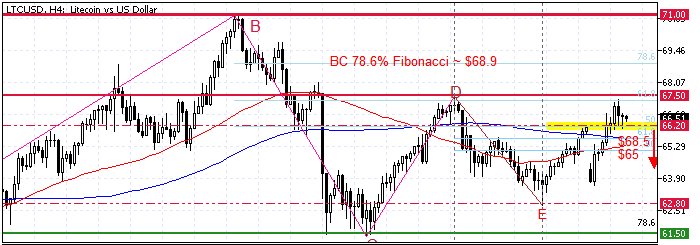

FxNews—Litecoin‘s pullback from $62.8 (E) extended to the October 10 high at $67.5, a ceiling that neighbors the BC wave’s 61.8% Fibonacci retracement. As of this writing, the LTC/USD pair experienced a minor return from the $67.5 critical resistance, trading at approximately $66.5.

The 4-hour chart below demonstrates the price, support, resistance levels, and technical indicators utilized in today’s analysis.

Litecoin Technical Analysis – 15-October-2024

The primary trend should be considered bullish because the LTC/USD price is above the 50- and 100-period simple moving averages. Additionally, the Awesome Oscillator histogram is green, above the signal line, which indicates that the bull market prevails.

Furthermore, the Relative Strength Index (RSI14) indicator depicts 59 in the description, meaning Litecoin is not overpriced and the uptrend could resume.

On the other hand, the 4-hour chart formed a bearish ‘Gartley’ pattern, which is a trend reversal pattern from an uptrend to a downtrend.

Overall, the technical indicators and the harmonic pattern suggest the primary trend is bullish, but it has the potential to reverse or consolidate toward the lower support levels.

Litecoin Price Forecast – 15-October-2024

The immediate resistance is at $67.5. From a technical perspective, the bullish wave from $62.8 (Point E) will likely target the BC wave’s 78.6% Fibonacci retracement level if bulls can pull the price above the $67.5 barrier.

If this scenario unfolds, bullish traders can be optimistic that the path to $71.0 in September 2024 will likely be paved.

Litecoin Bearish Scenario

On the flip side, if bears push the price below the 100-period SMA at $68.5, backed by the DE 61.8% Fibonacci retracement level, the uptrend should be considered invalid.

If this scenario unfolds and bears close LTC/USD below the $68.5 resistance and can stabilize it, today’s bearish momentum could spread to the DE wave’s %50 Fibonacci at $65.0.

Furthermore, a dip below the $65.0 resistance can trigger a robust bearish wave extending to the October 10 low at $62.8.

Litecoin Support and Resistance Levels – 15-October-2024

Traders and investors should closely monitor the key levels below to make informed decisions and adjust their strategies accordingly as market conditions shift.

- Support: $68.5 / $65 / $62.8

- Resistance: $67.5 / $68.9 / $71.0