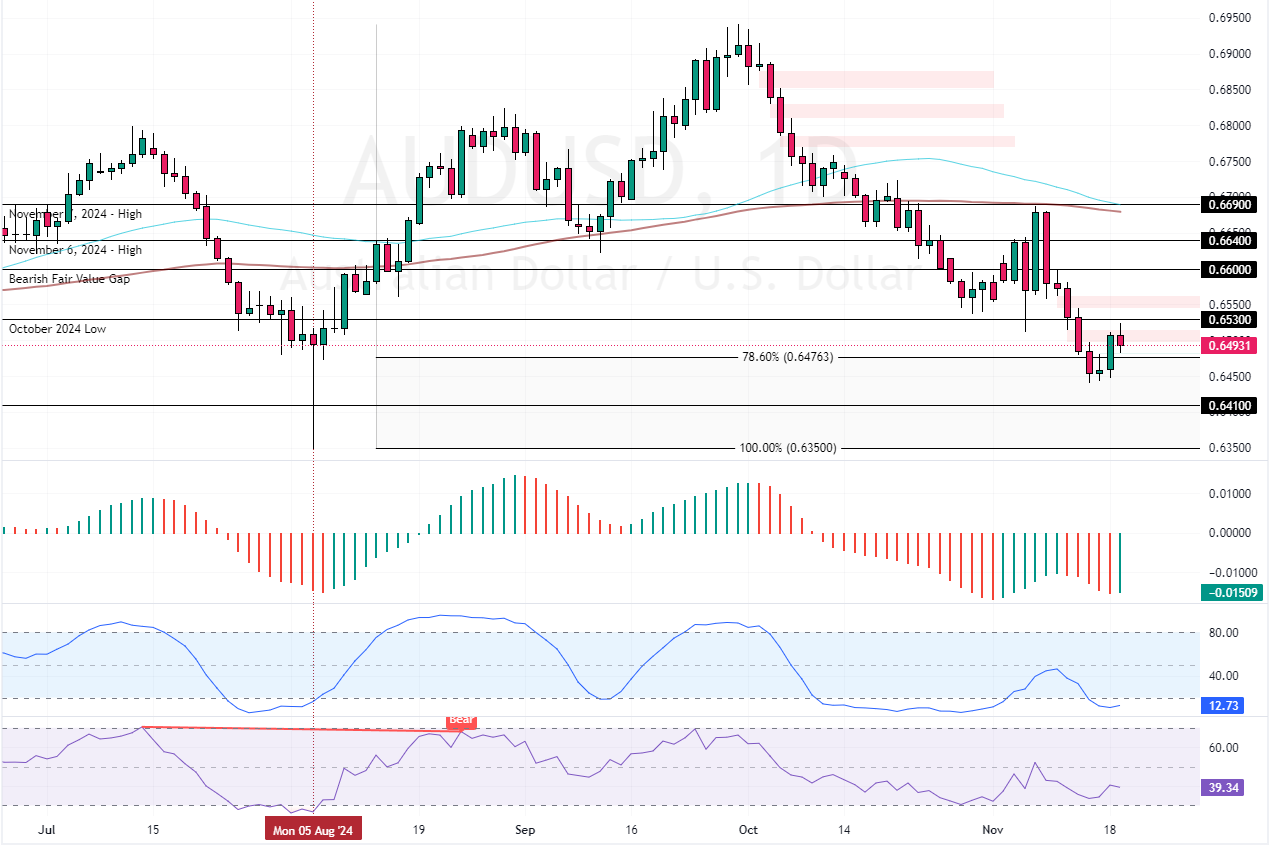

The Australian dollar climbed above the %78.6 Fibonacci, marking its third consecutive day of gains. This increase occurred after investors examined the Reserve Bank of Australia’s (RBA) November meeting minutes. As of this writing, the AUD/USD currency pair trades at approximately $0.649.

RBA Stays Firm on Tight Policy to Control Inflation

The minutes revealed that the RBA intends to keep monetary policy tight until it is certain that inflation is steadily moving toward its target. The RBA is also wary of potential increases in inflation beyond expectations.

However, the RBA emphasized not committing to any specific future policy changes. Currently, markets do not anticipate an interest rate cut from the RBA until May next year. There’s only a 38% chance of a move in February.

November Reports May Change Aussie Fate

Meanwhile, investors are turning their attention to upcoming reports on November manufacturing and services activity. These reports could offer more insights into the overall economic outlook.

Despite these recent gains, the Australian dollar remains near its lowest level in over three months. This is due to factors like a strong U.S. dollar, economic uncertainties in China, and declining commodity prices.